In just 8 years, Vivriti Capital has emerged as one of India’s fastest-growing debt capital providers for mid-market enterprises. For those interested in Vivriti Capital: The Financial Story of India’s Emerging Mid-Market Lender, this report presents Vivriti Capital’s financial and strategic evolution from FY20 to FY25, detailing how the fintech NBFC scaled into a profitable, diversified, and highly rated mid-market lending institution. It captures Vivriti Capital’s full journey across lending growth, risk performance, equity funding, and operational milestones, making it a comprehensive financial story of one of India’s fastest-growing mid-market lenders.

The Origin Story: Solving India’s Mid-Market Credit Gap

In 2017, Vineet Sukumar founded Vivriti Capital with a simple but powerful insight: India’s mid-market enterprises were too large for microfinance but too small (or too unrated) for banks and bond markets.

The mid-market lacked scalable access to structured, customized institutional debt.

Vineet, who earlier led structured finance at IFMR Capital (Northern Arc), recognized that data-driven underwriting, securitization know-how, and technology could enable customized capital for this underserved borrower class.

Thus, Vivriti Capital was born with three core pillars:

- Structured finance expertise

- Technology-enabled underwriting and distribution

- Risk-first, borrower-first philosophy

Vivriti Capital Phase 1 (2017–2020): The Foundation Years

In its early years, Vivriti focused on:

- Lending to smaller NBFCs and microfinance institutions.

- Providing structured wholesale credit.

- Building the CredAvenue (now Yubi) debt marketplace, allowing external lenders to access curated mid-market loan opportunities.

By FY20, Vivriti’s AUM had reached ₹537 Cr, a 10x scale-up from inception. It had also successfully established itself as a reliable, structured debt partner in India’s financial ecosystem.

🌐 Phase 2 (2021–2023): The Pivot to Mid-Market Enterprises

Around FY22, Vivriti entered its second major growth phase:

- Expanded lending beyond financial sector NBFCs.

- Directly financed mid-market businesses across healthcare, manufacturing, logistics, education, renewables, EV infrastructure, SaaS, and more.

- Introduced product innovations:

- Receivables-backed lending

- Leasing structures

- Supply chain finance

- Green financing

- Trade finance pools

- Receivables-backed lending

By FY23, Vivriti’s AUM crossed ₹5,836 Cr, with nearly 40% of its exposure diversified beyond financial services clients. This diversification made Vivriti structurally stronger, more granular, and more aligned with India’s growing consumption and infrastructure story.

Fueling Growth: Equity Fundraising

Vivriti attracted marquee institutional investors who bought into its mid-market thesis.

| Year | Funding Round | Amount Raised | Investors |

| 2019 | Series A | ₹210 Cr | Creation Investments |

| 2020 | Series B | ₹350 Cr | Lightrock (Aspada) |

| 2020 | Series B2 | ₹110 Cr | Creation, Others |

| 2022 | Series C | ₹540 Cr | Lightrock, TVS Capital |

| 2023 | Series D | ₹100 Cr | TVS Capital |

Over ₹1,400 Cr of equity capital was raised over five rounds, which allowed Vivriti to scale its AUM 17X, maintain strong capital adequacy, and fuel product diversification without over-leveraging the balance sheet.

Phase 3 (2023–2025): Co-Lending & VivFlo Platform Launch

The next growth engine came from co-lending partnerships. In FY25, Vivriti officially launched its fully digital co-lending platform: VivFlo, enabling seamless partnerships with:

- Private sector banks

- Small finance banks

- NBFCs

- Fintechs

Through co-lending:

- Partners originated the loans while Vivriti underwrote and co-funded.

- Retail segments like MSME loans, LAP, vehicle finance, and consumer finance became accessible.

- Co-lending disbursements crossed ₹5,325 Cr by FY25.

- Co-lending contributed ~40% of Vivriti’s total ₹9,081 Cr AUM by FY25.

This platform-first model allowed Vivriti to scale rapidly without building costly branch-led networks. Co-lending enabled Vivriti to expand its retail participation without bearing 100% of origination risks. It has become the key engine of scale, with strong tech integration managing credit risk dynamically.

The Financial Scale-Up (FY20–FY25)

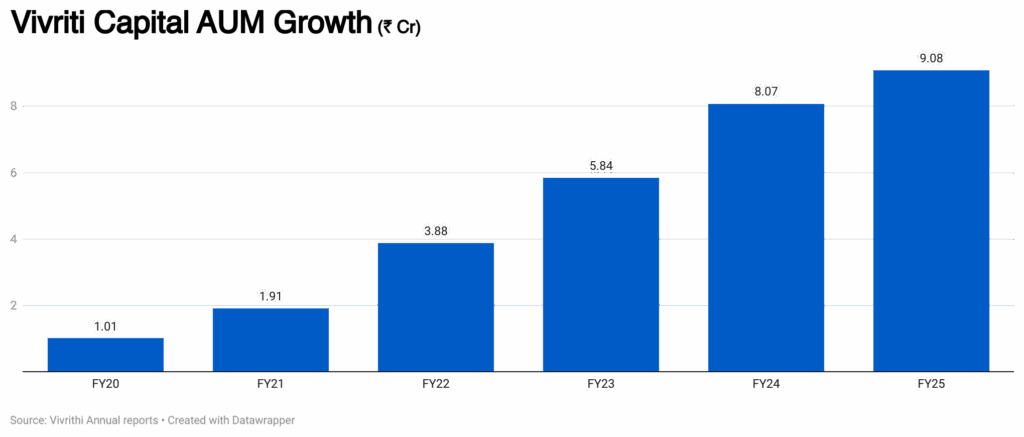

Vivriti Capital scaled its AUM nearly 9x from ₹1,009 Cr in FY20 to ₹9,081 Cr in FY25, clocking a 54% CAGR.

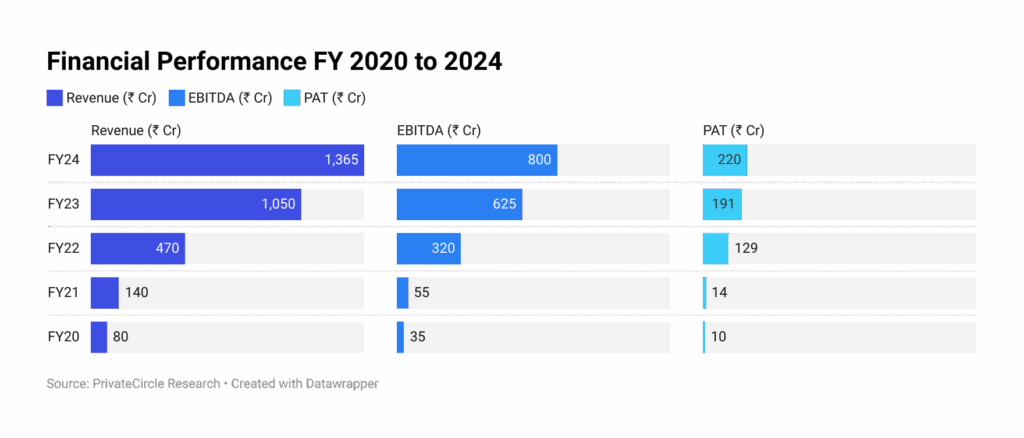

Revenue scaled 17x over 5 years, while EBITDA margins improved as operating leverage kicked in. Profit growth was consistent as provisioning, risk management, and cost controls matured alongside rapid loan book expansion. Vivriti moved from marginal profits to delivering consistent profitability from FY22 onwards. Profit growth accelerated as operating leverage improved, credit costs stayed stable, and margins held up despite scale.

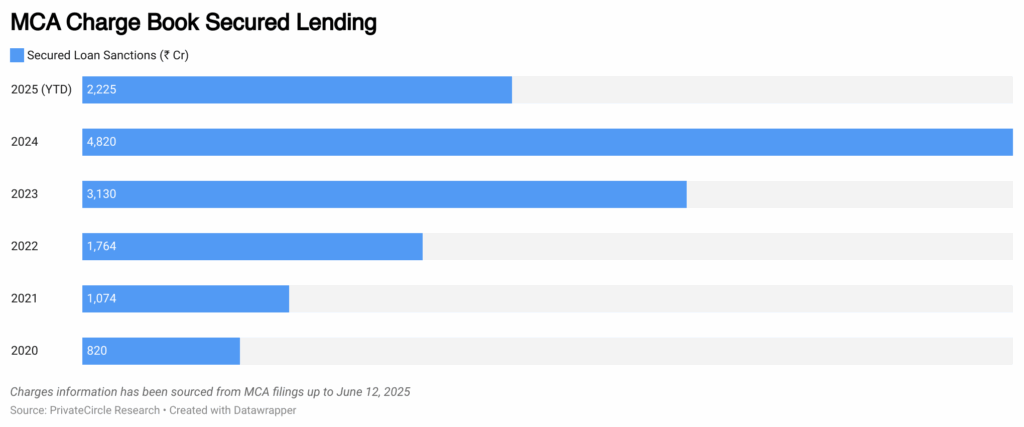

🔐The MCA Charge Book: Secured Lending Activity

Beyond disclosures, Vivriti’s MCA charge filings provide a transparent view of its secured lending activity, i.e., where Vivriti created charges against borrower assets.

Cumulative secured lending sanctions (FY20–FY25): ₹13833 Cr.

The MCA data validates Vivriti’s expanding secured mid-market lending footprint, as it extended credit not only to NBFCs but to operating companies across healthcare, education, renewables, technology, logistics, and more.

🔎Borrower Diversity

Vivriti’s sector exposure as of FY25 includes:

- Financial Services: NBFCs, MFIs, small lenders.

- Healthcare: Hospitals, health-tech, ambulance services.

- Education: EdTech, skill training.

- Renewables: Solar, EV ecosystem.

- SaaS & Technology Platforms: Fintech aggregators, leasing platforms.

- Logistics & Trade Finance: SME supply chains.

- Consumer Finance: Retail co-lending partners.

🛡 Risk Management & Asset Quality

| Year | GNPA (%) | NNPA (%) |

| FY20 | 0.2% | 0% |

| FY21 | 0.3% | 0.07% |

| FY22 | 0.29% | 0.08% |

| FY23 | 0.31% | 0.08% |

| FY24 | 1.10% | 0.46% |

| FY25 | 1.89% | 0.71% |

- GNPA rise from FY24 was regulatory-led: RBI’s digital lending guidelines required Vivriti to recognize co-lending NPAs on its own books.

- Adjusted loss exposure remained minimal after partner guarantees.

Vivriti’s credit costs remain fully provisioned and its borrower concentration is well-diversified, with no single exposure exceeding 1% of AUM. Vivriti scaled while maintaining industry-leading risk metrics, a rare feat in India’s credit landscape.

🌿ESG, Green Finance, and Global Debt Capital Access

Vivriti demonstrated leadership in diversifying its liabilities:

- First private-sector NBFC to issue a certified climate bond (₹209 Cr) with the Asian Development Bank.

- Offshore ECBs raised for diversification.

- GuarantCo guarantees secured for EV financing via Axis Bank partnerships.

- 19+ domestic lenders continuously expanded credit lines.

The funding profile is now multi-dimensional, combining domestic, offshore, development finance, and ESG-linked capital, positioning Vivriti strongly for the future.

🧭 Founder’s Vision: The Vineet Sukumar Playbook

Vineet Sukumar’s mission from day one has remained steady:

- Build India’s largest mid-market credit institution.

- Serve businesses that banks ignore but are highly bankable with structured underwriting.

- Marry risk-first underwriting, technology platforms, and sectoral expertise.

- Blend institutional-grade capital with flexibility that India’s entrepreneurs need.

“We’re not a fintech. We’re not a traditional NBFC. We are India’s mid-market debt platform with institutional underwriting at the core.”

, Vineet Sukumar, Founder & MD, Vivriti Capital

🔮 What’s Next? The FY26–FY28 Growth Playbook

- Target AUM CAGR of 20–25% over the next 3 years.

- Expand secured retail asset share within co-lending.

- Deepen sectoral pools (EV, healthcare, renewables, infra adjacencies).

- Move towards public markets (potential IPO candidate as scale and profitability stabilize further).

- Maintain RoA ~2.5–3% and RoE ~12–15% trajectory.

Vivriti Capital has mastered the art of scaling mid-market lending in India, combining technology-driven operations, risk-first underwriting, sector diversification, and institutional capital to build one of India’s most balanced mid-market debt platforms. Its evolution is not just a story of scale, but one of risk-calibrated expansion, balance sheet discipline, and sector-led lending, right at the heart of India’s credit growth engine.

This report reflects exactly what PrivateCircle enables, transforming fragmented and scattered private market data into decision-grade financial stories. Behind this Vivriti Capital narrative sits:

- 5 years of MCA charge filings capturing ₹13,500+ Cr of secured lending activity

- ₹1,400+ Cr of equity fundraises stitched from funding disclosures

- Audited annual reports compiled across multiple financial years

- 55+ sectors mapped through borrower-level charge data

- Co-lending trends reconstructed from partnership filings

- Credit rating movements tracked across agencies

All of this is cleaned, connected, verified, and structured into one comprehensive financial narrative, not just for Vivriti Capital, but across 2 lakh+ private companies in India.

That’s the PrivateCircle advantage: clean data, connected signals, and deep private market intelligence.