Whether it is Zomato’s bumper IPO, or Blinkit’s strategic acquisition, Indian startup ecosystem has hit an inflection point. We have transitioned from celebrating big funding rounds to now anticipating startup exits.

Some say it is a sign of maturing ecosystem. Others see it as a direct impact of investors demanding a clear path to profitability and a predictable exit route. Either way, the ultimate dream of any startup founder is to do a successful IPO.

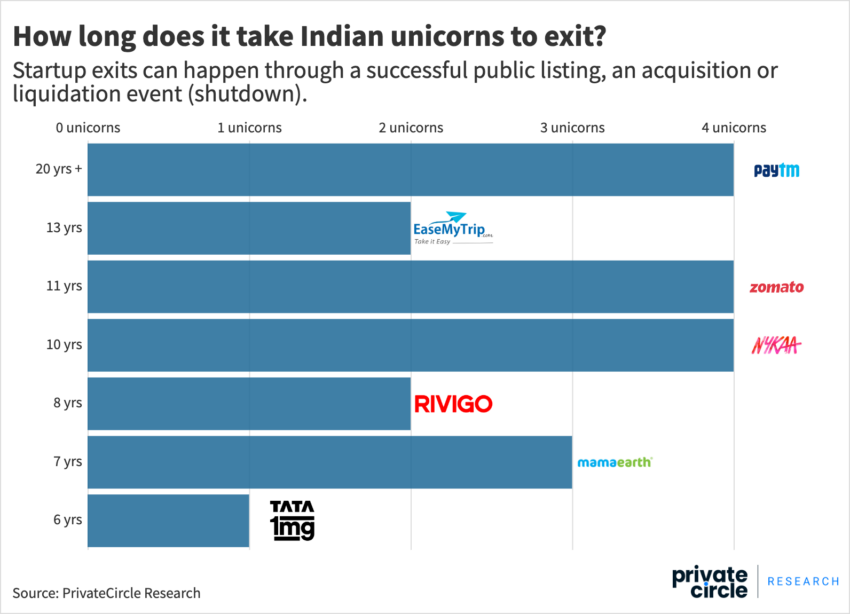

However, an IPO is just one of the many exit routes available to startups. Startup exits can happen through a successful public listing, an acquisition or an unsuccessful liquidation (shutdown).

One of the major startup acquisitions in the Indian ecosystem took place in 2018. Global e-commerce giant Walmart bought a majority 77% stake in Indian e-commerce startup Flipkart for a massive $16 bn.

This acquisition brought authenticity to the startup dream and even inspired young Indians to become entrepreneurs. (See our post on Flipkart Mafia, companies started by ex-flipkart folks.) One thing it could not do was to inspire more such big startup exits.

A global pandemic and an unprecedented funding frenzy changed this. As many as 9 unicorn exits (7 IPOs and 2 acquisitions) took place in 2021. But we need to figure, how long does it really take Indian unicorns to exit in any form?

PrivateCircle analysed a list of 114 Indian unicorns and the time it took them to exit, from 1995 to till now. Let’s examine the findings.

Median 10 Years to Exit

Overall, 20 Indian unicorns have gotten an exit till April 2024, whether a public listing, acquisition, or shutdown. It took unicorns a median of 10.5 years (since incorporation) to find these exits.

However, unicorns like Mamaearth, Blinkit, Flipkart, and 1mg did manage to get early exits in 6-7 years of incorporation. Out of these, Mamaearth was a public listing while the rest were acquisitions.

Five Star Business Finance and MapMyIndia took the longest time(more than 25 years) to achieve an exit after its incorporation in the 1984 and 1995 respectively. Paytm and IndiaMart were the other two startup unicorns that took over 20 years to exit.

Interestingly, unicorns that took longer to exit also took longer to reach unicorn valuation. For example, IndiaMart, which was founded in 1999, became a unicorn in 2020, but was listed in 2019.

Maximum Unicorn Exits in 2021

Almost 30% of unicorns got acquisition exits while the rest 70% were IPOs. Further, 9 unicorns exited in 2021 as compared to 5 exits in 2022 and 1 in 2023. So far, 2021 saw the maximum number of unicorn exits in India.

As funding rounds slowed down in 2023, many startups delayed their IPO plans. Now as the late-stage funding is starting to resume, Indian unicorns are again starting their IPO journey. Zomato’s arch-rival, Swiggy has recently changed to a public entity in preparation for an expected IPO later this year.

Swiggy is also reportedly in talks to raise a pre-IPO round. Other unicorns that are expected to go for an IPO soon include hospitality major OYO, EV two-wheeler manufacturer Ola Electric, digital insurance startup Digit Insurance, and others.

There is also an ongoing IPO rush on small and medium entreprises’ board. In 2023, the SME board recorded the highest number (178) of IPOs in a single year as compared to 109 in 2022 and 52 in 2021.

Infact, the SME board has already seen 64 IPOs in the first three months of 2024. Growing numbers of exits are a positive sign for the overall ecosystem, as it increases investors and employees trust in startups.

Very Informative and Very Useful blog you have posted.