In our latest report for April 2024, we dive into the numbers to uncover the trends shaping the startup landscape across key cities in India.

Highlights to navigate:

- Top Ten Cities Funding

- Amount Raised

- Deal Value

- Average Deal Size

- Investor Type

City-Wise April 2024: Top Ten Cities Funding (₹ cr)

Mumbai, Bengaluru, and Delhi NCR take the spotlight as the top three cities in startup funding for April 2024.

These urban hubs continue to attract investors and nurture innovation, driving the growth of the startup ecosystem.

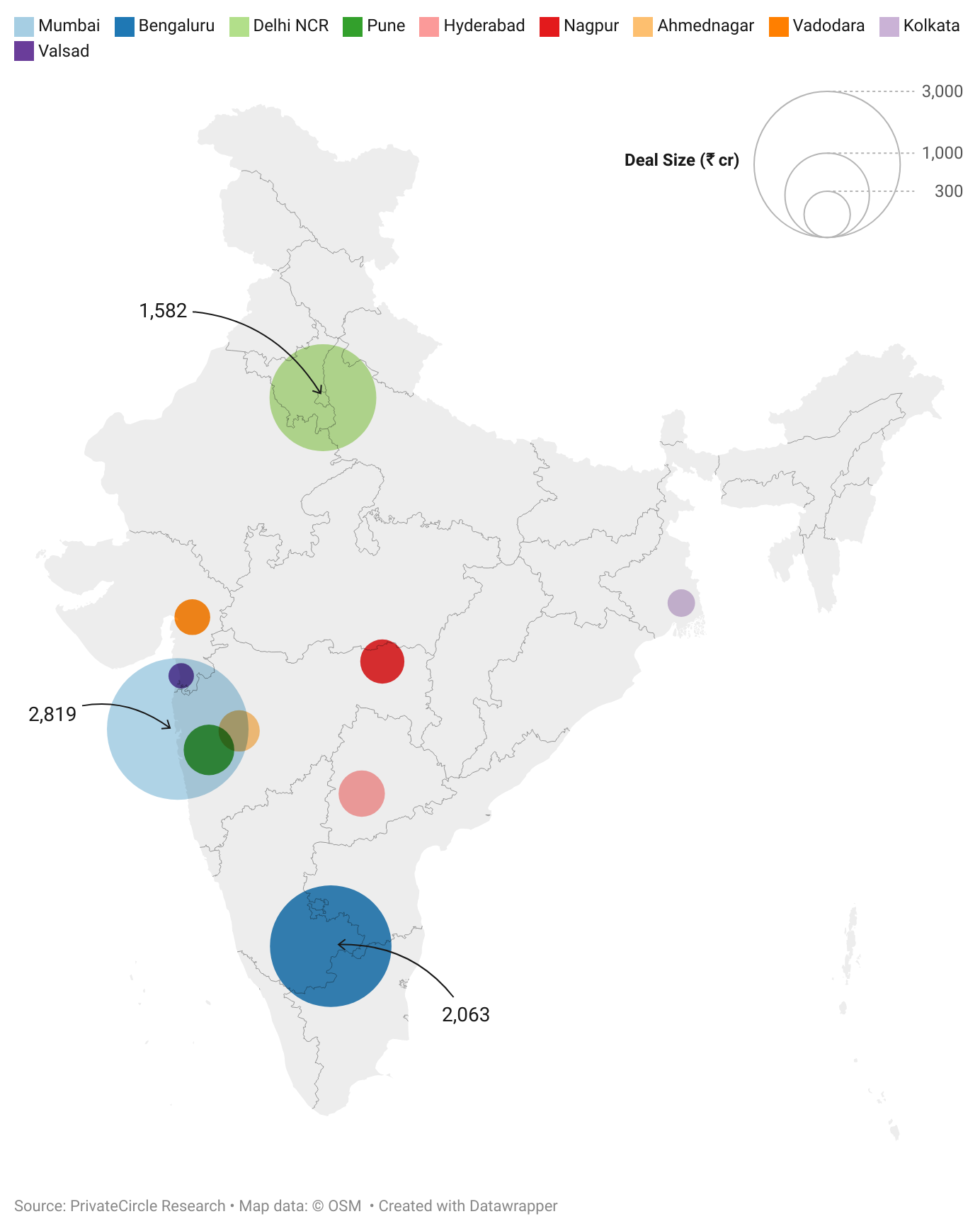

City-Wise April 2024: Amount Raised (₹ cr)

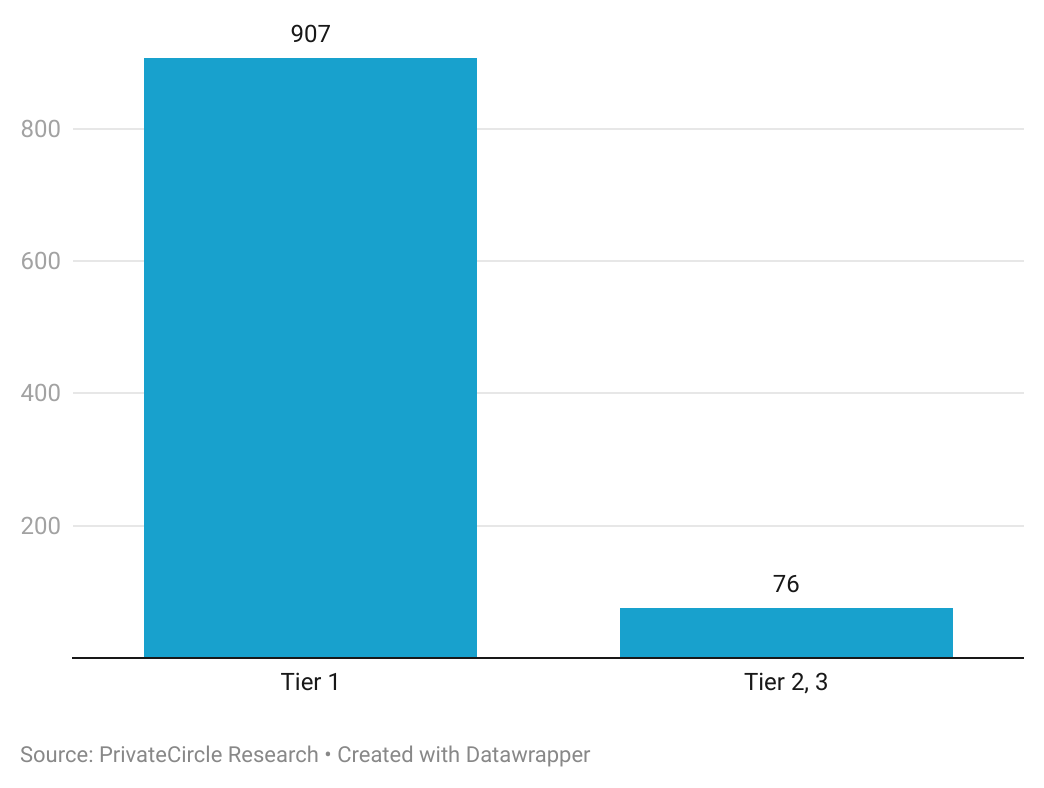

The graph below illustrates the total funding raised by startups in various cities, grouped by the tiers.

Mumbai leads the pack, followed closely by Bengaluru and Delhi NCR, showcasing their resilience and appeal to investors.

Nagpur, Ahmednagar, and Vadodara raised the highest amount from Tier 2, 3 cities.

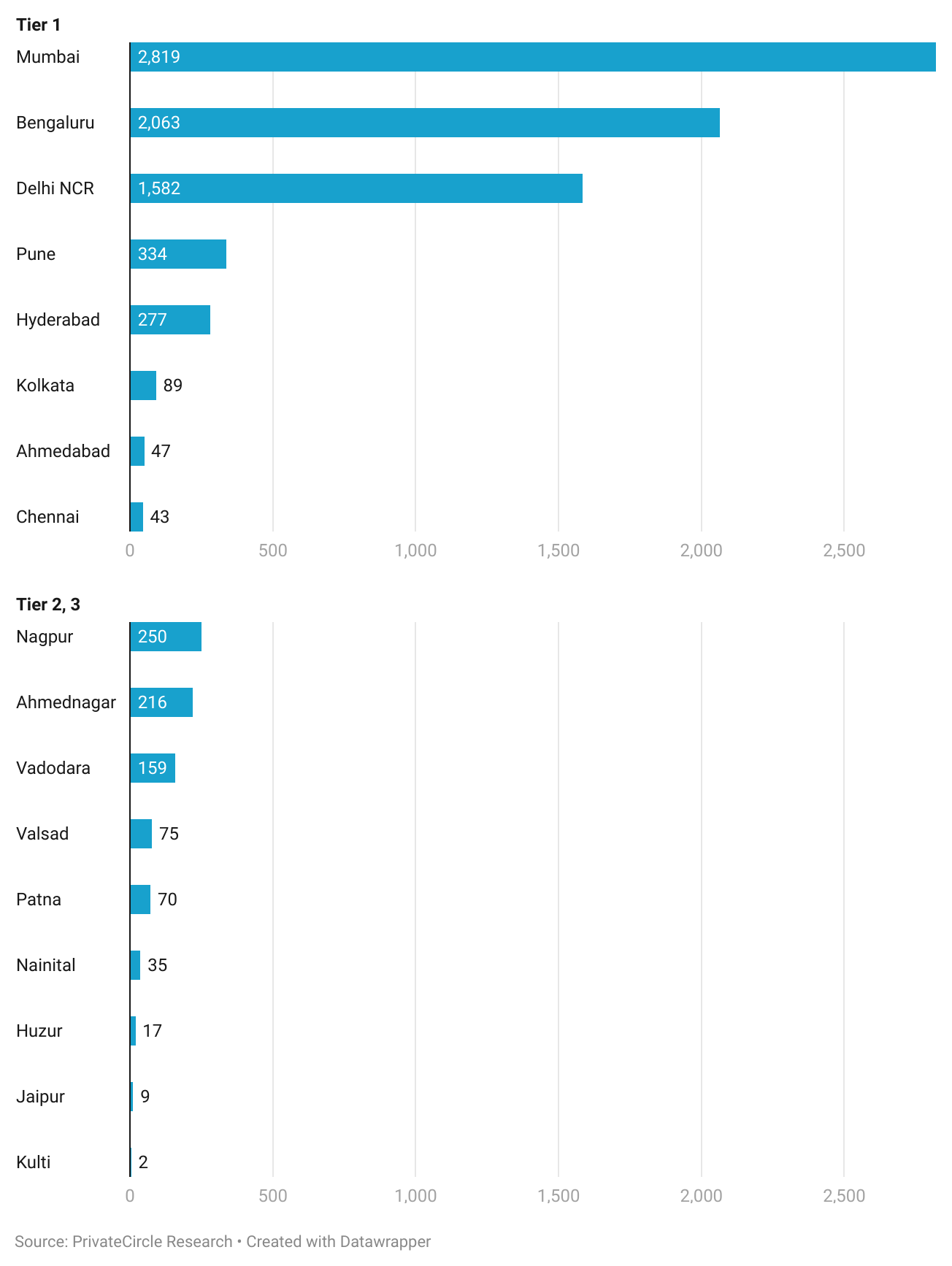

City-Wise April 2024: Deal Value (₹ cr)

Tier 1 cities dominate the deal value, accounting for 90% of the total funding in April 2024.

This highlights the concentrated investment activity in major urban centers like Mumbai, Bengaluru, and Delhi NCR.

City-Wise April 2024: Average Deal Size (₹ cr)

Tier 1 city startups command significantly higher average deal sizes compared to tier 2 and 3 cities.

This disparity underscores the preferential treatment and larger investments received by startups based in major urban hubs.

| City | Tier | Average deal size (₹ cr) |

| Mumbai | Tier 1 | 141 |

| Bengaluru | Tier 1 | 98 |

| Delhi NCR | Tier 1 | 61 |

| Pune | Tier 1 | 334 |

| Hyderabad | Tier 1 | 40 |

| Kolkata | Tier 1 | 22 |

| Ahmedabad | Tier 1 | 9 |

| Chennai | Tier 1 | 43 |

| Nagpur | Tier 2, 3 | 250 |

| Ahmednagar | Tier 2, 3 | 216 |

| Vadodara | Tier 2, 3 | 159 |

| Valsad | Tier 2, 3 | 75 |

| Patna | Tier 2, 3 | 70 |

| Nainital | Tier 2, 3 | 35 |

| Huzur | Tier 2, 3 | 17 |

| Jaipur | Tier 2, 3 | 9 |

| Kulti | Tier 2, 3 | 2 |

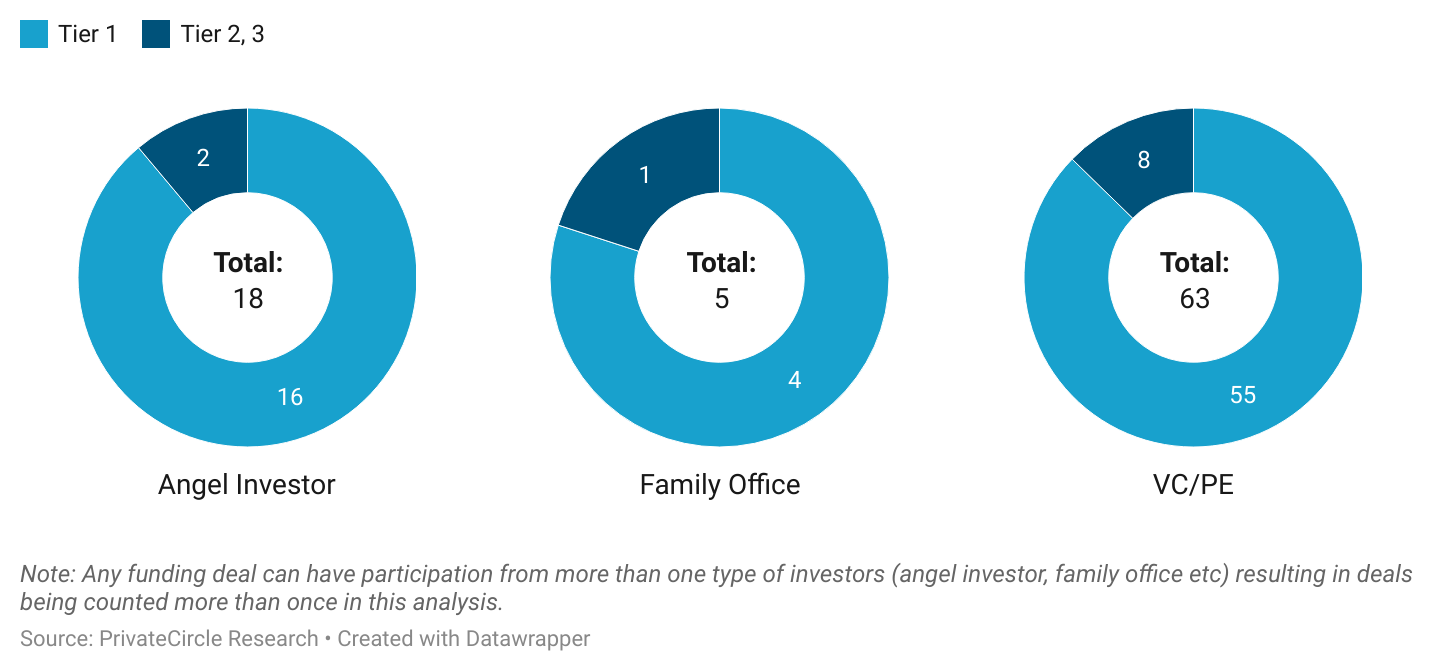

City-Wise April 2024: Investor Type (Deal Volume)

VC/PE firms lead the pack in terms of deal volume, followed by angel investors and family offices.

These investors play a crucial role in fuelling the growth of startups across all tiers, contributing to the vibrancy of the startup ecosystem.

In conclusion, there is continued prominence of Mumbai, Bengaluru, and Delhi NCR as the epicentres of startup activity in India and have been succesfull in garnering the large chunk of the country’s funding interests.

As we look ahead, it is essential to monitor these trends and support the diverse range of startups driving innovation and economic growth.

Stay tuned for more insights from PrivateCircle as we navigate the ever-evolving landscape of startup funding and entrepreneurship.

Follow us on social media for latest updates and insights into the dynamic landscape of Indian Private Markets.

Sign up on PrivateCircle Research to access data and insights on all things India Private Markets.