The Indian automobile sector has been on quite the rollercoaster ride over the past couple of years.

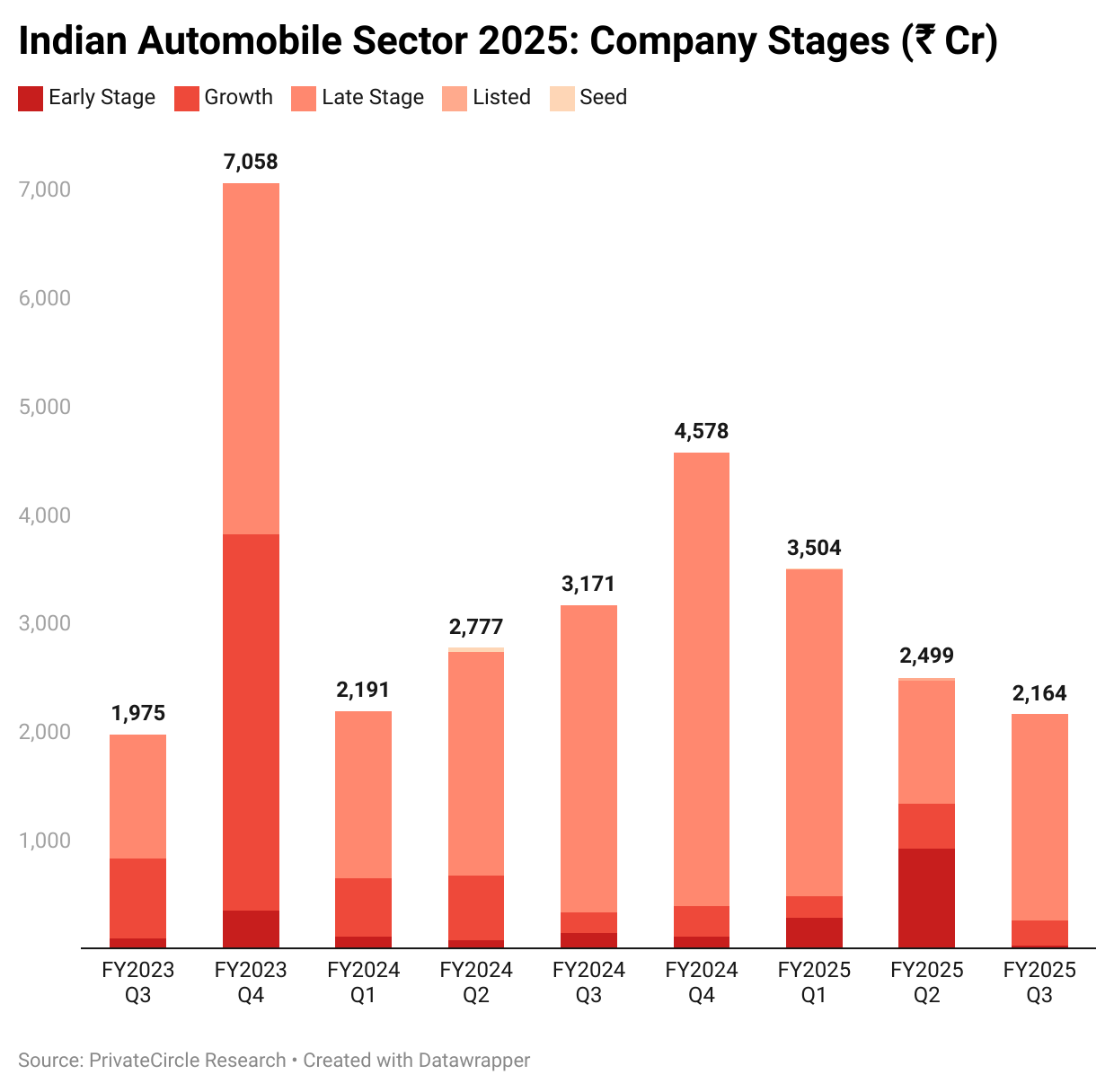

What started as a funding boom in FY2023 Q4 – hitting a peak of ₹7,058 crore – has since taken a winding road downhill, landing at ₹2,164 crore in FY2025 Q3.

Investors seem to be pressing the brakes, but not entirely. They’re just being a bit more selective about the direction they are steering their money towards.

The Indian automobile sector saw a funding surge in FY2023 Q4 (₹7,058 Cr), followed by fluctuating but declining investments, reaching ₹2,164 Cr in FY2025 Q3.

The dominance of late-stage and listed companies indicates a shift towards established players, with early and seed-stage funding remaining minimal.

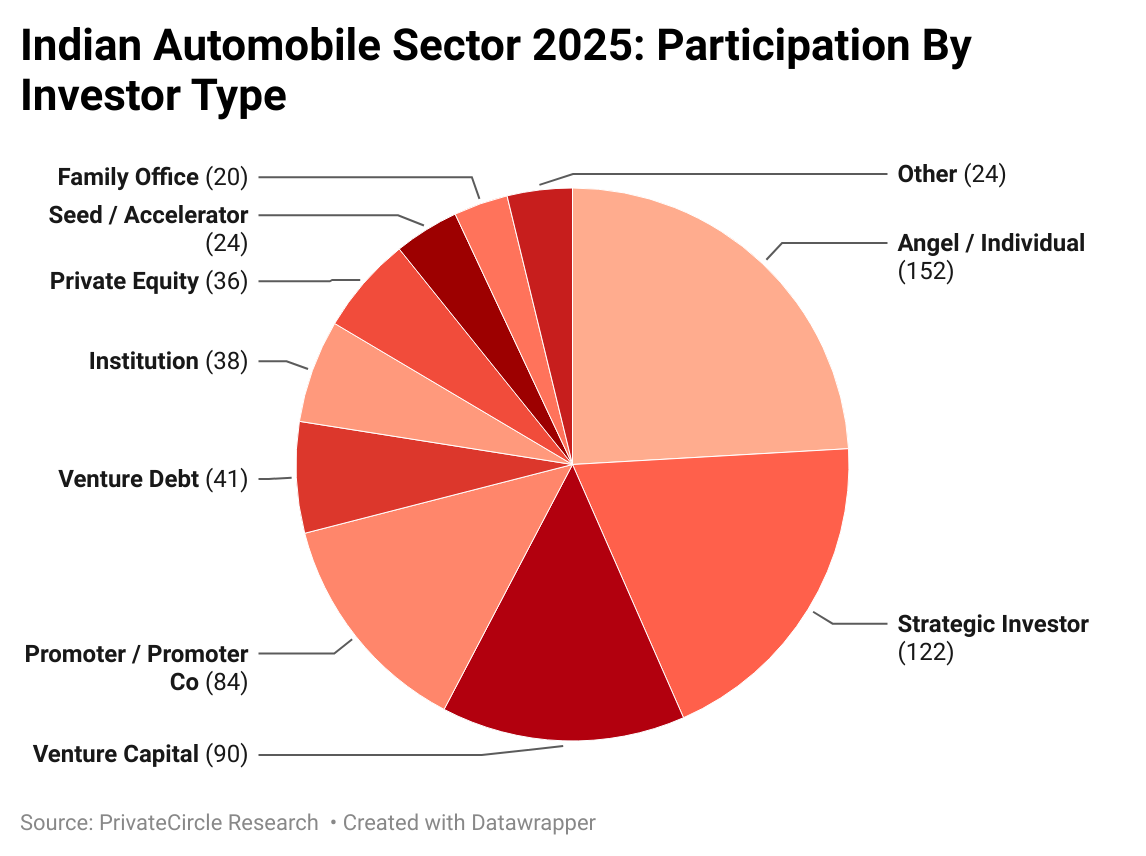

Angel/Individual investors (152) and Strategic Investors (122) are the most active in the Indian automobile sector, highlighting strong participation from independent backers and industry players.

Venture Capital (90) and Promoter/Promoter Co (85) also play key roles, while Seed/Accelerator (24) and Family Offices (20) have limited presence.

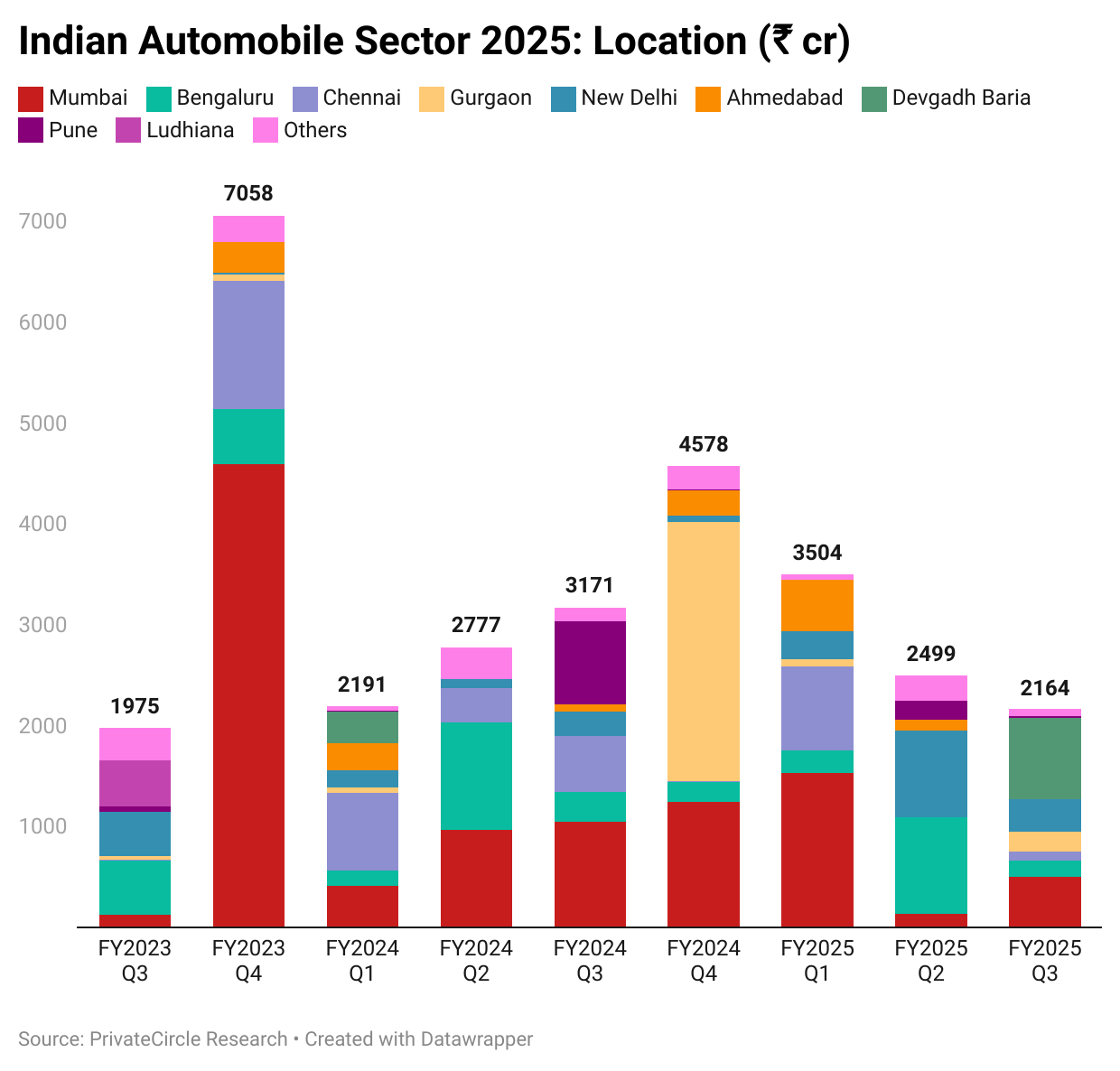

Mumbai dominates automobile sector investments across all quarters, with Bengaluru and Chennai also securing significant funding.

While Q4 FY2023 saw a peak at ₹7,058 Cr, investments have since declined, with FY2025 Q3 reaching ₹2,164 Cr, indicating a slowdown in sectoral funding across major cities.

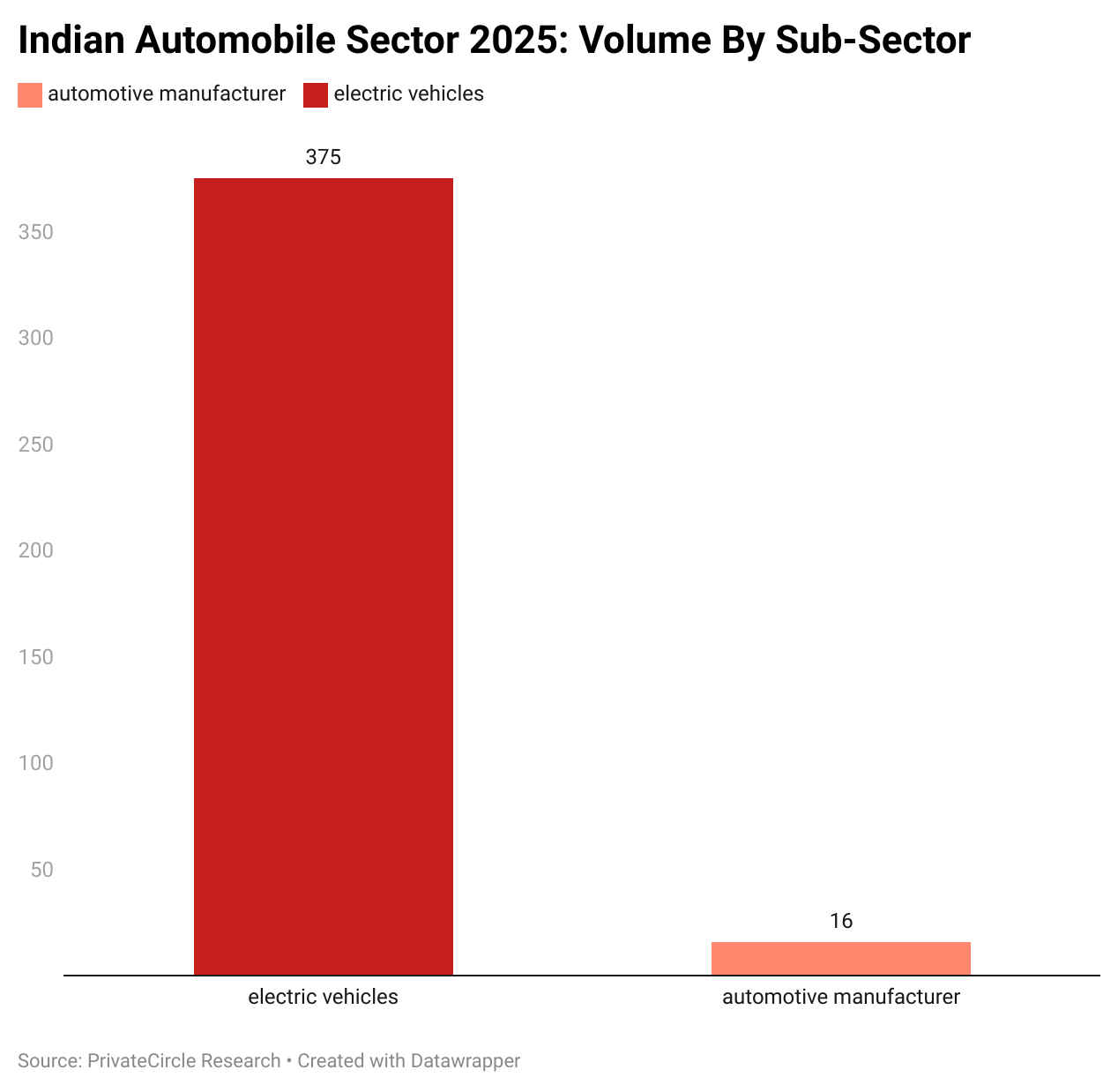

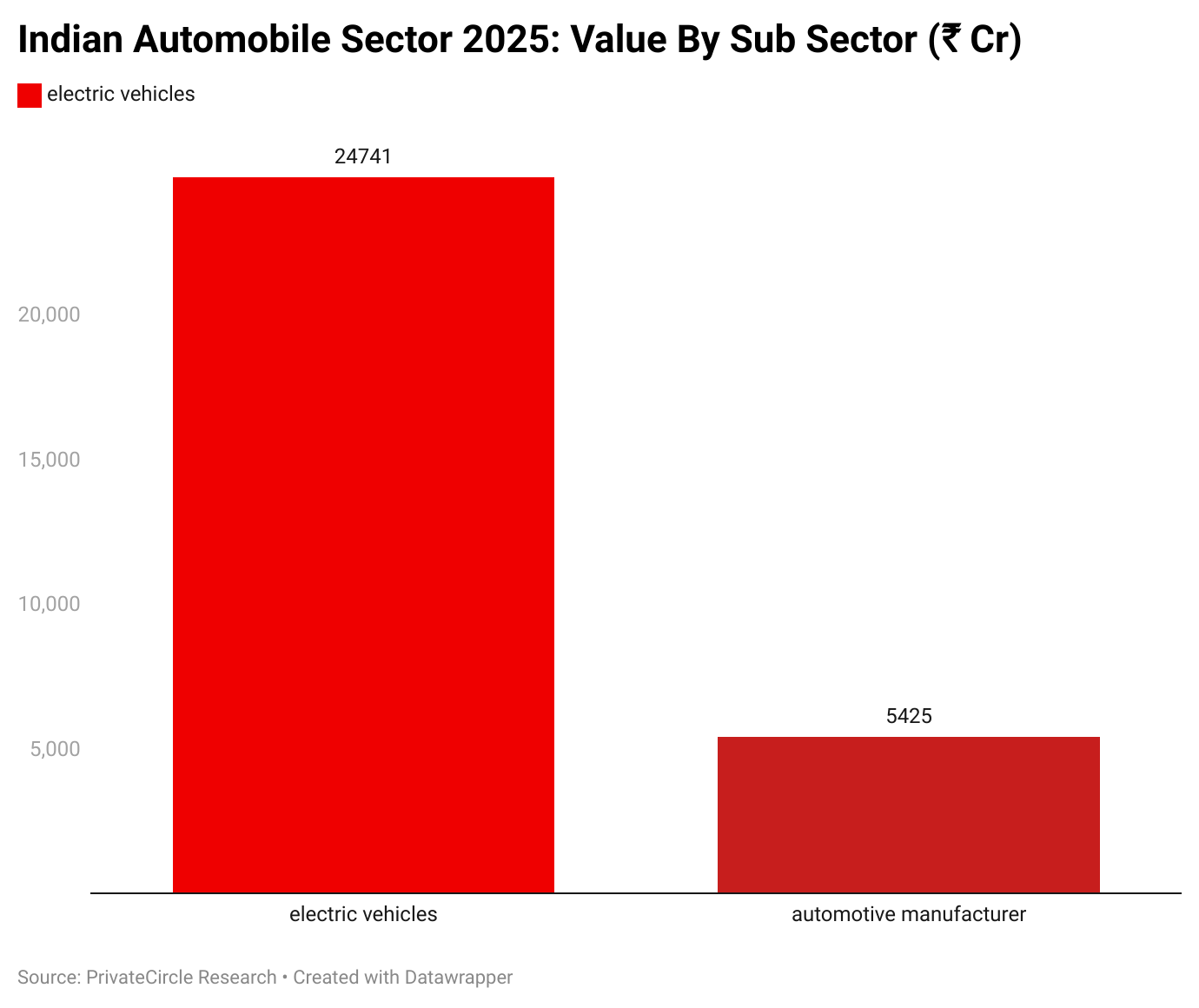

Automotive manufacturers signed on 16 deals, while electric vehicles had 375 deals.

Electric vehicles dominates with ₹24,741 cr sum of deal value, while automotive manufacturers followed with ₹5425 cr.

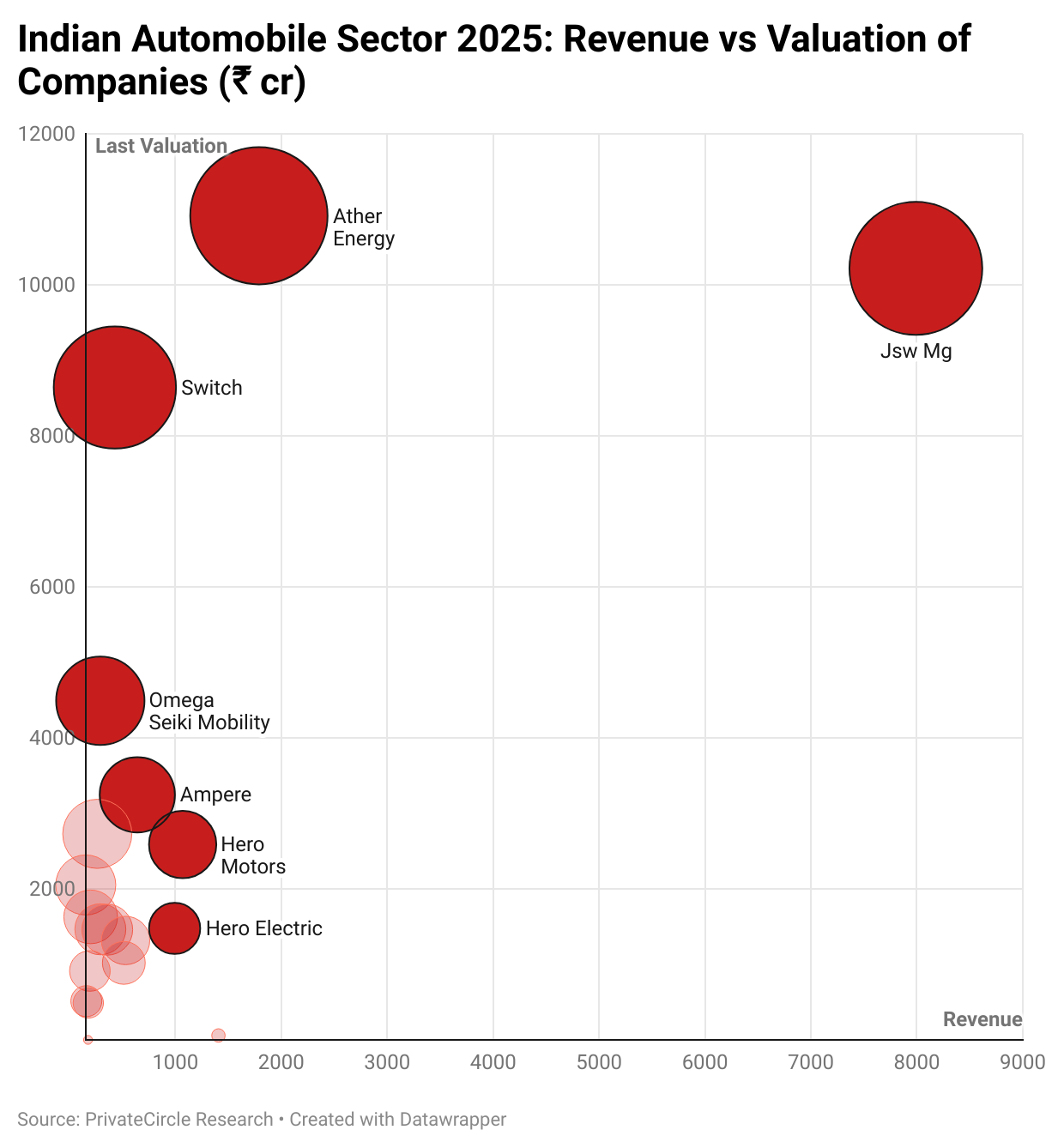

JSW Mg led the revenue charts with an impressive ₹7,990 crore, while new-age competitor Ather Energy claimed the top spot in valuation, soaring to ₹10,916 crores.

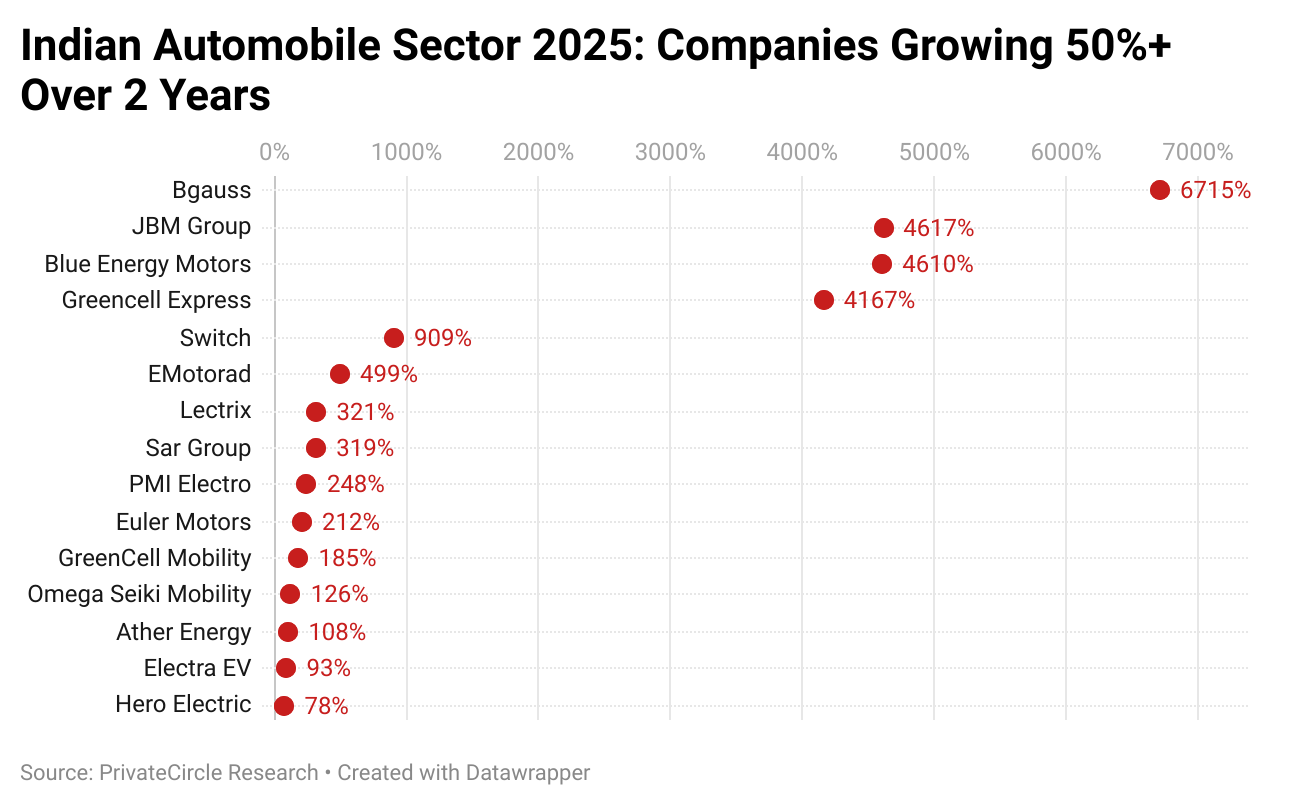

BGAUSS had the highest 2-year CAGRs at 6715%, followed by JBM Group and Blue Energy Motors.

The road ahead looks exciting but bumpy.

Traditional automakers need to adapt to changing consumer preferences, EVs need to prove their long-term profitability, and early-stage startups need to find creative ways to secure funding.

One thing is for sure: the automobile sector in India isn’t slowing down – it’s just shifting gears.

The next few years will be crucial in defining which companies steer the industry forward and which ones get stuck in the rearview mirror.

Follow us on social media for latest updates and insights into the dynamic landscape of Indian Private Markets.

Sign up on PrivateCircle Research to access data and insights on all things India Private Markets.

Data Curation by Ganesh Lokesh M of PrivateCircle.

Explore More Sector Deals Summary Reports:

Indian Retail Sector: 2024 Deals Summary Report

Amazing report