Welcome to the ‘It’s-a-big-deal’ blog, powered by PrivateCircle Research. It’s-a-big-deal is a video series where we dive into the world of Indian private markets and analyze deals to provide context with insights.

This is the blog version of our video series episode 5 that is available on Linkedin and YouTube.

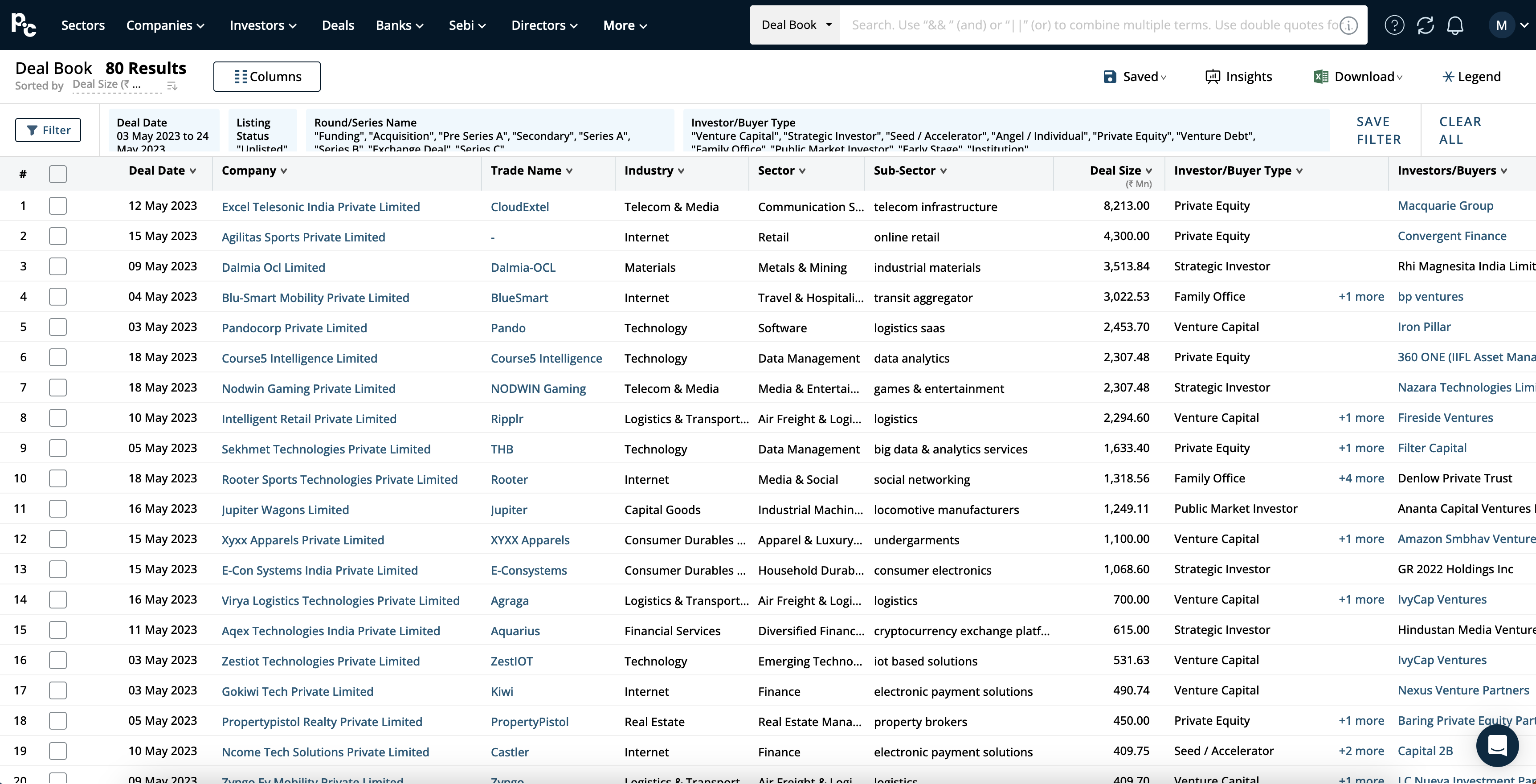

In this episode, we will analyze the deals from the last three weeks, covering 03 – 24 May 2023.

Within the deal-book criteria, we apply the date-filter and few more filters to view all the PE/VC deals. The list then will be sorted based on descending deal size.

Macquaire Group’s Acquisition and Investment Strategy

The largest deal in the past three weeks was the acquisition of a 51% stake in CloudExtel by Macquaire Group, valued at approximately ₹820 cr. CloudExtel is a Network-as-a-Service (NaaS) provider, catering to telecom operators, ISPs, data centers, and enterprises.

However, our focus will be on the Macquaire Group and its investment activities. With nearly 40 different investments, Macquaire Group has a diverse portfolio. Their investment sizes range from as low as $150k to as high as $260 million, making the CloudExtel acquisition less than half the size of their biggest deal so far.

While their primary focus is on private equity, they also have some debt investments in their portfolio.

Investment Trends and Analysis

A closer look at Macquaire Group’s investment history reveals an interesting pattern. Prior to the CloudExtel deal in FY 2024, their activity had been relatively mild since 2019.

This pattern of being dormant for a few years and then becoming super-active at regular intervals is consistent throughout their investment timeline. For instance, they made significant deals amounting to ₹800 cr in 2011 but remained inactive for several years until 2014.

Following that, they engaged in deals totaling just over ₹300 cr in 2014, only to become dormant again until 2019. In 2019, they expanded their investment focus to include debt investments in addition to private equity.

The Expanding Definition of Infrastructure

Macquaire Group’s investments primarily revolve around infrastructure development, with a particular emphasis on physical infrastructure.

However, their recent investment in telecom infrastructure, especially after the CloudExtel deal, indicates an evolving definition of infrastructure.

It appears that even for investors like Macquaire Group, the concept of infrastructure now encompasses digital projects such as telecom and potentially extends to include cloud infrastructure in the near future.

The Significance of Infrastructure Deals in Private Equity

To understand the significance of infrastructure deals in the private equity sector, we analyzed the PE deals data for the past three years. We examined the percentage of deals and deal values attributed to infrastructural development, particularly within the power, telecom, and infrastructure sub-sectors.

Over the past three years, approximately 5% of all private equity deals were related to infrastructure. In terms of deal value, infrastructural investments accounted for a little over 2% of the total private equity deal value, with an aggregate value of around ₹9,800 cr compared to the overall deal value of approximately ₹455K cr.

Conclusion

Macquaire Group’s recent acquisition of CloudExtel highlights their strategic expansion into the telecom infrastructure sector. This move also reflects the changing landscape of infrastructure investments, as digital projects gain prominence alongside traditional physical projects.

Analyzing the data for the past three years, we observed that infrastructure deals constituted a small but significant portion of the private equity market in India.

As the private equity landscape continues to evolve, keeping an eye on emerging trends and investment patterns will be crucial for both investors and industry observers. Conduct your own analysis of the Indian Private Markets using PrivateCircle Research’s free trial and consider scheduling a product demo.

We welcome your feedback, so please share your thoughts in the comments section. Stay tuned for more insightful episodes in the future.

Disclaimer: The content provided in this article is for educational and informational purposes only and does not constitute professional financial advice. The opinions expressed herein are those of the author and do not necessarily reflect the views of the company / organization. Please consult a qualified financial professional prior to making any financial decisions.

Read more blogs of this series;

Epsiode 1 | 27 Feb – 05 Mar 2023

Episode 3 | 13 Mar -15 Apr 2023

Episode 4 | 16 Apr – 02 May 2023

Watch the ‘It’s a big deal’ video series episodes;

Epsiode 1 | 27 Feb – 05 Mar 2023

Episode 3 | 13 Mar -15 Apr 2023.