Overview

The Indian personal products sector has seen dynamic growth from Q2 2023 to Q2 2024, marked by varying trends in funding, sector participation, and geographical dominance.

While late-stage funding has consistently attracted the largest investments, early and seed-stage rounds have been more volatile.

With Mumbai emerging as a dominant player in deal volumes and startups like myglamm standing out in terms of valuation, the industry is a fascinating blend of traditional growth with new, innovative brands on the rise.

Indian Personal Products 2024 Figures;

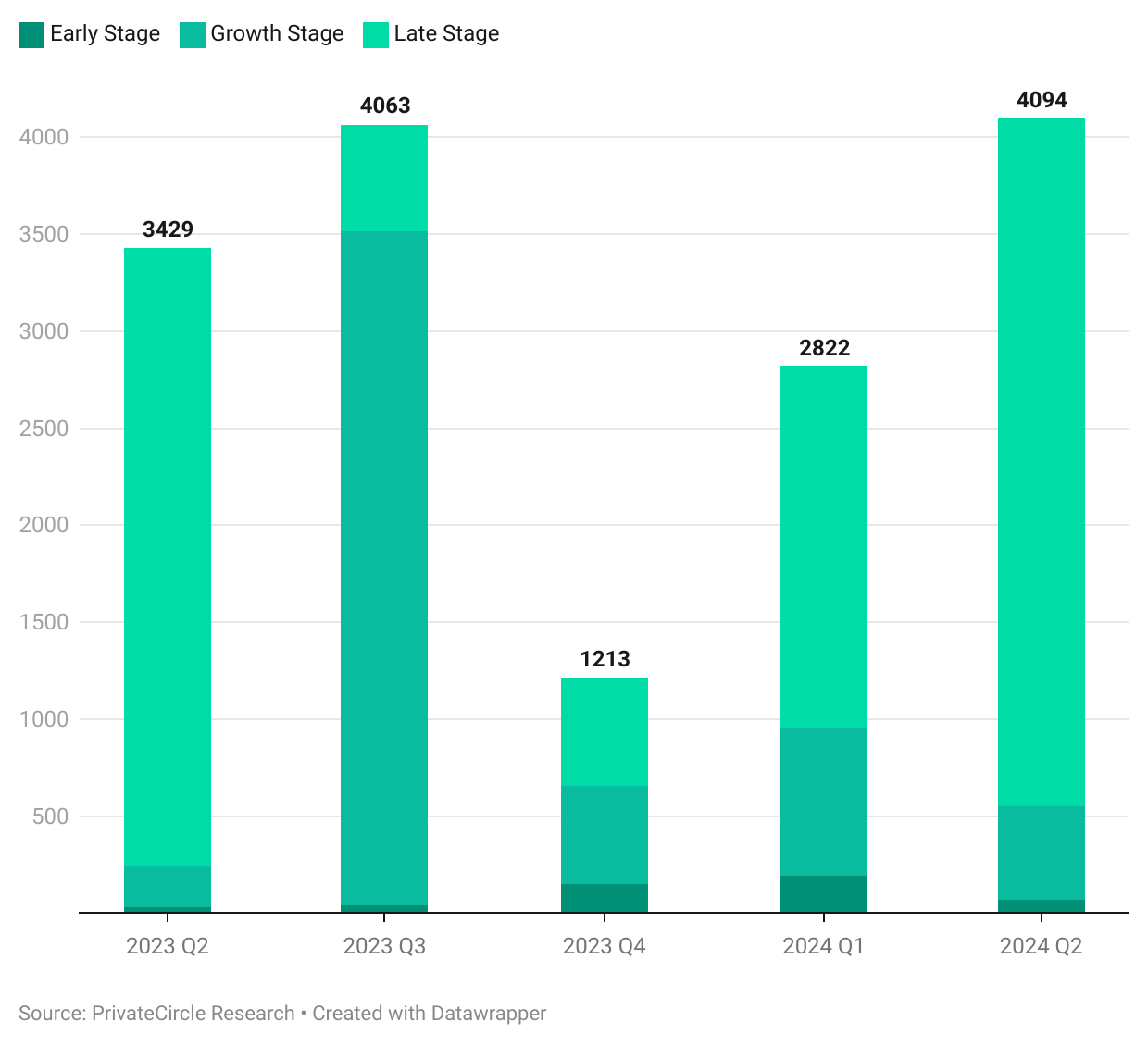

- Q2 2024 Total Funding: ₹4,094 Cr | Early Stage ₹67 Cr | Growth Stage ₹485 Cr | Late Stage ₹3,542 Cr

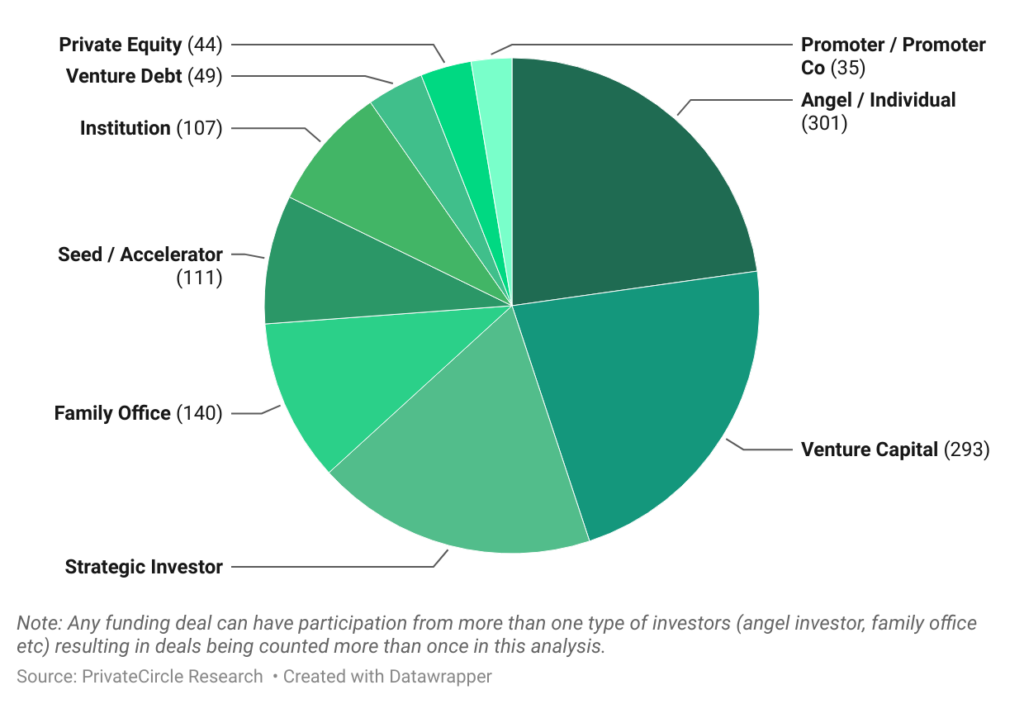

- Total Deals: 462 | Angel / Individual 301 Deals | Venture Capital 293 Deals | Strategic Investor 242 Deals | Family Office 140 Deals | Seed / Accelerator 111 Deals | Institution 107 Deals | Venture Debt 49 Deals | Private Equity 44 Deals | Promoter / Promoter Co 35 Deals

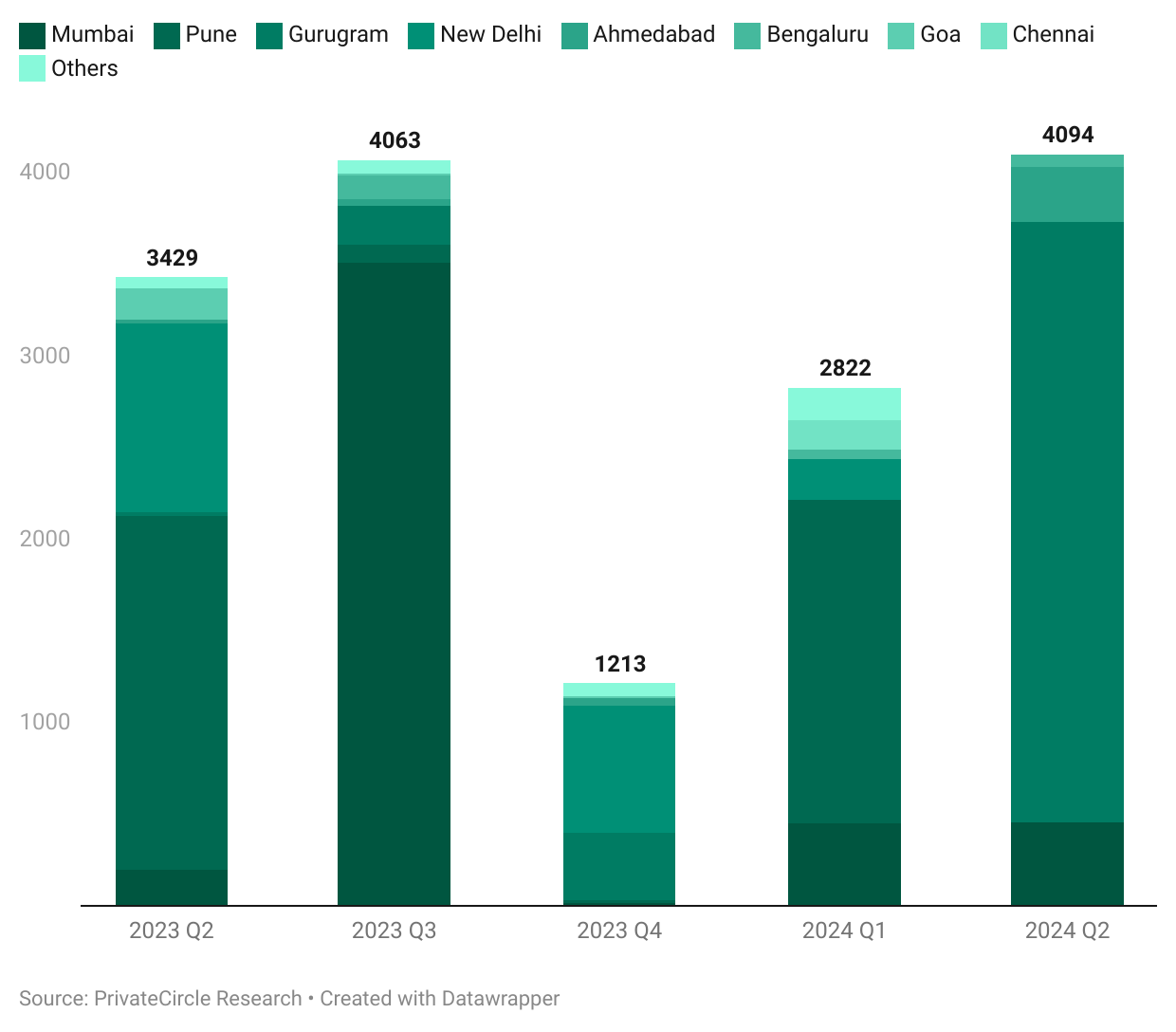

- Q2 2024 Funding Based on Location: Mumbai ₹456 Cr | Gurugram ₹3,270 Cr | Ahmedabad ₹300 Cr | Bengaluru ₹68 Cr |

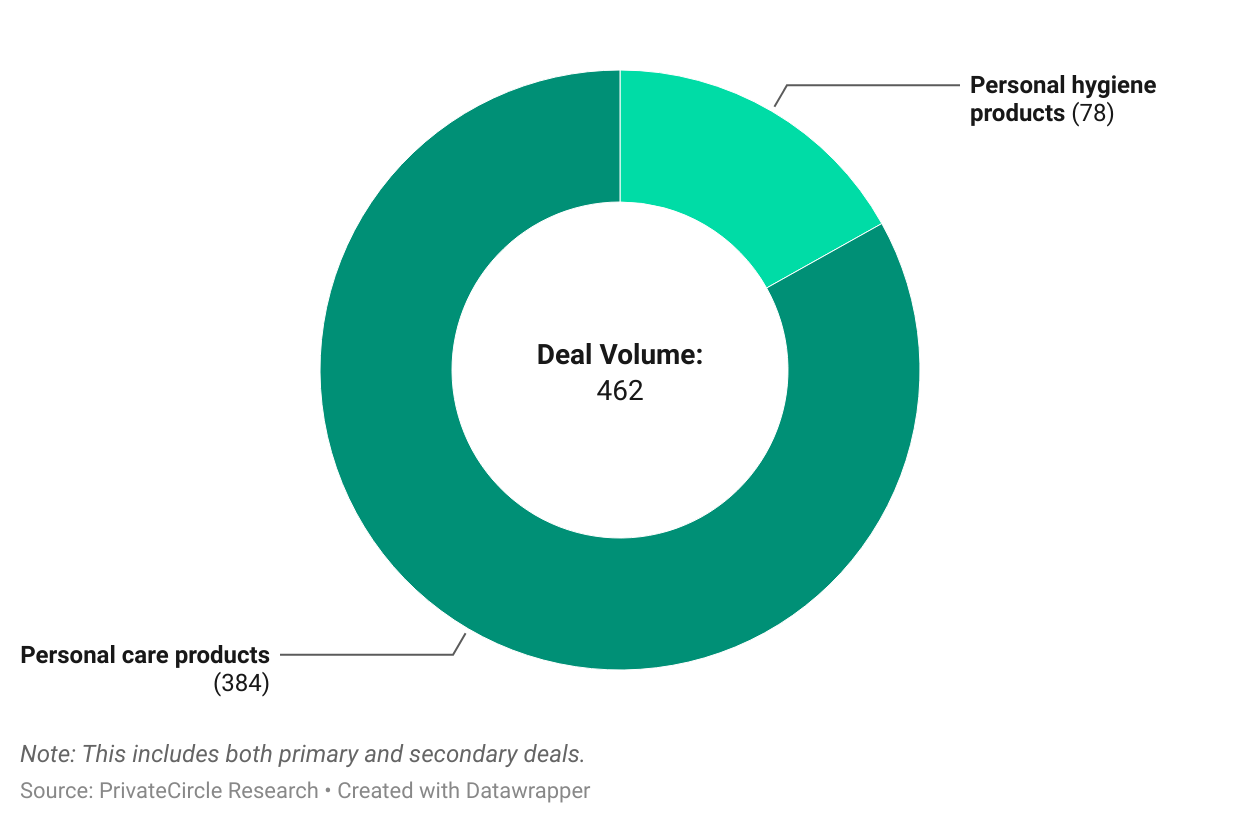

- Deal Volume by Sub-Sector: Personal hygiene products 78 Deals | Personal care products 384 Deals

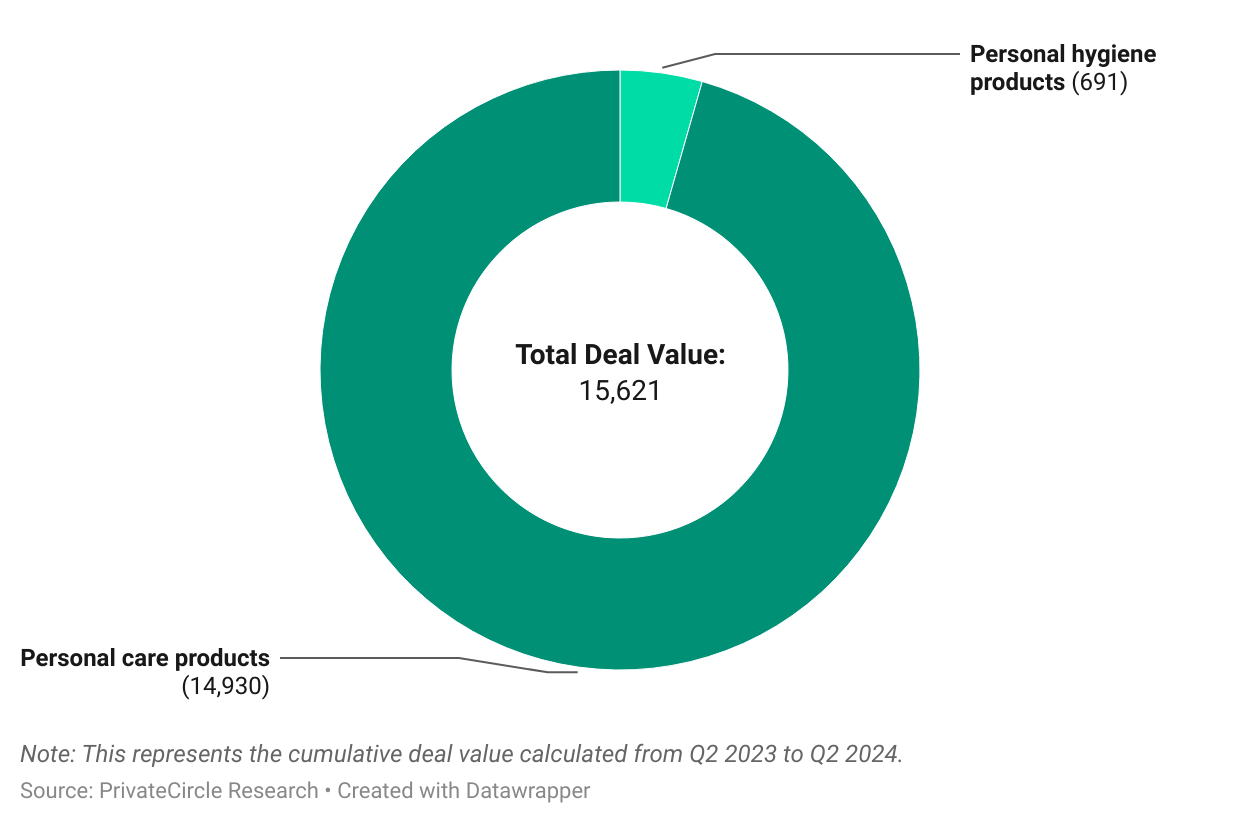

- Total Deal Value: ₹15,621 Cr | Personal hygiene products ₹691 Cr | Personal care products ₹14,930 Cr

Blog Outline; Data and Insights by PrivateCircle Research.

- Company Stages (₹ cr)

- Participation by Investors Type

- Location (₹ cr)

- Volume by Sub-Sector

- Value by Sub-Sector (₹ Cr)

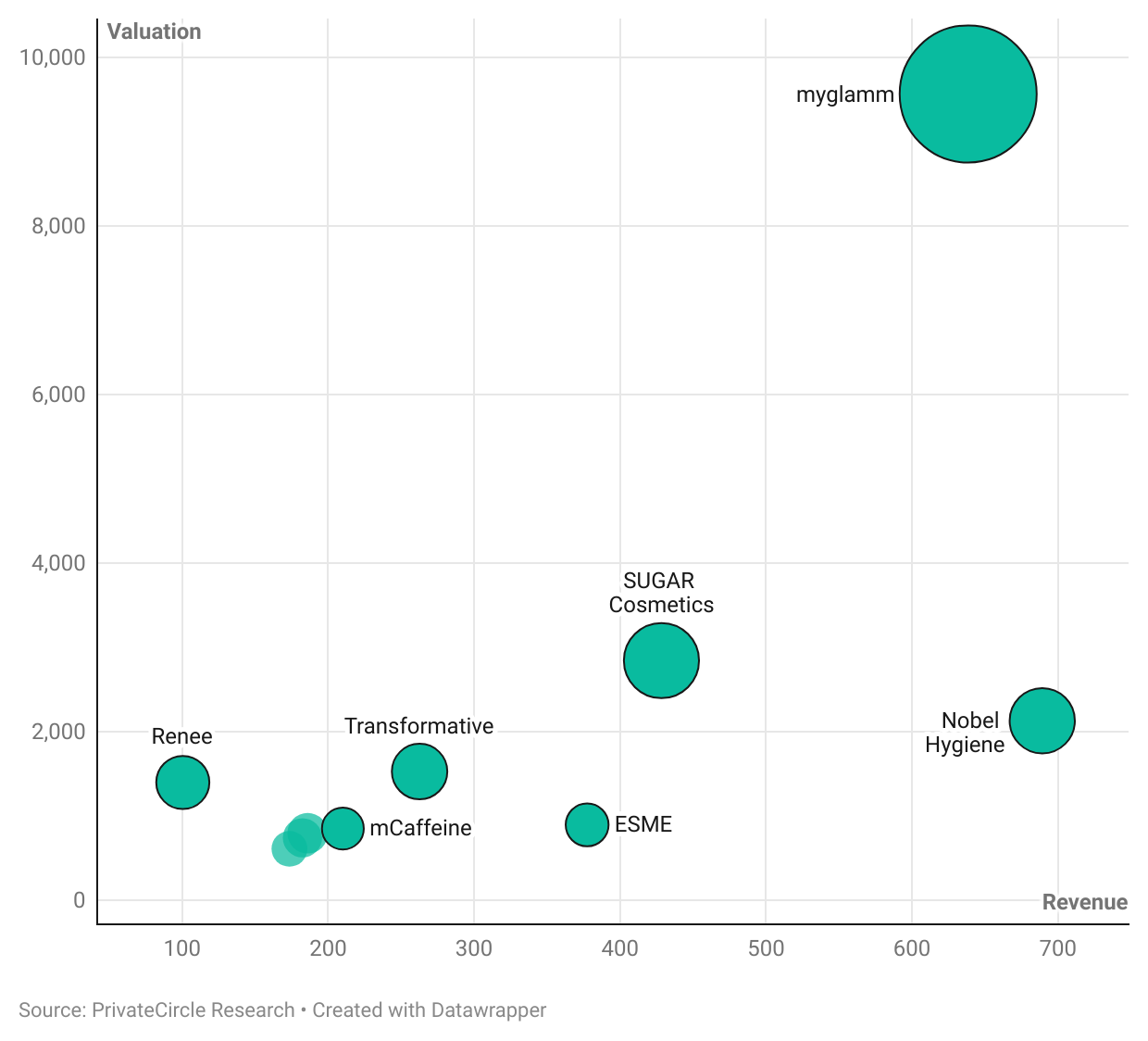

- Revenue vs Valuation of Companies (₹ cr)

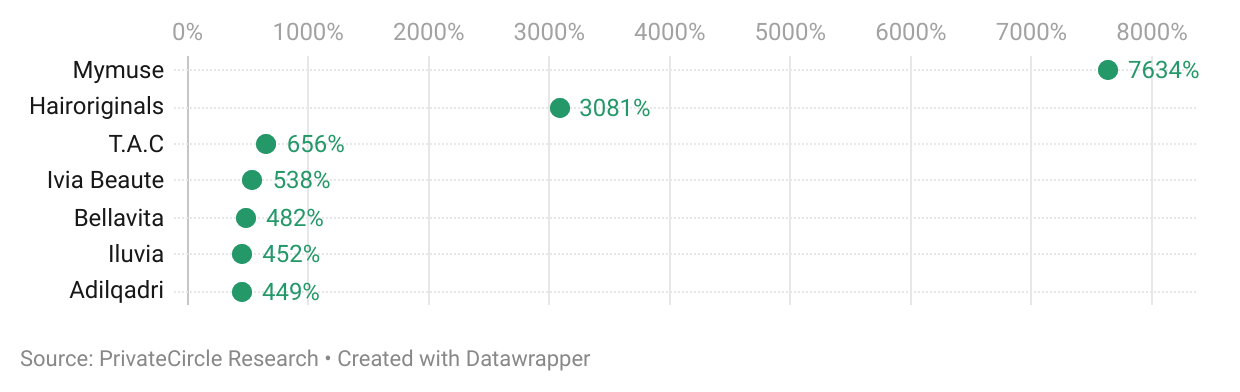

- Companies Growing 350%+ Over 2 Years

- Job Creation & Economic Impact

- Comparative Analysis – Monthly Performance | Investor Activity

- In-Depth Insights

- Funding Dynamics

- Strategic Investments

- Future Outlook

- Conclusion

Company Stages (₹ cr)

The data reveals a consistent pattern where late-stage deals tend to attract the largest investments, while early-stage and seed funding fluctuates across quarters.

Growth-stage funding shows strong activity in Q3 2023.

Participation by Investors Type

Angel/Individual and Venture Capital investments are leading, signalling strong entrepreneurial and late-stage funding trends in this industry.

Strategic investors also play a significant role, Family offices and seed/accelerator programs show moderate participation contributing to a large portion of the deals.

Location (₹ cr)

Mumbai dominates in most quarters, particularly in Q3 2023, showing the highest volume of deals. Gurugram and Pune are leading the way to the top.

Other cities like Chennai and Goa show smaller contributions, but consistent participation across the quarters.

Volume by Sub-Sector

This suggests that personal care remains the central focus, with hygiene products contributing to a smaller but meaningful share of the market’s investment activity.

Value by Sub-Sector (₹ Cr)

This suggests that personal care products dominate the market compared to personal hygiene products and experienced less financial engagement during this time frame.

Revenue vs Valuation of Companies (₹ cr)

myglamm stands out with the highest valuation and significant revenue. Nobel Hygiene shows high revenue but a lower valuation compared to myglamm.

Companies like BellaVita, mCaffeine, Renee, Soothe healthcare, and Bombay Shaving Company have smaller revenues and valuations, with some clustering around the lower end of both axes.

Companies Growing 350%+ Over 2 Years

These businesses represent some of the fastest-growing brands in the personal products industry, highlighting their rapid rise and increasing influence in the market over the last two years.

Their substantial growth points to successful strategies and strong consumer demand within the sector.

Job Creation and Economic Impact

The personal products industry in India is a major driver of employment, with startups and established brands alike creating a substantial number of jobs.

The rise of fast-growing companies that have achieved over 350% growth over two years suggests not only product-market fit but also the ability to scale operations quickly.

This rapid growth has strong implications for local economies, especially in cities like Mumbai, Gurugram, and Pune, which are emerging as investment hubs.

Comparative Analysis

A comparative look at revenue versus valuation data reveals interesting dynamics. Companies like Nobel Hygiene generate high revenues but have comparatively lower valuations than more digitally forward companies like myglamm.

The difference may highlight the importance investors place on brand visibility, marketability, and tech-enabled scaling potential.

Smaller players like Renee and Bombay Shaving Company also stand out with more conservative growth but strong niche dominance, indicating various successful business models within the sector.

Monthly Performance

Q3 2023 was a high-performing quarter for growth-stage investments, particularly in cities like Mumbai, where the concentration of deals peaked. This quarter also saw strong participation across different types of investors, suggesting renewed confidence in both early-stage and late-stage companies.

However, Q2 2024 showed fluctuating performance for seed and early-stage investments, potentially indicating more cautious investor sentiment as these markets mature.

Investor Activity

Angel investors, venture capitalists, and strategic investors have led funding in this period, reflecting continued confidence in the sector’s long-term growth potential.

Seed accelerators and family offices, while showing moderate participation, still account for a notable portion of deals.

This distribution indicates that even small-scale, early-stage companies can attract high-quality investment, laying the foundation for long-term success.

In-Depth Insights

Several personal product companies have demonstrated exceptional growth. The analysis of companies growing over 350% highlights their unique ability to capture market share quickly.

These businesses, supported by strong demand and innovative strategies, provide insights into the evolving preferences of Indian consumers. From a brand standpoint, the focus on wellness, beauty, and sustainable product offerings seems to be fueling consumer interest and sales.

Funding Dynamics

Late-stage funding deals dominate in terms of both volume and size, with early and growth-stage deals fluctuating more across quarters.

Growth-stage funding, particularly in Q3 2023, showed strong activity, indicating robust investor interest in scaling businesses that have already found traction. This dynamic may point to the increasing maturity of the Indian personal products industry, where larger brands seek to expand while newer entrants still explore market potential.

Strategic Investments

Strategic investors have been especially active in this period, as companies look to consolidate market positions and enter new product categories.

The involvement of family offices and seed accelerators, while less visible, is also critical in nurturing the next generation of personal product brands.

Partnerships with larger companies and corporate ventures have bolstered innovation, allowing startups to leverage industry expertise and scaling capabilities.

Future Outlook

Looking ahead, the Indian personal products market is poised for sustained growth. With consumer demand continuing to shift towards personalized, premium, and eco-friendly products, companies that can innovate and scale efficiently are likely to be the biggest winners.

The sector is expected to experience further consolidation, with successful startups potentially becoming acquisition targets for larger players or eyeing IPOs.

Investment activity, particularly in the growth stage, is anticipated to remain strong as companies continue expanding their market reach.

Conclusion

The Indian personal products market has shown resilience and dynamism from Q2 2023 to Q2 2024, with companies large and small contributing to the industry’s evolution.

As funding flows continue to support late-stage deals and personal care remains a central focus, the industry offers substantial opportunities for growth and innovation.

Investors are increasingly recognising the potential in early-stage and growth-stage companies, setting the stage for further expansion in this thriving market.

Stay tuned for more in-depth analyses and insights on the latest trends in the startup world.

Follow us on social media for latest updates and insights into the dynamic landscape of Indian Private Markets.

Sign up on PrivateCircle Research to access data and insights on all things India Private Markets.

Data curation by Dinesh SV and Krishna Bhattad of PrivateCircle.