Ather Energy, a Bengaluru-based electric vehicle (EV) startup, has emerged as a significant player in India’s rapidly evolving EV landscape.

Founded in 2013 by IIT Madras alumni Tarun Mehta and Swapnil Jain, Ather has been at the forefront of designing and manufacturing intelligent electric scooters, notably the Ather 450 series.

Financial Performance

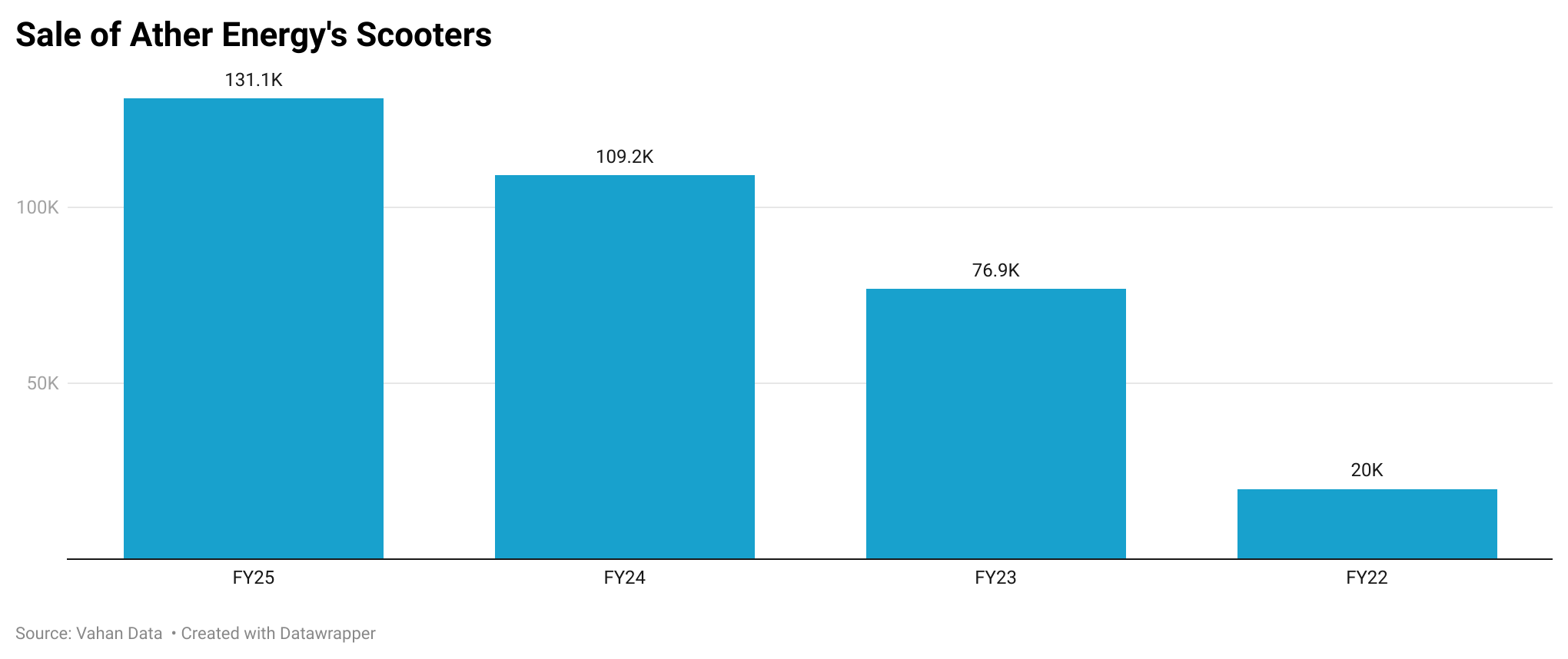

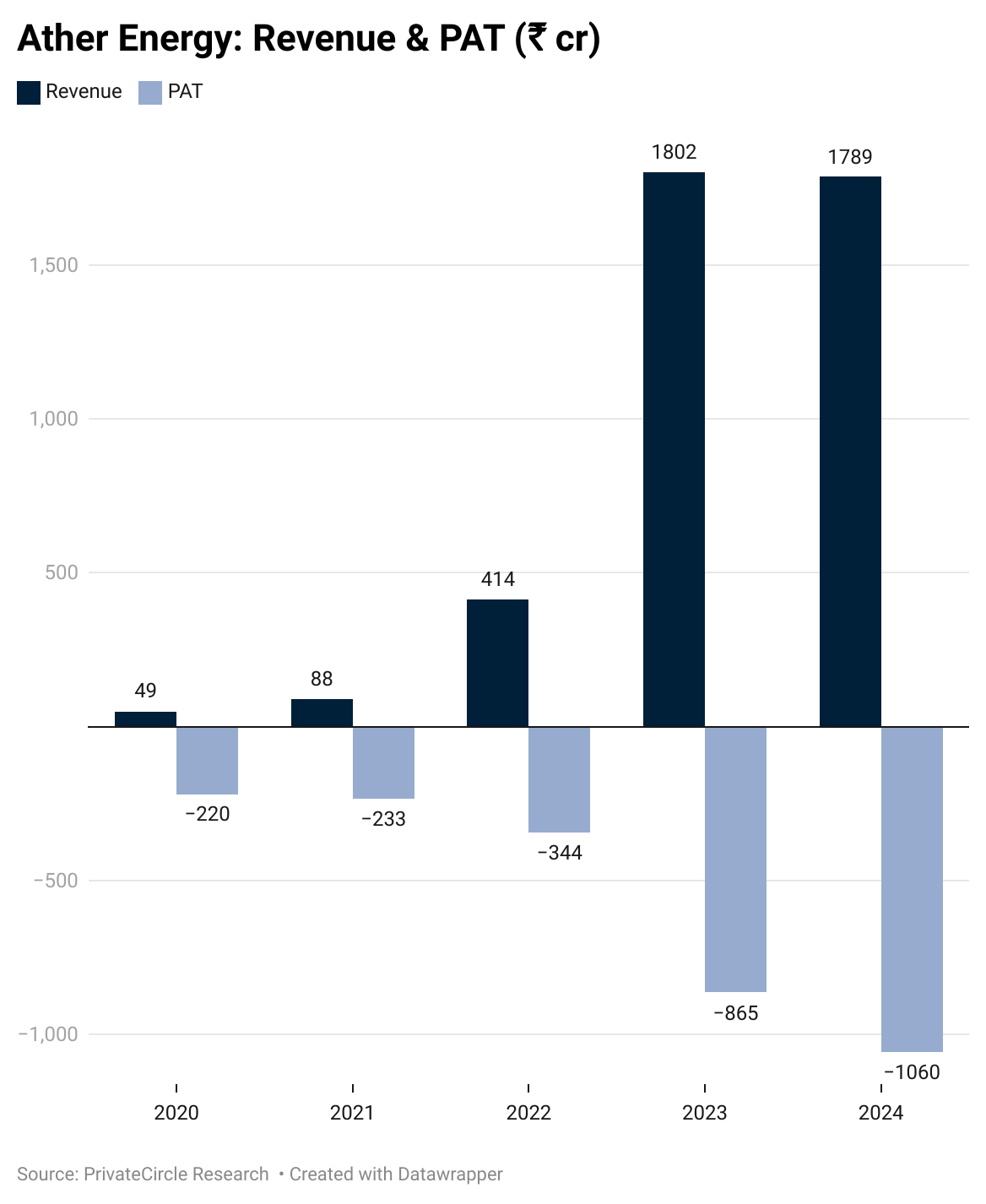

In the fiscal year 2023-24, Ather Energy reported a revenue of ₹1,789 crore.

This growth underscores the rising demand for electric two-wheelers in India.

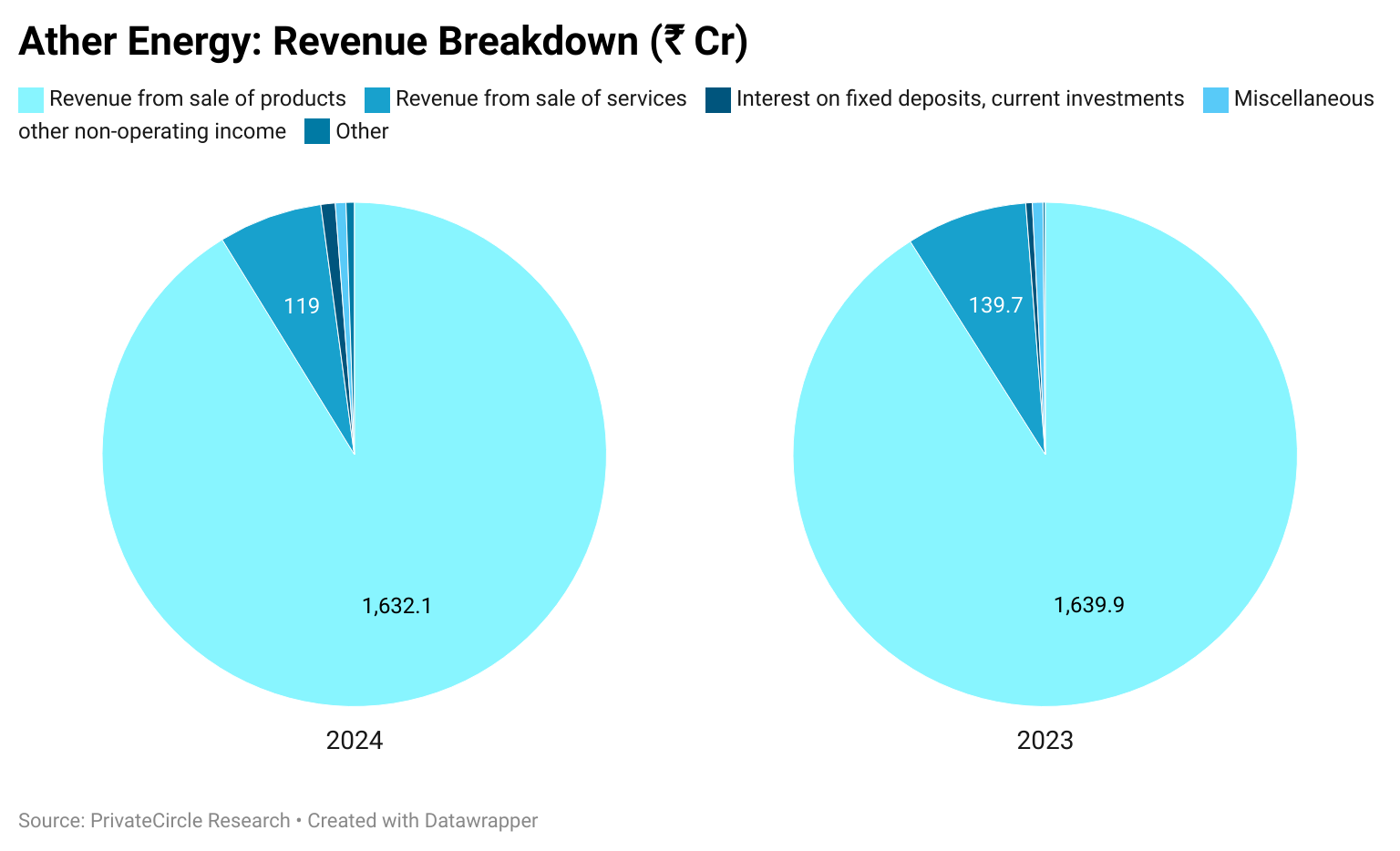

Revenue Breakdown

- Vehicle Sales: Approximately ₹1,640 crore, accounting for about 84% of total revenue.

- Charging Infrastructure & Services: Around ₹139 crore, contributing 11%.

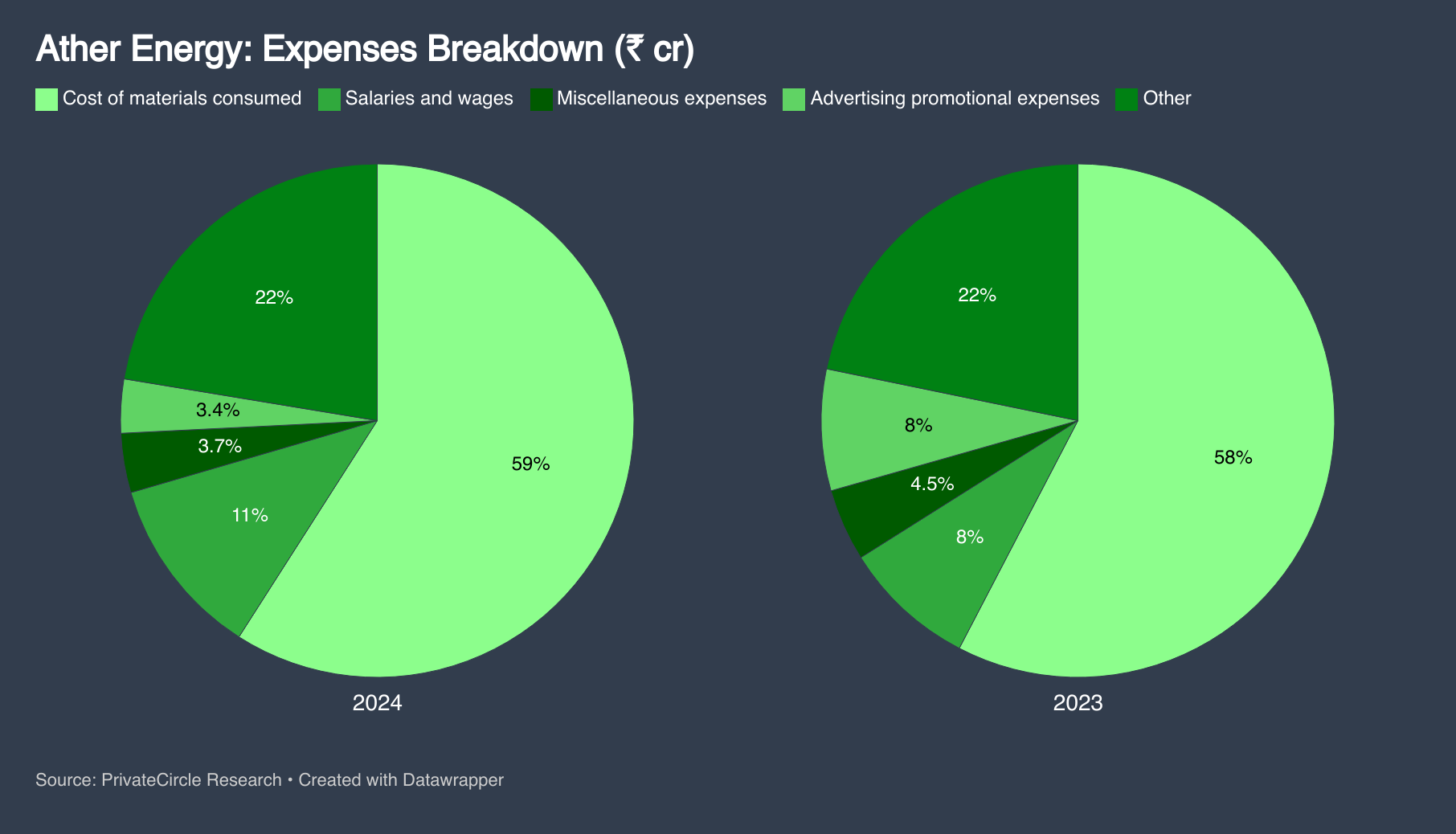

Expense Breakdown

- Cost of Goods Sold (COGS): ₹1,200 crore, primarily due to battery procurement and manufacturing expenses.

- Research & Development: ₹150 crore, reflecting Ather’s commitment to innovation.

- Sales & Marketing: ₹250 crore, indicating aggressive market penetration strategies.

- Administrative Expenses: ₹100 crore, covering operational and personnel costs.

Net Profit/Loss: Despite impressive revenue growth, Ather reported a net loss of ₹200 crore in FY 2023-24, attributed to high R&D and marketing expenditures as the company focuses on long-term growth.

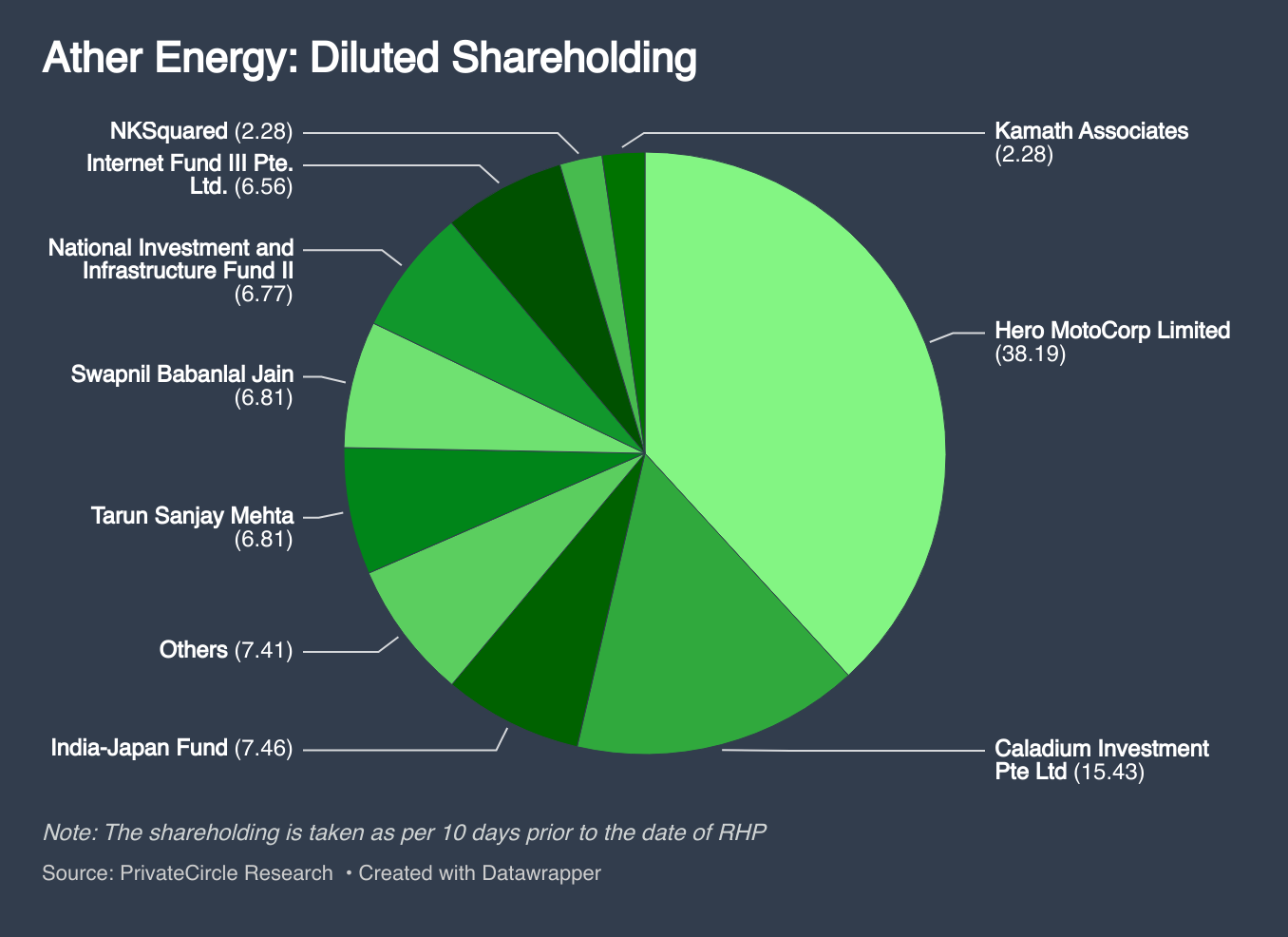

Shareholding Structure

Ather Energy’s shareholding as of March 2025 is as follows:

- Hero MotoCorp: 38.19%

- Caladium Investment Pte Ltd 15.43%

- India-Japan Fund 7.46%

- Founders (Tarun Mehta & Swapnil Jain): 6.81%

- Others (including employees and angel investors): 38.22%

Hero MotoCorp’s significant stake underscores its strategic interest in the EV segment, providing Ather with manufacturing and distribution support.

Infrastructure and Expansion

Ather has established a robust charging network, “Ather Grid,” with over 1,500 fast-charging stations across 100 cities in India. The company plans to expand this network to 5,000 stations by 2027.

In terms of manufacturing, Ather operates a state-of-the-art facility in Hosur, Tamil Nadu, with an annual production capacity of 120,000 units, aiming to scale up to 500,000 units in the next two years.

Market Position and Industry Context

India’s EV market is witnessing exponential growth, with two-wheelers leading the charge. According to the Ministry of Micro, Small & Medium Enterprises (MSME), the sector’s contribution to India’s GDP was 30.1% in 2022-23, with MSMEs playing a pivotal role in EV component manufacturing.

Ather’s focus on indigenous design, software integration, and customer experience positions it uniquely against competitors like Ola Electric and Bajaj’s Chetak.

Future Outlook

Ather Energy plans to diversify its product portfolio by introducing more affordable models to cater to a broader customer base. The company is also exploring international markets in Southeast Asia and Europe.

With continued investment in R&D, infrastructure, and strategic partnerships, Ather is poised to be a significant contributor to India’s sustainable mobility goals.

Interesting insights! I especially liked how you captured the growing link between electric mobility and private-market funding. EV tech is clearly opening doors not just for drivers, but for investors and energy innovators too.