In the vast expanse of the cosmos, India’s space odyssey has reached an unprecedented milestone in 2023. As we gaze toward the heavens, we witness a nation at the forefront of a space renaissance, where the skies are no longer the limit but the beginning of an exciting new chapter.

Armed with the latest data available, we delve into a captivating journey through India’s spacetech landscape. From pioneering startups to ambitious government initiatives, the Indian spacetech arena is bustling with activity.

Why Spacetech?

In late August 2023, India became the first country to accomplish a soft landing on the moon’s south pole. This naturally sparked global interest in India’s space endeavors, leading us to also dig deeper into the sector.

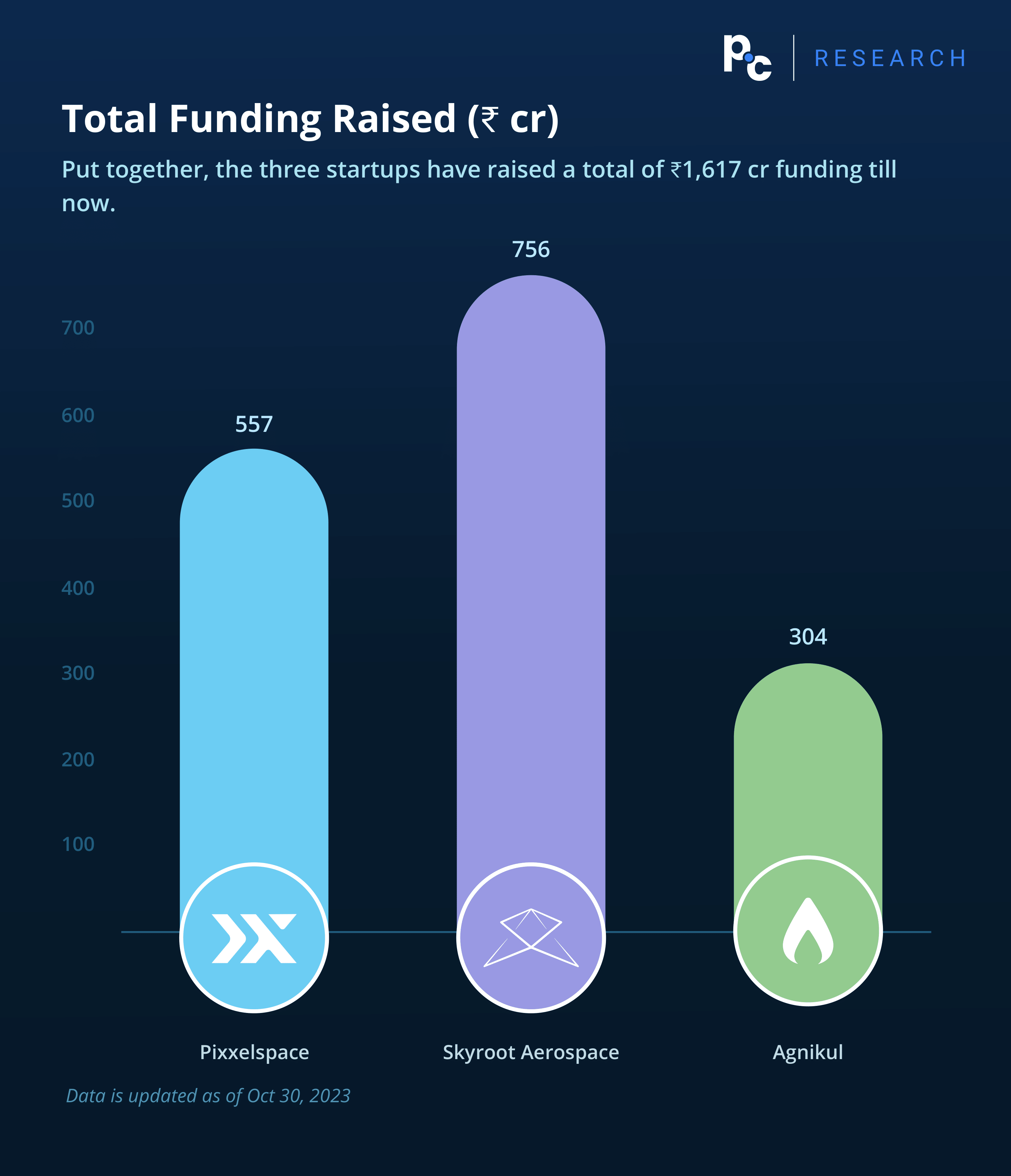

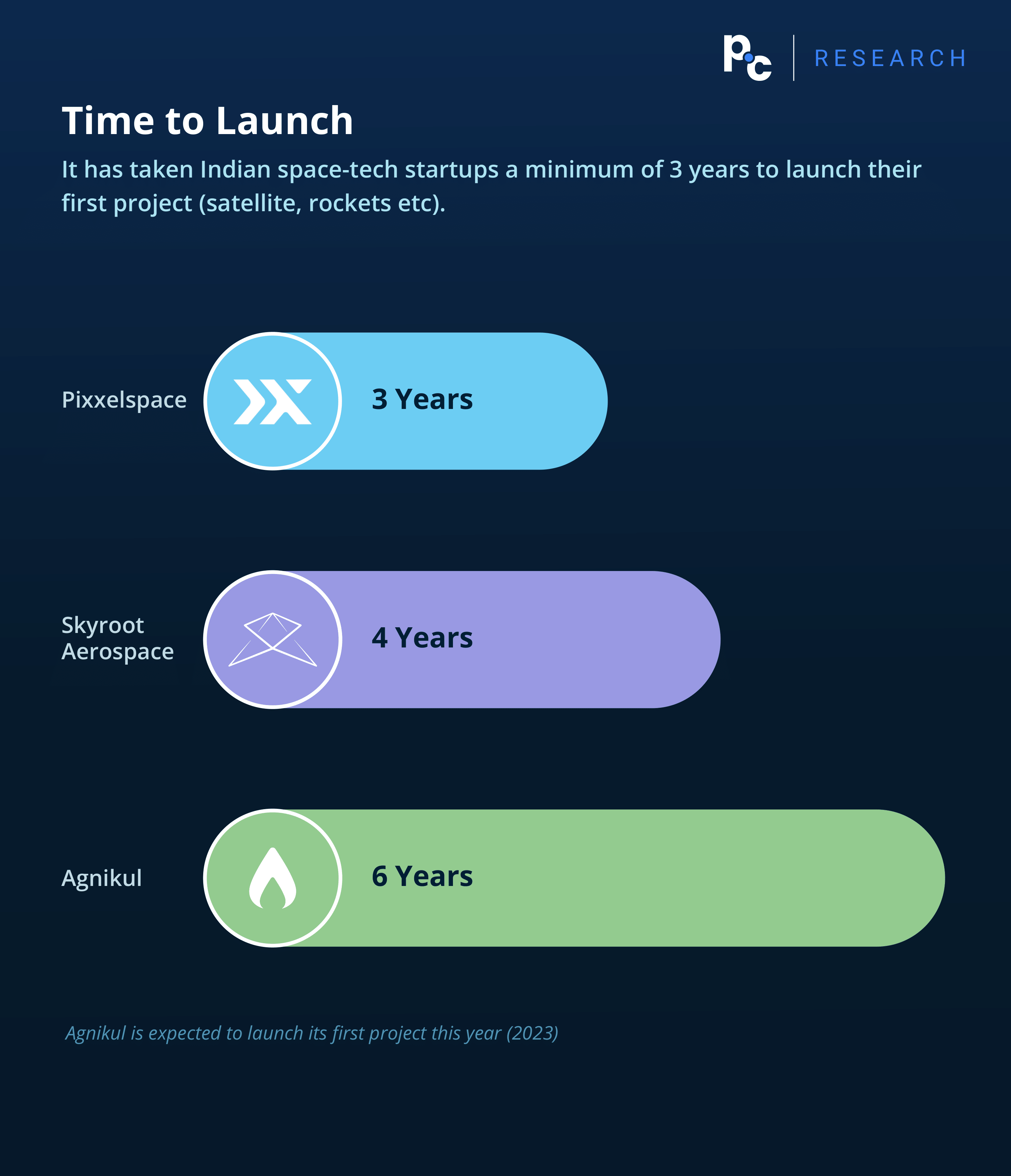

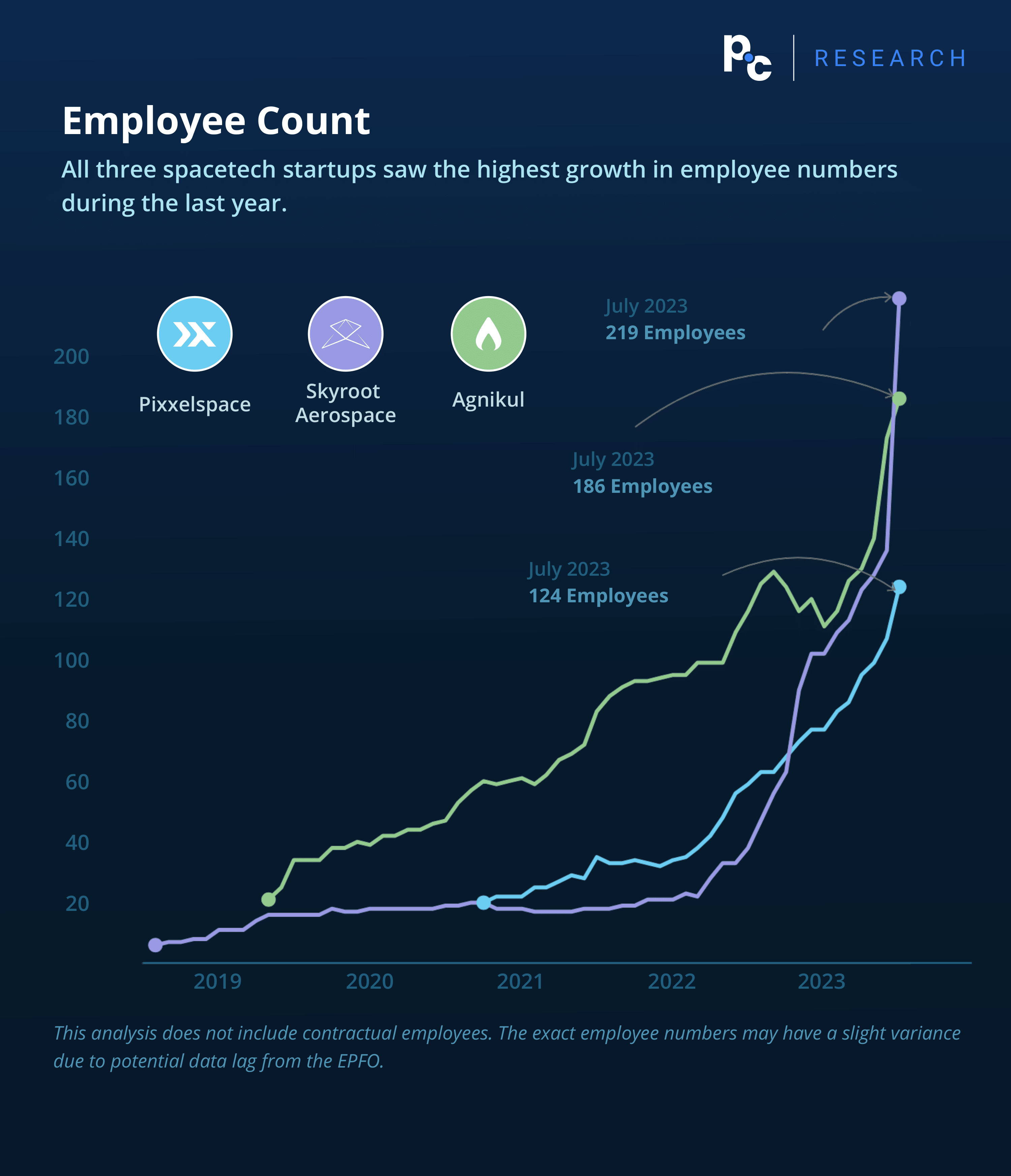

In this CCAR, we have focused on the three highest funded private space-tech startups in India featuring Pixxelspace, Skyroot Aerospace, and Agnikul. The report compares them on metrics such as Total Funding raised, Time to Launch, and Employee Count.

What is CCAR?

Comparable Company Analysis Report is our endeavor to delve deeper into a trending sector, all through the lens of data. As a robust data intelligence platform, these reports serve as a testament to the capabilities of the PrivateCircle Research dashboard.

Highlights:

- $77 Bn+ estimated spacetech market opportunity by 2030

- 68% Indian spacetech industry will be driven by the downstream segment

- 100 spacetech startups in India

- India boasts the world’s 8th largest fleet of operational satellites

- The country has executed 44 spacecraft missions, 42 launch vehicle missions, and 5 technology demonstrators

- Skyroot Aerospace became the first private Indian startup to successfully launch a rocket into space

- Pixxelspace, another Indian startup was the first to successfully launch its satellite – Shakuntala into low Earth orbit

ISRO

Indian Space Research Organisation (ISRO) is the space agency of India. The organization is involved in science, engineering and technology to harvest the benefits of outer space for India and mankind.

ISRO is a major constituent of the Department of Space (DOS), Government of India. The department executes the Indian Space Programme primarily through various Centers or units within ISRO.

Established in 1962, ISRO has evolved into one of the world’s leading space agencies. With 118 spacecraft missions and 78 launches completed by 2019, ISRO is renowned for its reliable, cost-effective launch systems, attracting international clients.

ISRO is actively promoting private industry participation in launch systems and satellite manufacturing to bolster capacity. Over four decades, around 500 Indian companies, mostly SMEs, have become essential in developing space launch and ground infrastructure.

Notably, 80% of PSLV (Polar Satellite Launch Vehicle) production is outsourced to private industries, and major missions, including the Mars Orbiter Mission, involve contributions from over 120 companies. ISRO has instituted two steering committees to facilitate comprehensive collaboration with industry, transitioning from vendors to integrators of launch vehicles and satellites.

With private startups propelling the nation into a new era of space exploration, the Indian space technology landscape might be undergoing a transformative shift.

Spacetech Private Markets

Hyderabad based Skyroot Aerospace, a private startup, is set to launch India’s first private rocket, Vikram-S, from the ISRO’s launchpad. It was established with a vision to develop cost-effective and reliable launch vehicle technology, making space more accessible to a broader range of clients, including both commercial and government entities.

The founders and core team members of Skyroot Aerospace are former ISRO scientists and engineers. The company has raised ₹756 cr and specializes in 3D-printed rocket engines.

But Skyroot Aerospace is not alone. Pixxelspace, a Bengaluru based company specializing in deploying Earth imaging satellites, with a unique emphasis on hyperspectral imaging technology. Hyperspectral imaging captures a broad spectrum of light, providing detailed insights that conventional cameras may miss.

Pixxelspace’s mission extends beyond imaging. They aim to function as a kind of “health monitor” for our planet, capable of tracking climate-related risks such as floods, wildfires, and methane leaks.

The company has secured substantial funding, totaling ₹557 cr, with a significant $36 million investment from Google. This financial backing positions Pixxelspace to launch six additional satellites in the coming year. Pixxelspace is contributing to a refined approach in how we observe and safeguard our planet from above.

Another player in the landscape is Chennai based Agnikul Cosmos, which recently secured an additional $26.7 million (about ₹200 cr) in funding, bringing its total funding to ₹304 cr.

Agnikul Cosmos is dedicated to cost-effective launches and aims to undercut competitors in the rapidly growing global commercial space market. The company’s Agnibaan, a customizable two-stage launch vehicle, can carry up to 300 kg to orbits approximately 700 km away.

The company successfully conducted its first static test fire of the Agnibaan rocket’s engine in 2021.

The success of India’s Chandrayaan-3 mission has boosted the credibility of startups like Agnikul Cosmos, attracting investments from Celesta Capital, Rocketship, Artha Venture Fund, and others.

These private startups are flourishing due to India’s evolving space policies. The Indian government’s initiatives to privatize and attract foreign investments are driving India’s space sector to capture a larger share of the global commercial space market, which is expected to reach $1 trillion by 2040.

Conclusion

With over 190 Indian space startups emerging and private investments in the sector surging by 77% between 2021 and 2022, India’s space industry is on the cusp of a major transformation. These startups, leveraging India’s cost advantages and engineering talent, are set to redefine the nation’s role in space exploration.

While India’s space program has traditionally been led by ISRO, the new wave of private companies brings fresh energy and innovation to the field. As the private space sector continues to evolve and India deepens its reform of the industry, the nation is poised to expand its share in the global space economy, aiming to increase it from 2% to 9% by 2030.

The future of space tech in India is looking brighter than ever, with a dynamic and profitable industrial fabric taking shape, supported by both homegrown innovation and foreign investments.

Latest News

Latest Deals

Pixxelspace – Series B, Primary | Deal Size ₹3.0 Bn | Deal Date 01 June, 2023

Skyroot Aerospace – Series B | Deal Size ₹4.0 Bn | Stake Diluted 33.02 % | Deal Date 07 September, 2022.

Agnikul – Series B | Deal Size ₹2.0 Bn | Stake Diluted 12.38 % | Deal Date 04 January, 2023.

Other Players

Maxar Technologies India Private Limited (Mumbai based) with revenue of ₹48.3 Mn FY 2022 and 3-yr CAGR 84.39% FY 2022

Satsure Analytics India Private Limited (Bengaluru based) with revenue of ₹39.0 Mn FY 2022 and 3-yr CAGR 7.21% FY 2022

Dhruva Space Private Limited (Hyderabad based) with revenue of ₹16.8 Mn FY 2022 and 2-yr CAGR 236.74% FY 2022

Bellatrix Aerospace Private Limited (Bengaluru based) with revenue of ₹4.8 Mn FY 2021 and 3-yr CAGR 11.23% FY 2021

More CCARs from PrivateCircle Research:

Comparable Company Analysis Report: Indian HR SaaS Companies, 2022

Comparable Company Analysis Report: Indian Personal Care Products, 2022

Comparable Company Analysis Report: Indian Food Aggregators, 2022

Comparable Company Analysis Report: Indian EV Two-Wheeler OEMs 2022