Overview

The Indian retail sector has shown remarkable resilience and growth, with significant funding activity from Q2 FY 2023 to Q2 FY 2025.

This comprehensive analysis dives into the evolving trends across company stages, investor participation, key locations, and sectoral performance. With late-stage companies attracting most of the capital, the industry’s landscape is marked by diverse investor types and geographical hotspots.

Indian Retail Sector 2024 Figures;

- Q2 FY 2025 Total Funding: ₹1,656 Cr | Early Stage ₹325 Cr | Growth Stage ₹390 Cr | Late Stage ₹933 Cr | Seed Stage ₹08 Cr

- Total Deals: 982 | Angel / Individual 256 Deals | Venture Capital 182 Deals | Strategic Investor 179 Deals

- Q2 FY 2025 Funding Based on Location: Bengaluru ₹719 Cr | Mumbai ₹418 Cr

- Deal Volume by Sub-Sector: Online apparel 151 Deals | Online Retail 145 Deals

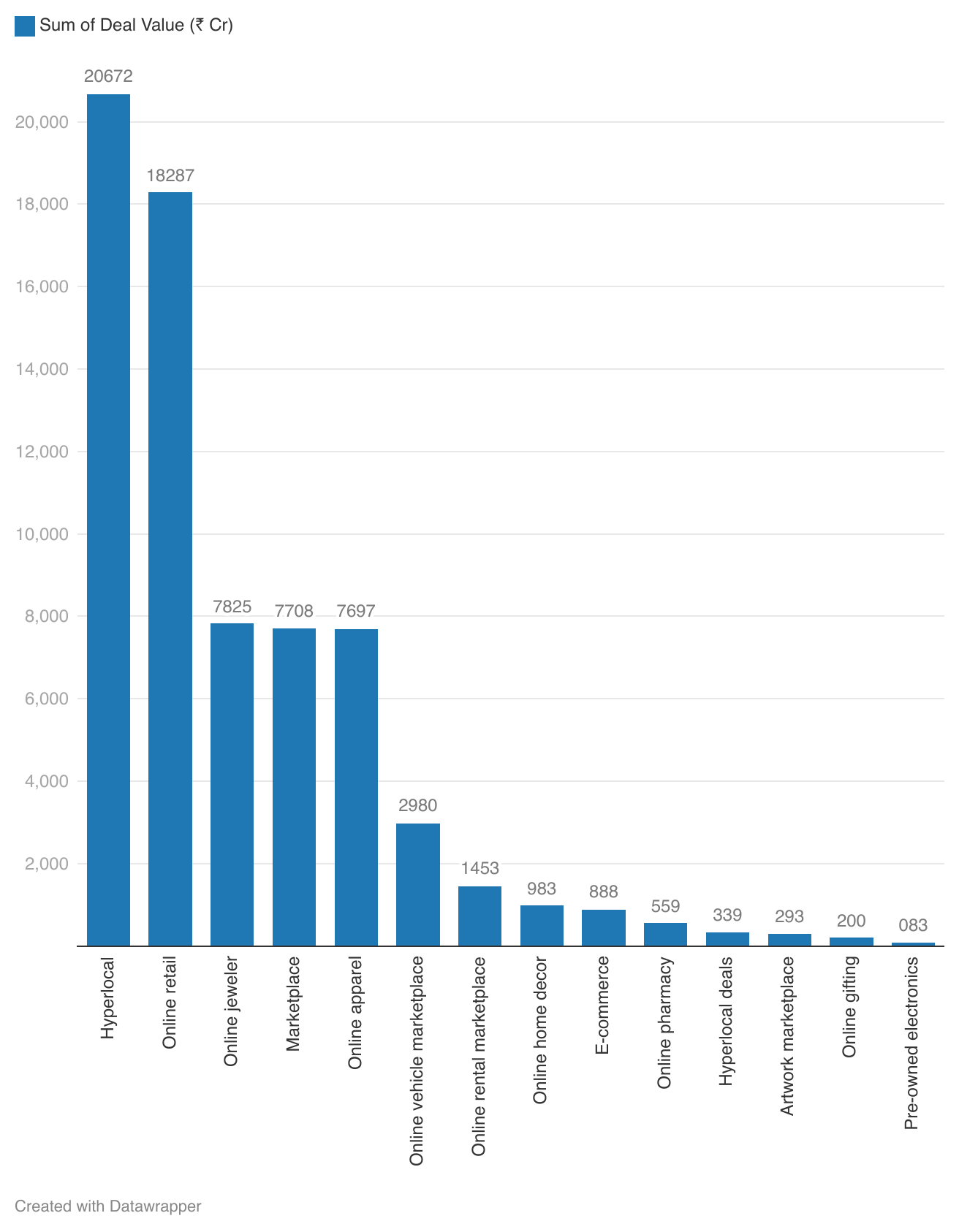

- Total Deal Value: ₹69,967 Cr | Hyperlocal ₹20,672 Cr | Online Retail ₹18,287 Cr

Blog Outline; Data and Insights by PrivateCircle Research.

- Company Stages (₹ cr)

- Participation by Investors Type

- Location (₹ cr)

- Volume by Sub-Sector

- Value by Sub-Sector (₹ Cr)

- Revenue vs Valuation of Companies (₹ cr)

- Companies Growing 50%+ Over 2 Years

- Job Creation & Economic Impact

- Comparative Analysis – Monthly Performance | Investor Activity

- In-Depth Insights

- Funding Dynamics

- Strategic Investments

- Future Outlook

- Conclusion

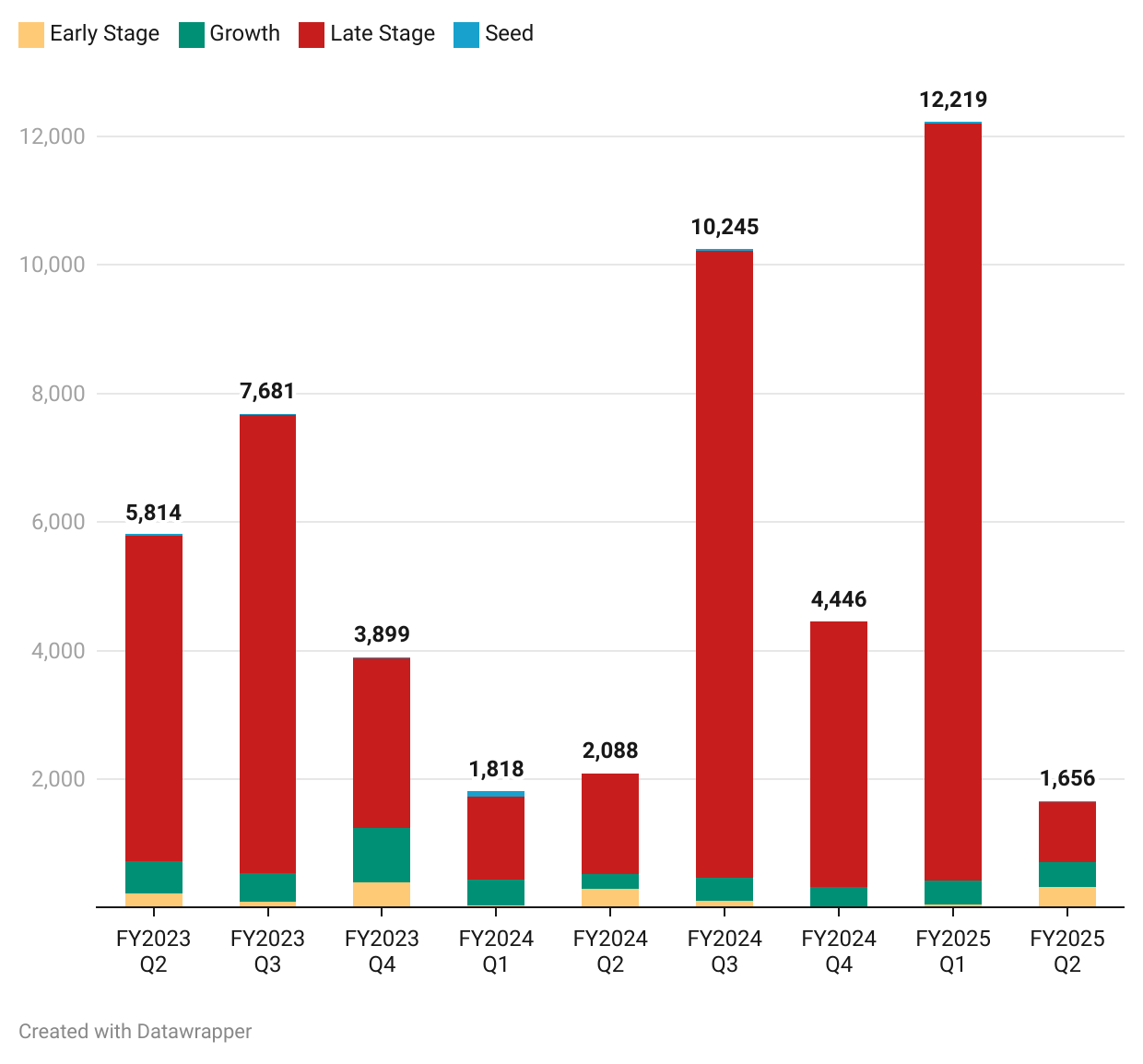

Company Stages (₹ cr)

The Late Stage received more funding than other stages in 2022-23, 2023-24 & 2024-25.

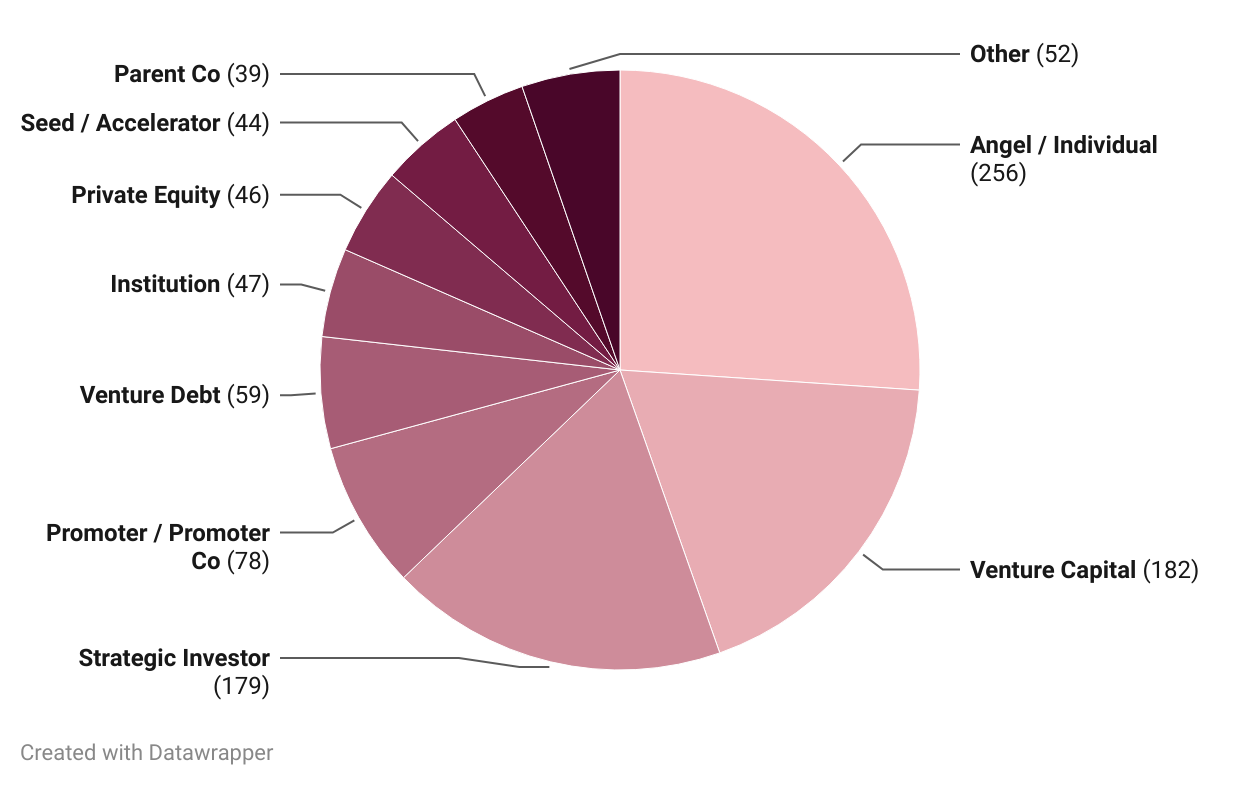

Participation by Investors Type

Angel/Individual investors and Venture Capital firms have been actively investing in the sector. Followed by Strategic Investors and others.

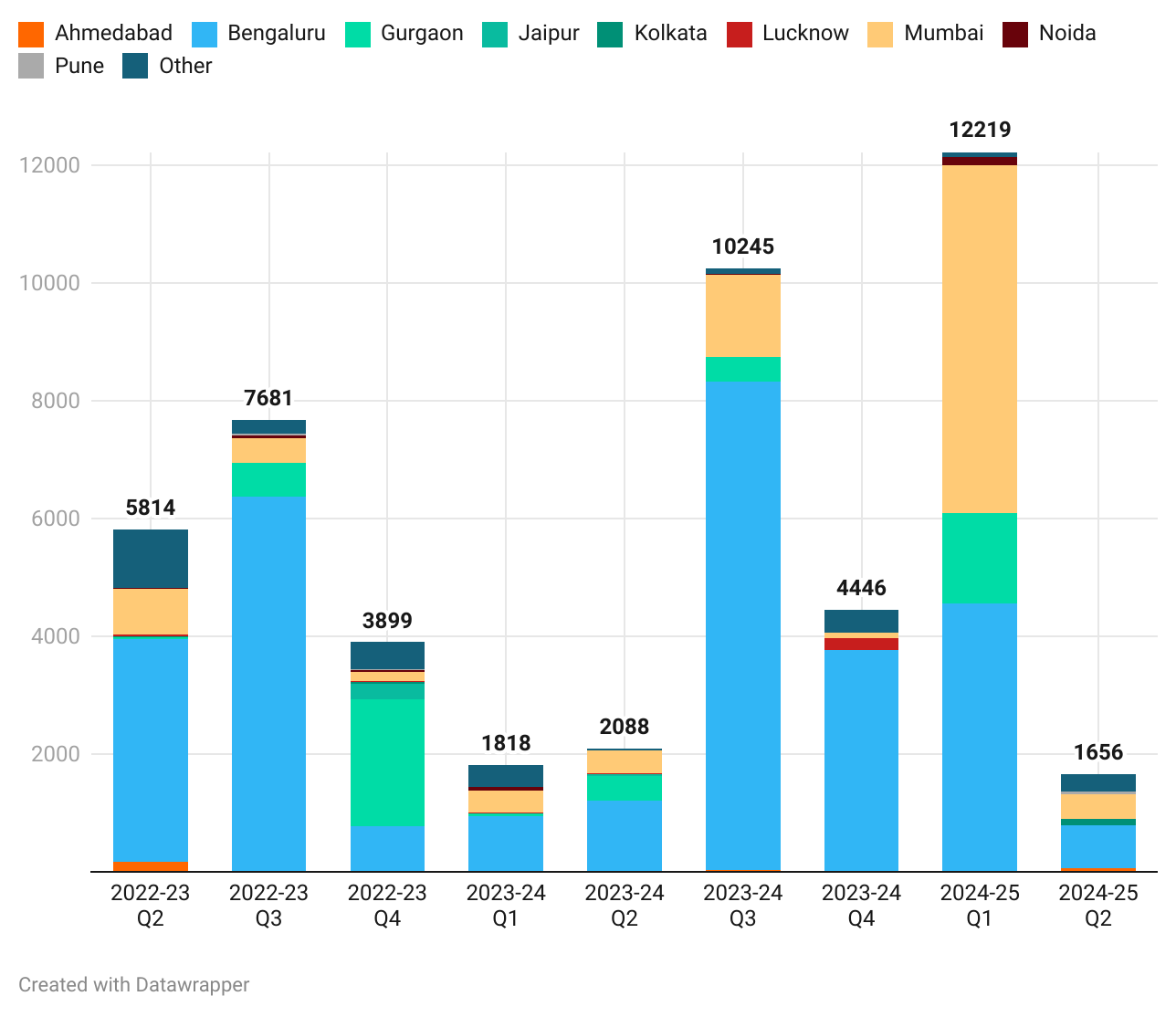

Location (₹ cr)

Bengaluru has received consistent major funding compared to other locations.

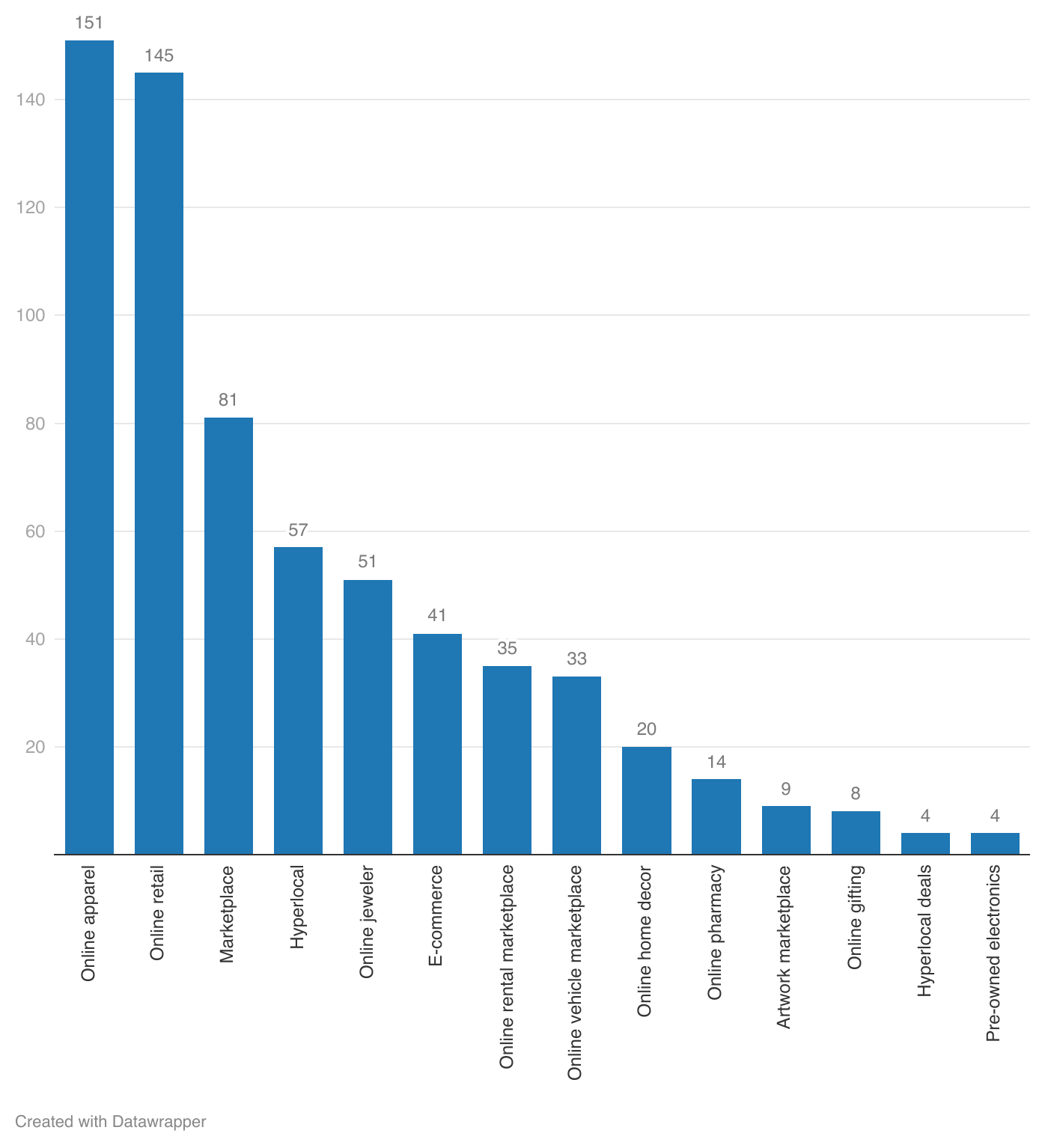

Volume by Sub-Sector

Online apparel and Online Retail accounted for approximately 45% of the total volume.

Value by Sub-Sector (₹ Cr)

Hyperlocal and Online Retail categories dominate deal sizes, indicating strong market activity in these segments.

Revenue vs Valuation of Companies (₹ cr)

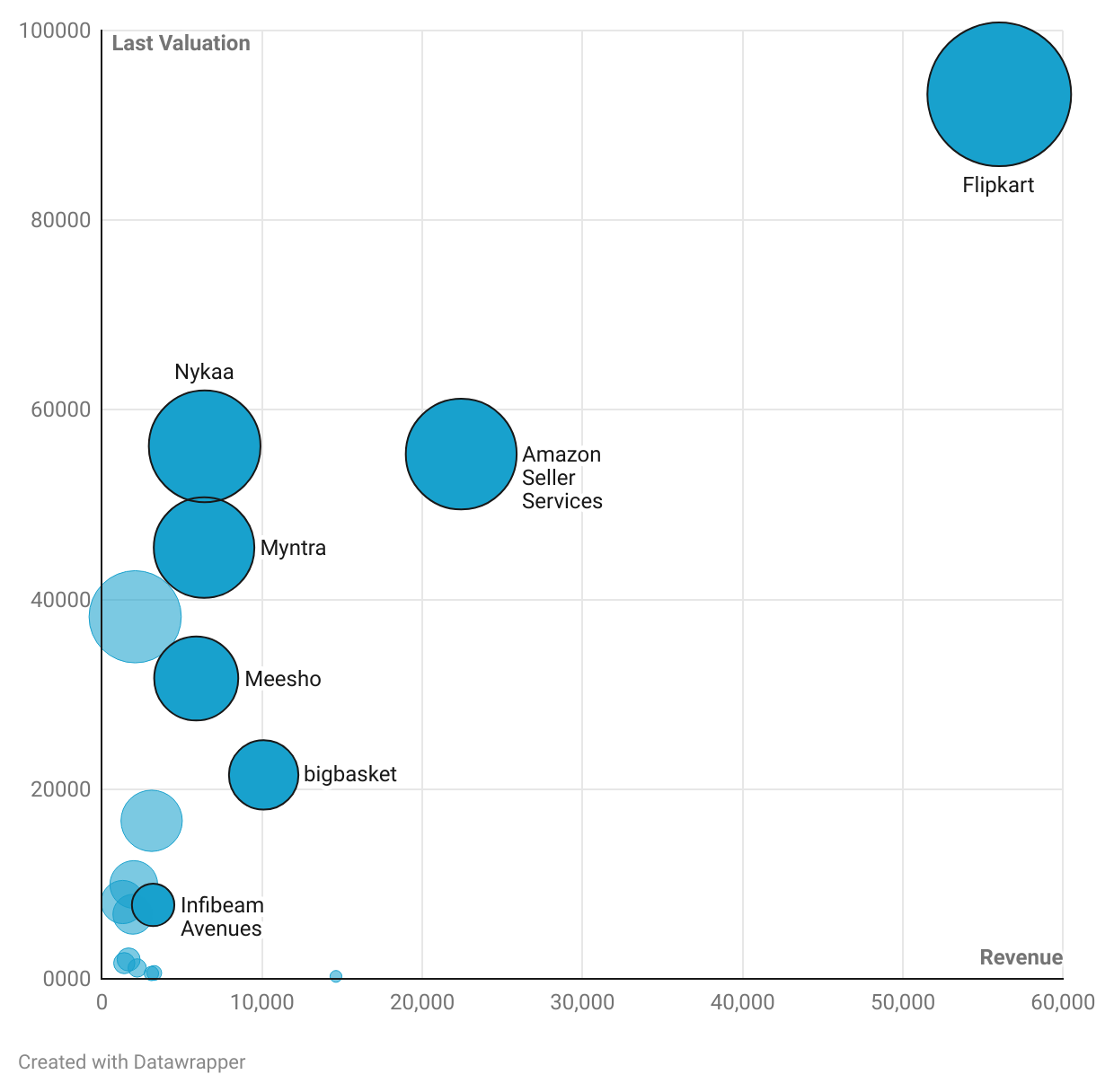

Flipkart and Amazon Seller Services lead both in revenue and valuation, demonstrating their strong positions in the market, while other companies exhibit varying degrees of performance and potential.

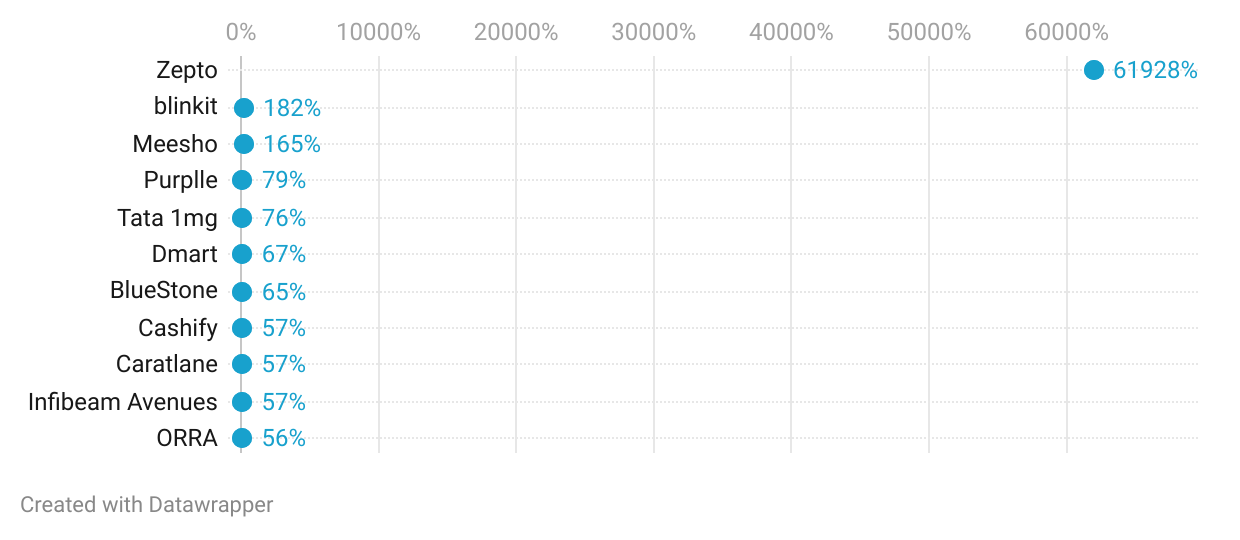

Companies Growing 50%+ Over 2 Years

Zepto had the highest 2-year CAGRs, while many more companies are clocking decent growth in the sector.

Job Creation and Economic Impact

Retail is a major employment generator in India, with funding directed at late-stage companies promising further job creation and economic benefits. The rise in funding suggests an increase in demand for talent across operations, logistics, and technology sectors, fuelling economic growth.

As hyperlocal services expand, employment opportunities are likely to grow in Tier 2 and Tier 3 cities, diversifying income streams and strengthening local economies.

Comparative Analysis – Monthly Performance | Investor Activity

Over the last three years, the late-stage segment received substantial funding, a trend driven by high-profile players like Flipkart and Amazon Seller Services.

Angel investors and venture capital firms are the primary contributors, indicating a sustained appetite for high-risk, high-reward investments. Strategic investors also play a notable role, supporting companies with strategic alignments that go beyond just capital infusion.

In-Depth Insights

Bengaluru emerged as the top-funded location, consistent with its status as India’s tech hub. The city’s strong infrastructure, talent pool, and access to investor networks make it an attractive destination for retail startups.

However, other metros like Mumbai and Delhi NCR are also catching up, driven by the growth of hyperlocal and online retail sectors that cater to urban consumers.

Funding Dynamics

The retail sector is witnessing a strategic shift, with hyperlocal services and online retail dominating in terms of deal value. Hyperlocal services, in particular, are benefiting from India’s unique demographic profile, addressing consumer needs for convenience and quick deliveries.

Meanwhile, online retail, which accounts for 45% of deal volumes, underscores a robust digital economy and changing consumer behaviours.

Strategic Investments

Online apparel and online retail, which accounted for nearly half of the sector’s volume, demonstrate a clear preference among investors for scalable business models.

The presence of both strategic and venture capital investors suggests a balanced approach, with an emphasis on long-term growth potential in these sub-sectors. This aligns with global trends as e-commerce and hyperlocal services redefine consumer access to goods.

Future Outlook

Given the rapid urbanization and rising disposable incomes, India’s retail sector will likely continue its upward trajectory. Online retail and hyperlocal services are poised for sustained growth, supported by improvements in digital infrastructure.

Government initiatives aimed at boosting digital literacy and e-commerce regulations are also expected to provide a favourable environment for startups to flourish, particularly those that can adapt to India’s diverse consumer base.

Conclusion

The Indian retail sector stands at a pivotal moment, where a robust mix of late-stage funding, strategic investments, and investor diversity is paving the way for future growth.

As both established and emerging cities compete for investor attention, the sector’s prospects look promising, with ample opportunities for job creation, economic impact, and regional development.

With continued focus on hyperlocal and online retail, the industry is set to play a transformative role in shaping India’s economic landscape.

Stay tuned for more in-depth analyses and insights on the latest trends in the startup world.

Follow us on social media for latest updates and insights into the dynamic landscape of Indian Private Markets.

Sign up on PrivateCircle Research to access data and insights on all things India Private Markets.

Data Curation by Sangeetha M of PrivateCircle.