Led by Ankit Chona, Chona Family Office has been expanding its portfolio across diverse sectors and become a significant force in the investment arena.

Let’s explore the pivotal insights extracted from their 2024 investment report. Let’s dive into the full report covering;

- Combined Revenue

- YOY Investment Trend

- Sector Investments

- Founders’ Alma Mater

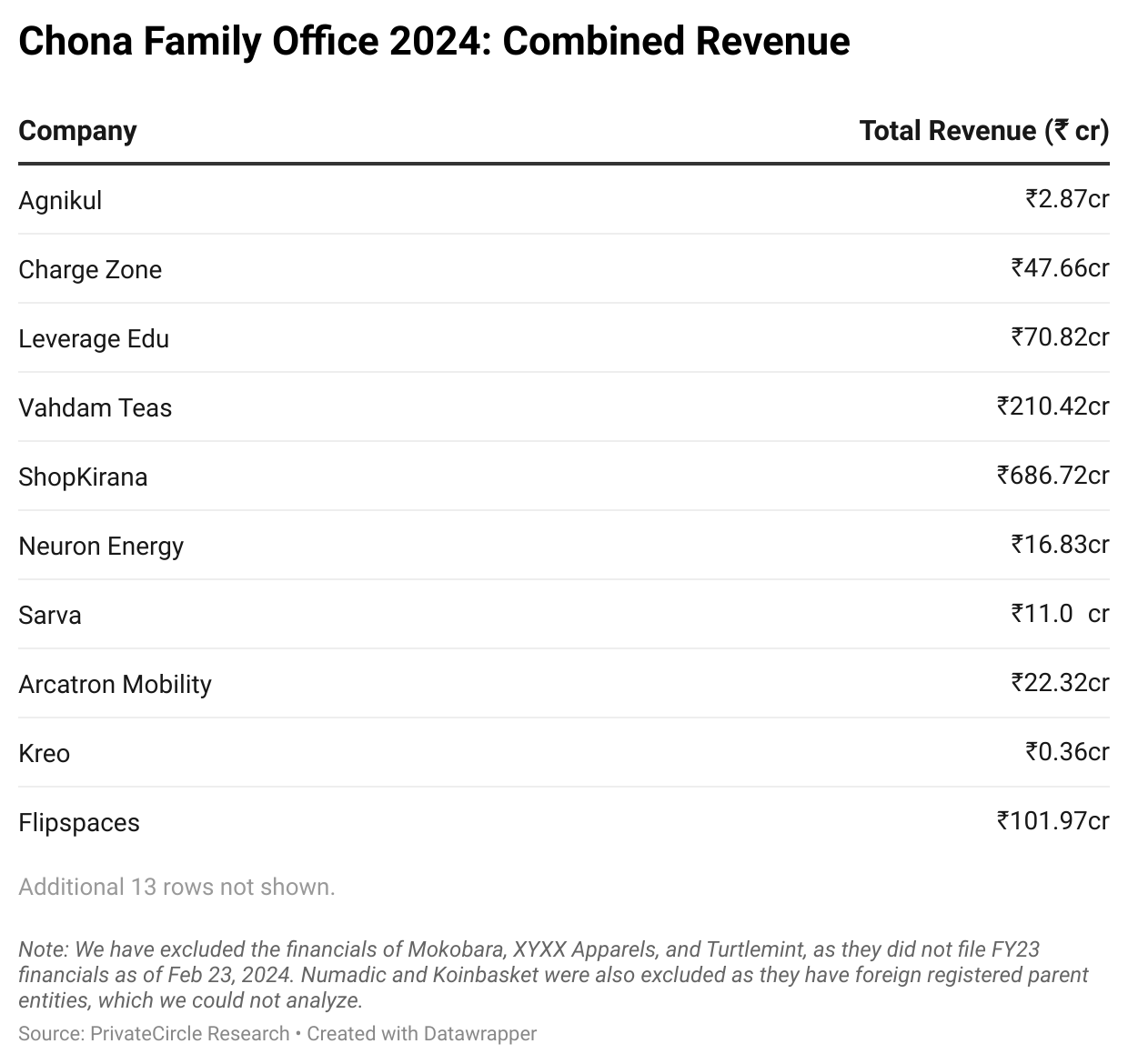

In 2024, the Chona Family Office’s portfolio exhibits strong performance with a total revenue surpassing ₹13,000 crores.

Leading the way were Nykaa, iDfy, and IndiaMart.

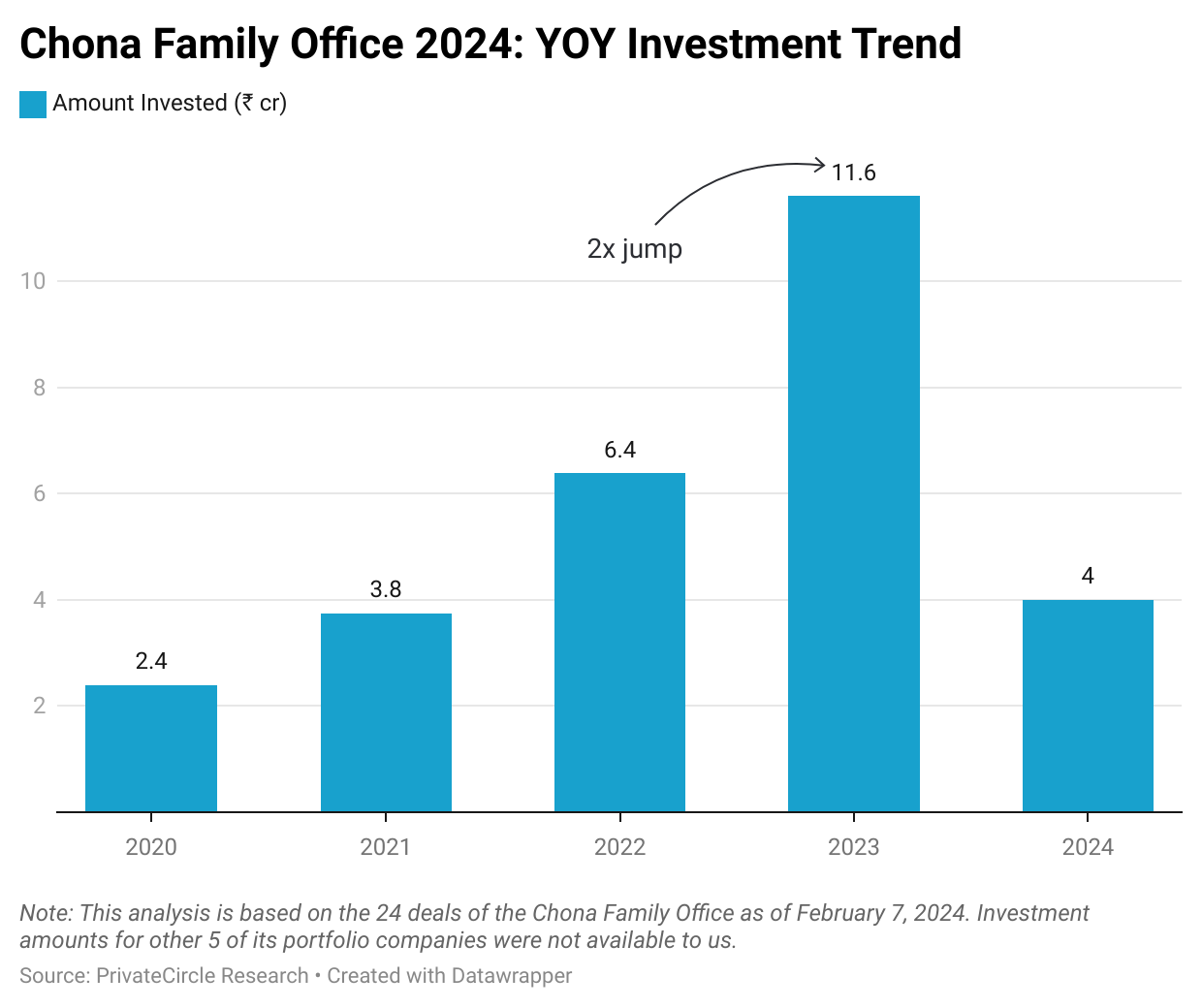

Despite the challenging startup landscape in 2023, characterized by a slowdown in funding rounds globally, Chona Family Office witnessed a significant uptick in investment value, nearly doubling compared to 2022.

This growth underscores their resilience and strategic approach to navigating market fluctuations.

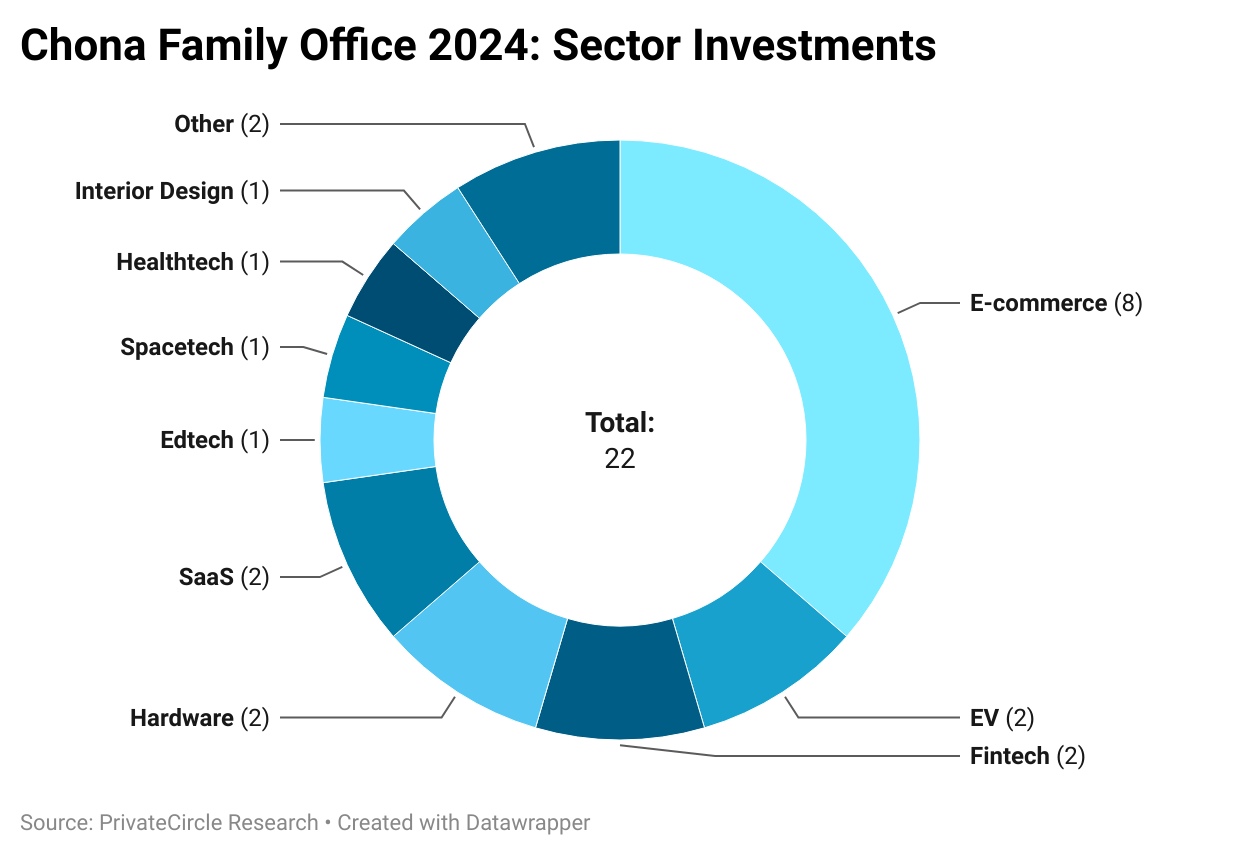

With a sector-agnostic investment strategy, Chona Family Office has diversified its holdings across spacetech, e-commerce, edtech, and EV charging sectors.

Notably, e-commerce emerges as a focal point, with the family office securing the highest number of deals within this sector. This diversified approach reflects their adaptability to emerging trends and market dynamics.

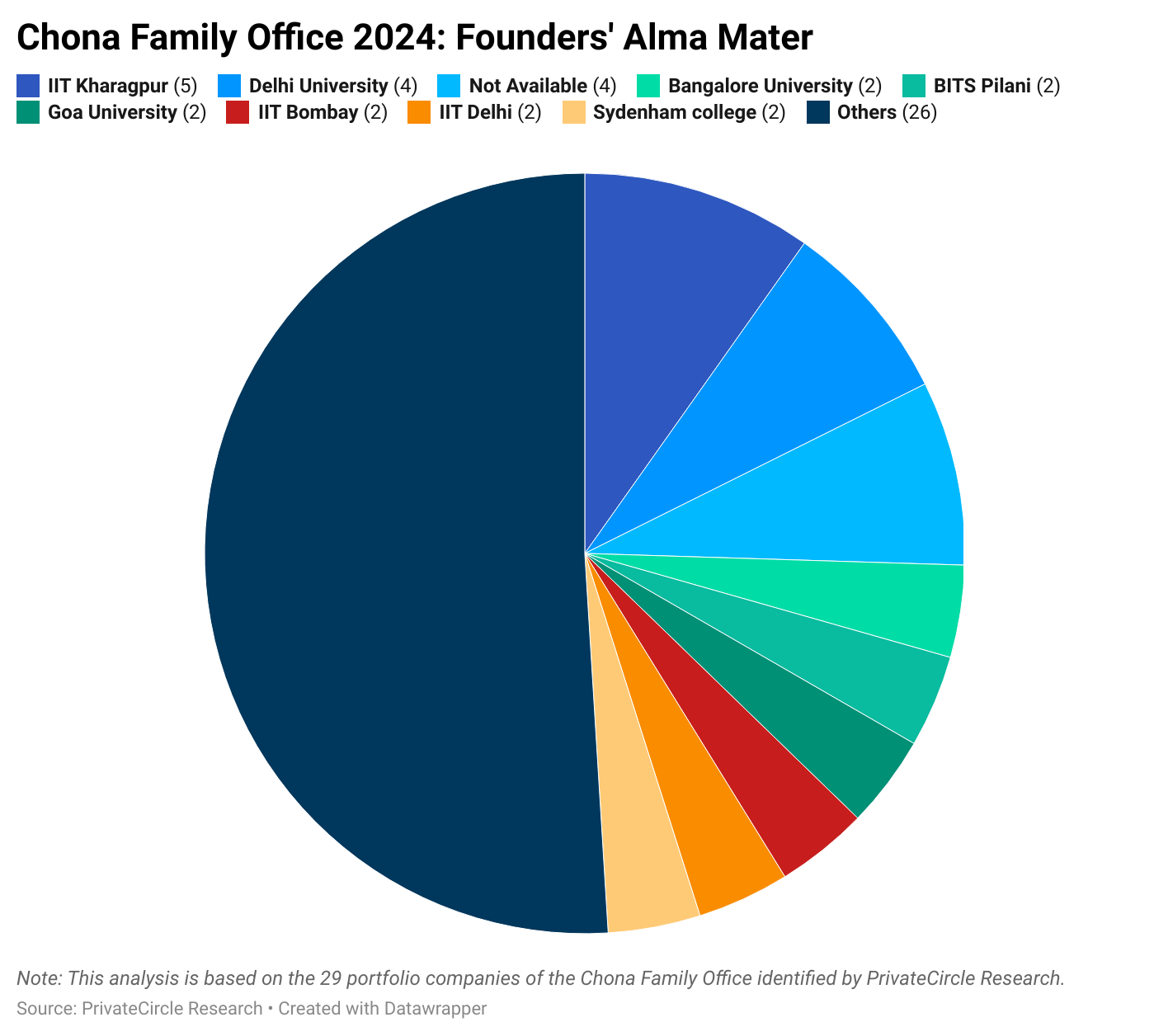

Majority of founders in Chona Family Office’s portfolio hail from state universities and private institutions, debunking the notion of a preference for IITian-led startups among Indian investors.

While 12 out of 52 founders did attend the Indian Institute of Technology, this data sheds light on the diverse educational backgrounds contributing to entrepreneurial success within their portfolio.

Conclusion

Chona Family Office’s 2024 investment portfolio highlights their strategic prowess and adaptability in navigating the dynamic startup ecosystem.

By fostering diversity across sectors and founder backgrounds, they continue to position themselves as a formidable force driving innovation and economic growth.

Follow us on social media for latest updates and insights into the dynamic landscape of Indian Private Markets.