India is poised for an exceptional revolution in electric mobility. In terms of the number of companies, the Indian EV market holds the third position globally, trailing behind the United States and China.

This transformation is fueled by factors such as increasing fuel prices, growing environmental concerns, government initiatives, declining battery costs, technological advancements, infrastructure development, shifting consumer mindset, and the demands of modern living.

The year 2023 has witnessed a remarkable surge in the adoption and popularity of electric two-wheelers (E2Ws) in India.

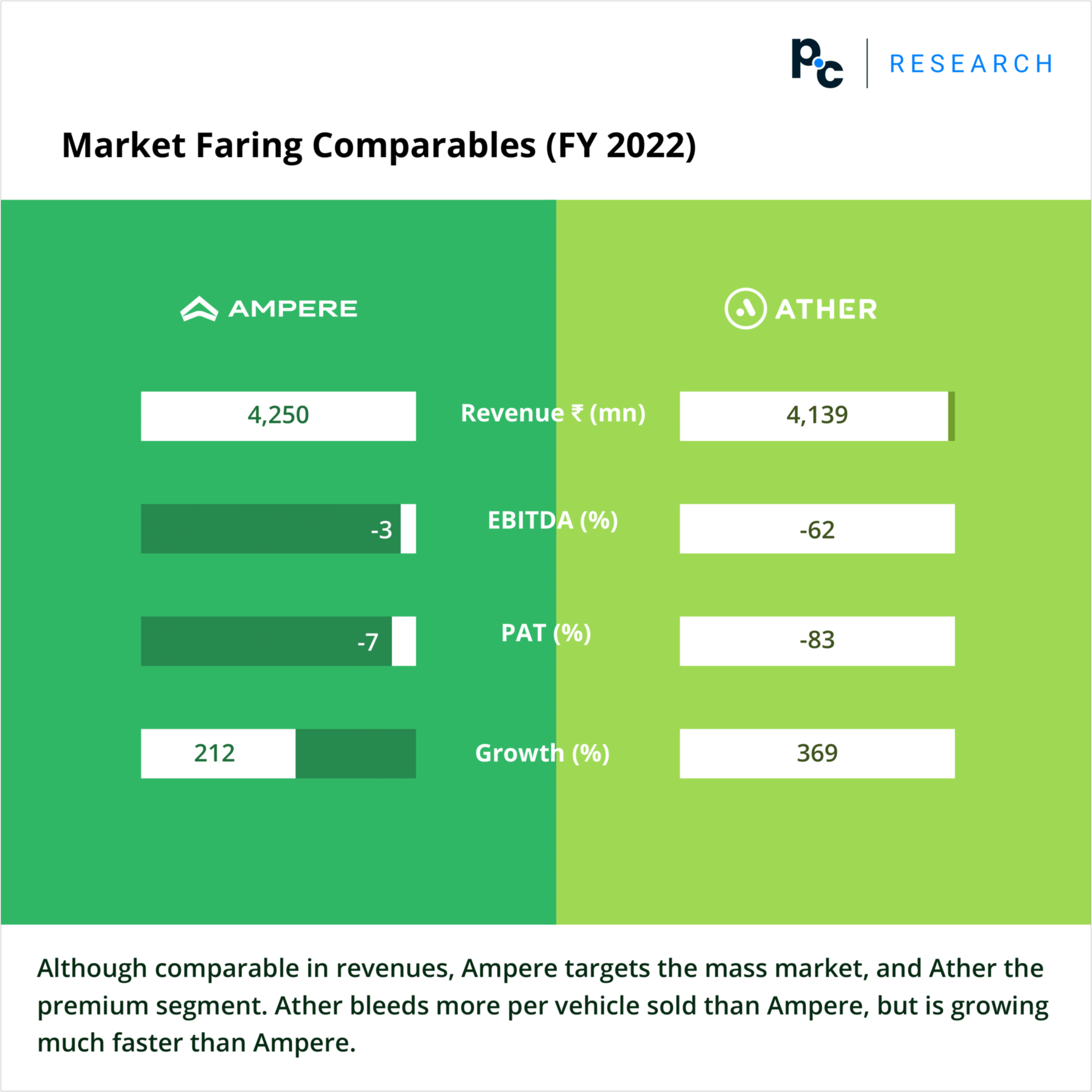

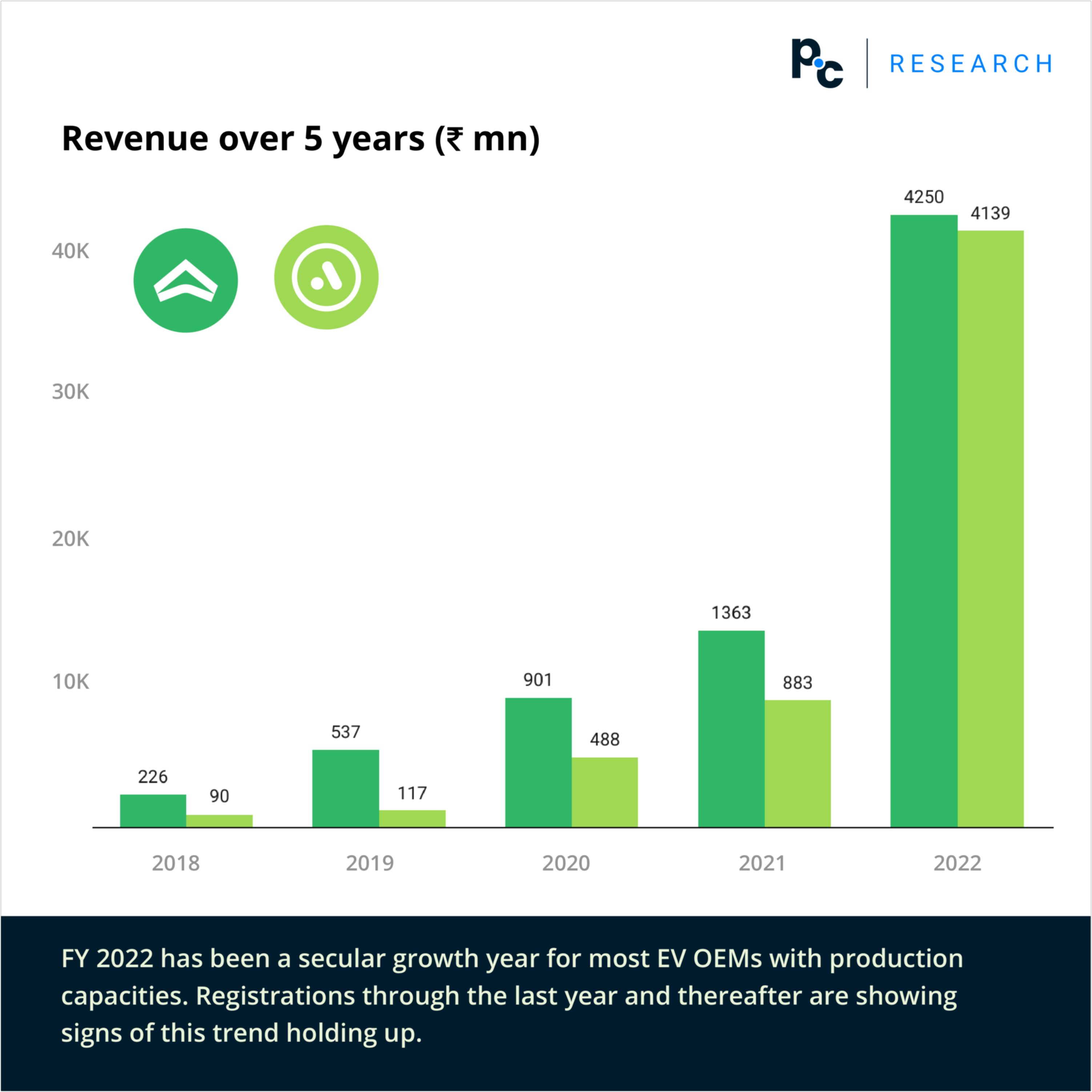

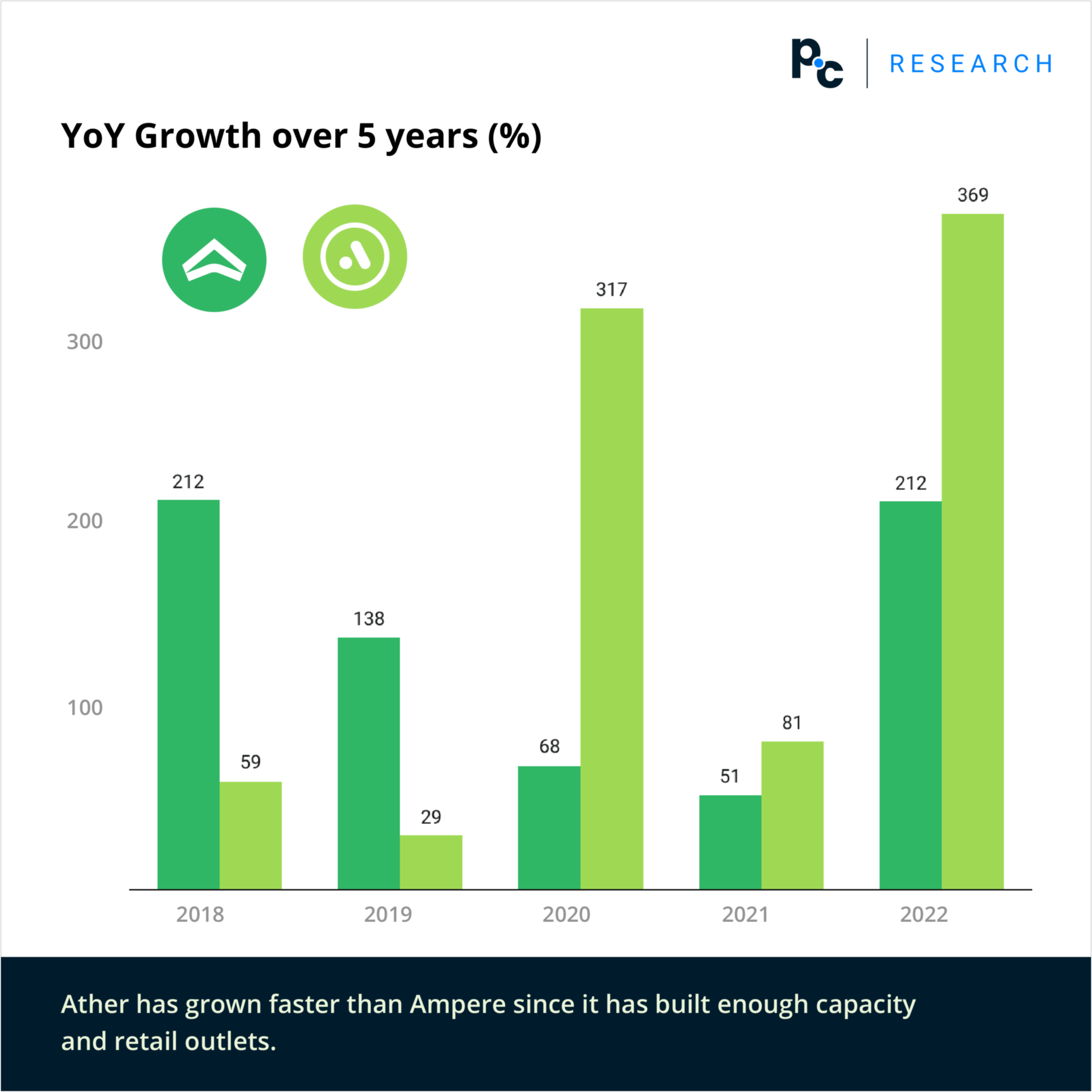

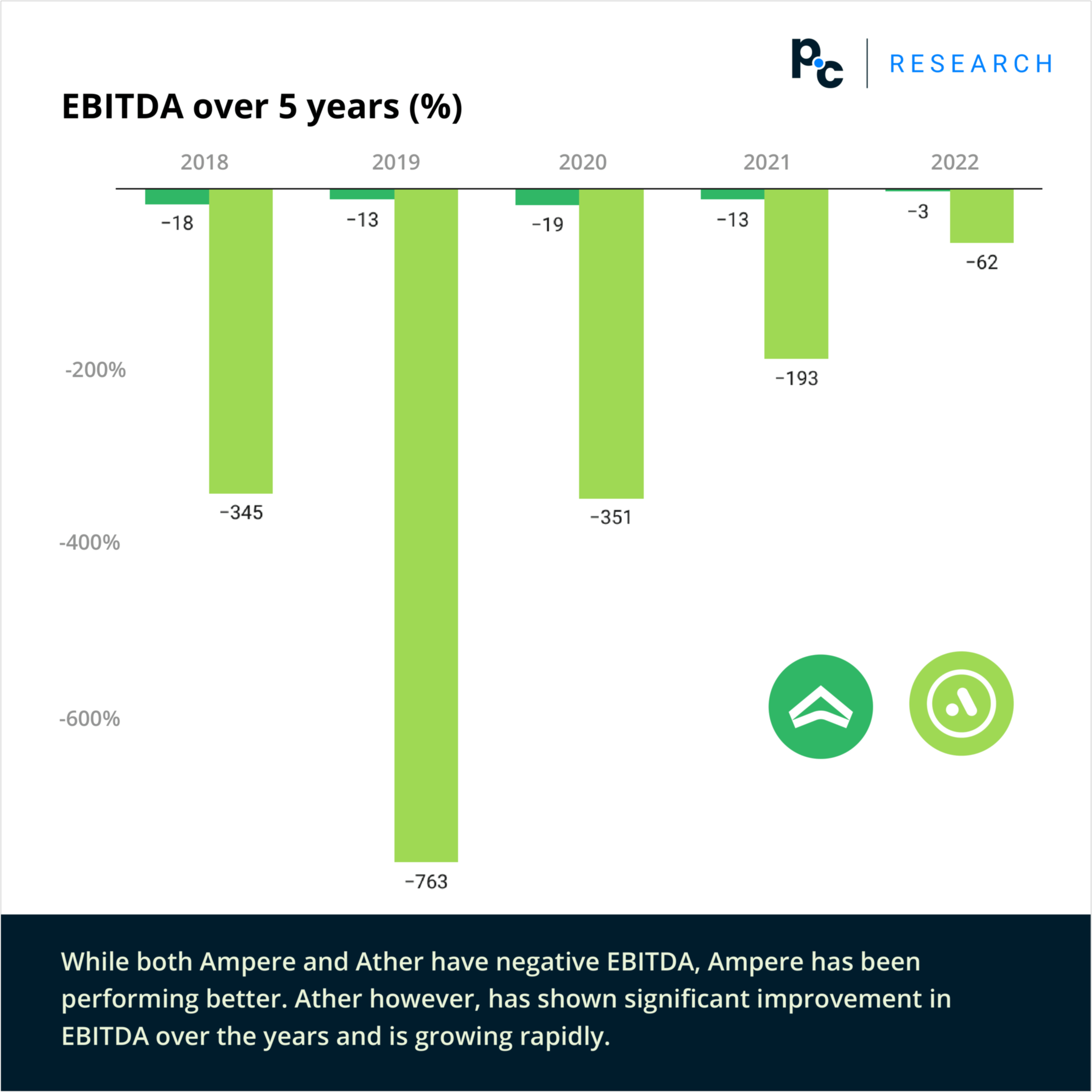

Capitalising on our CCAR on Indian EV Two-Wheeler OEMs 2022, comparing Ampere Vehicles vs Ather Energy, we present to you an overview of the Indian E2Ws market.

Highlights:

- The market for E2Ws has grown from fewer than 2,000 vehicles in 2013 to over 600,000 per year in 2022.

- In FY2022, the E2W industry led the EV revolution in India, capturing 55% of total EV sales.

- In H1 FY2023, E2W sales in India reached 4.56 lakh units, doubling the sales compared to H1 FY2022. High-speed (HS) E2W sales accounted for over 65% of the total E2W sales during the same period.

- So far, 25 states or union territories have either issued draft or implemented their own EV policy.

- The Indian electric two-wheeler market has attracted significant investments, with approximately ₹14,000 cr invested overall and ₹3,844 cr injected in H1 FY2023 alone.

Table of Contents:

- Market Faring Comparables

- Revenue over 5 years (₹ mn)

- YoY Growth over 5 years (%)

- EBITDA over 5 years (%)

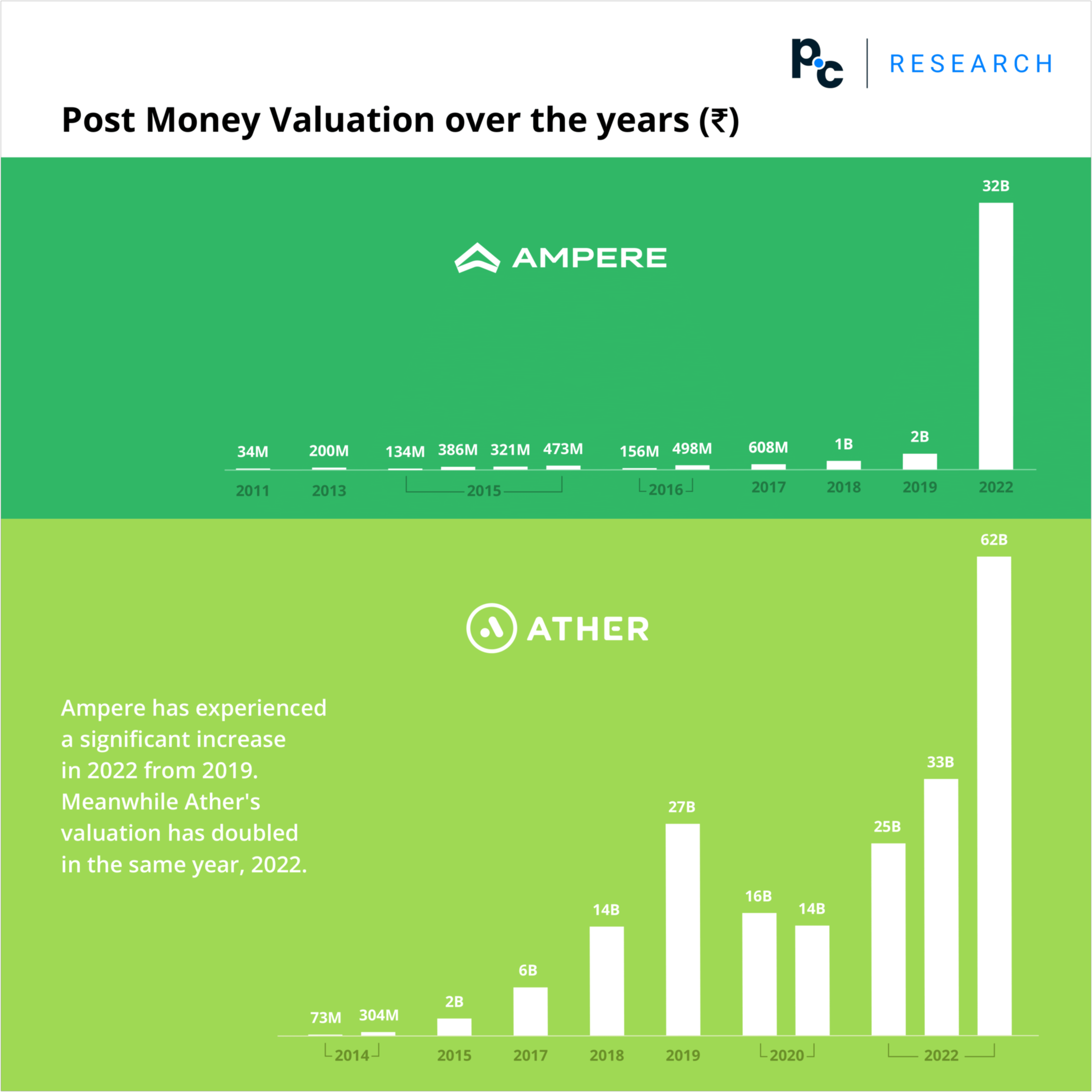

- Post Money Valuation over the years (₹)

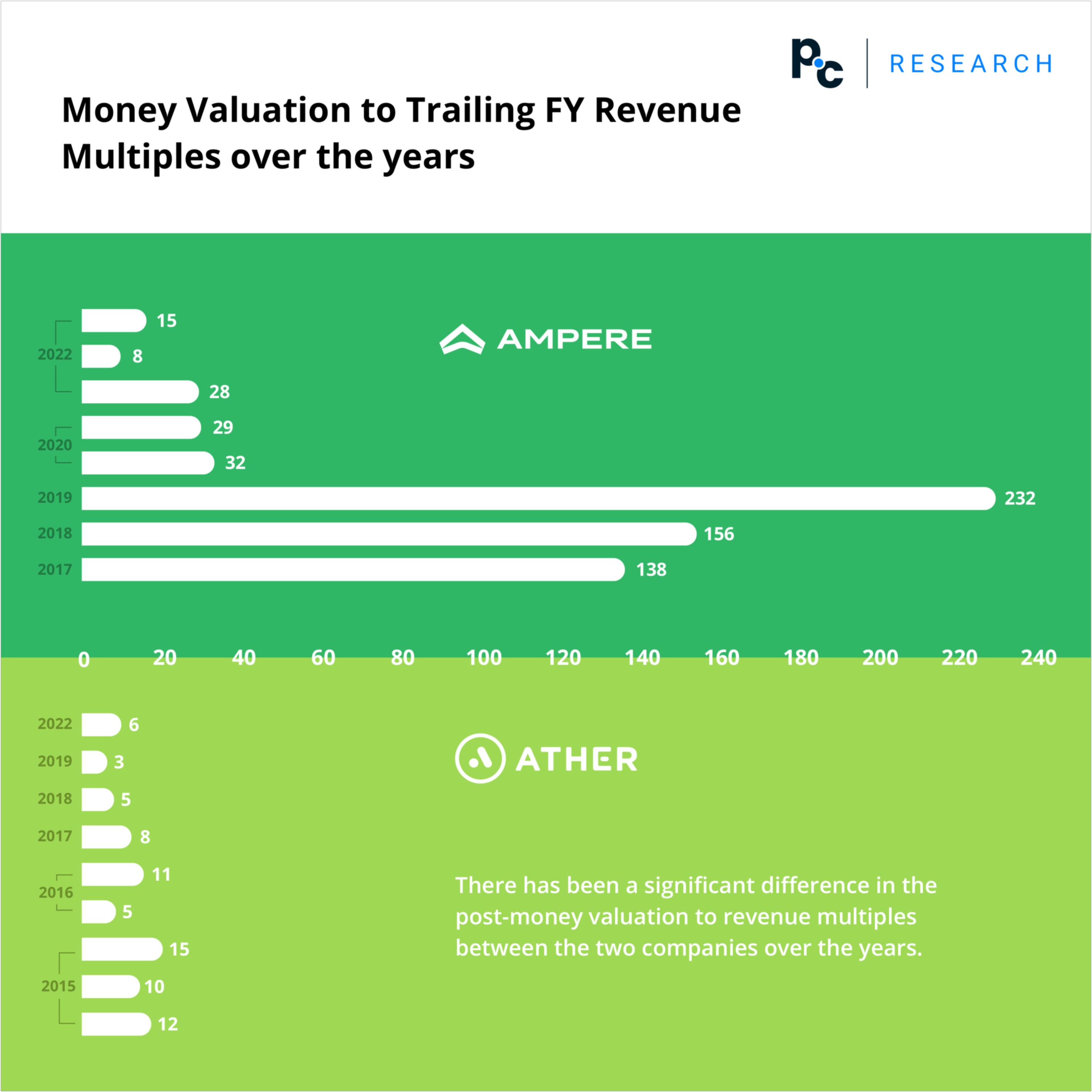

- Post Money Valuation to Trailing FY Revenue Multiples over the years

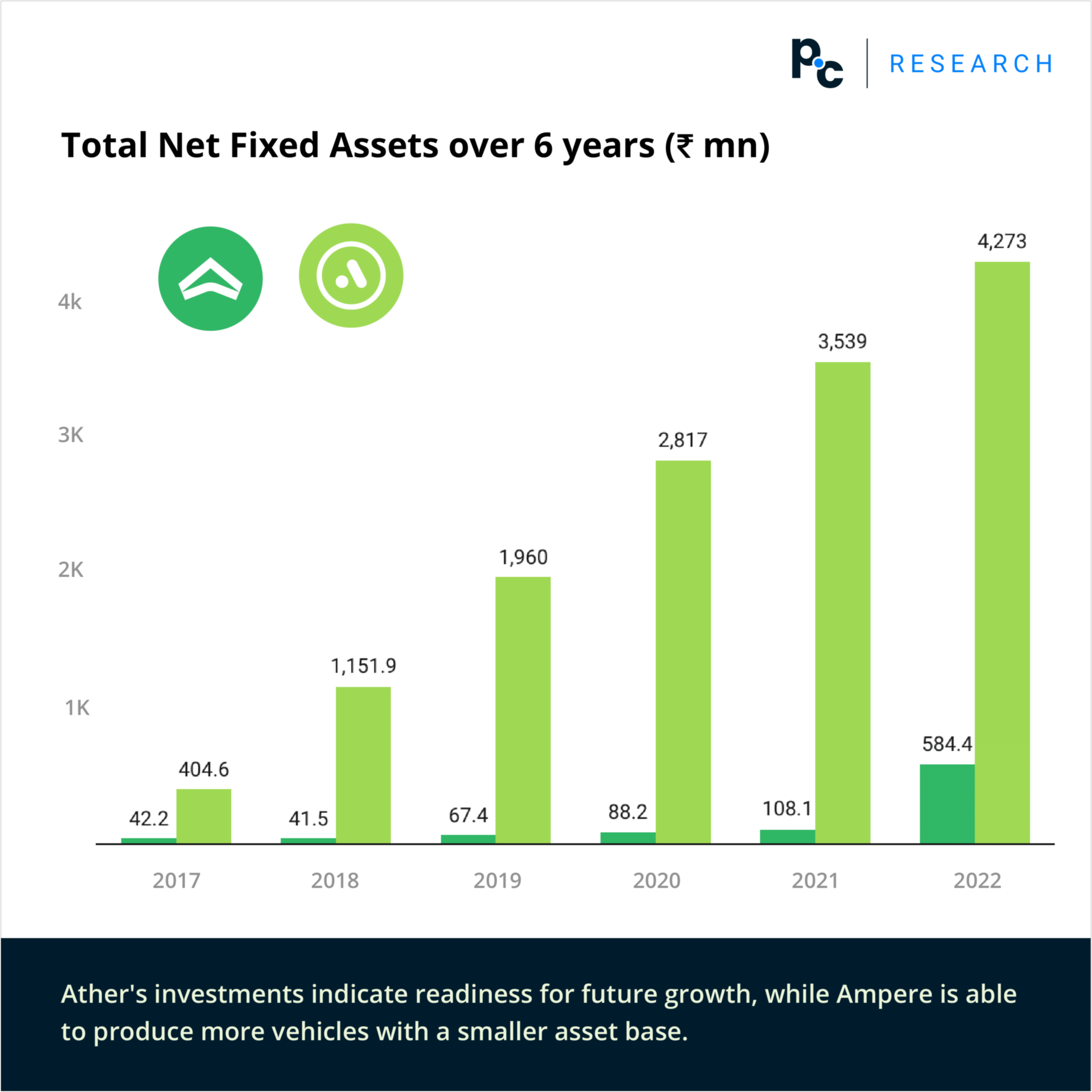

- Total Net Fixed Assets over 6 years (₹ mn)

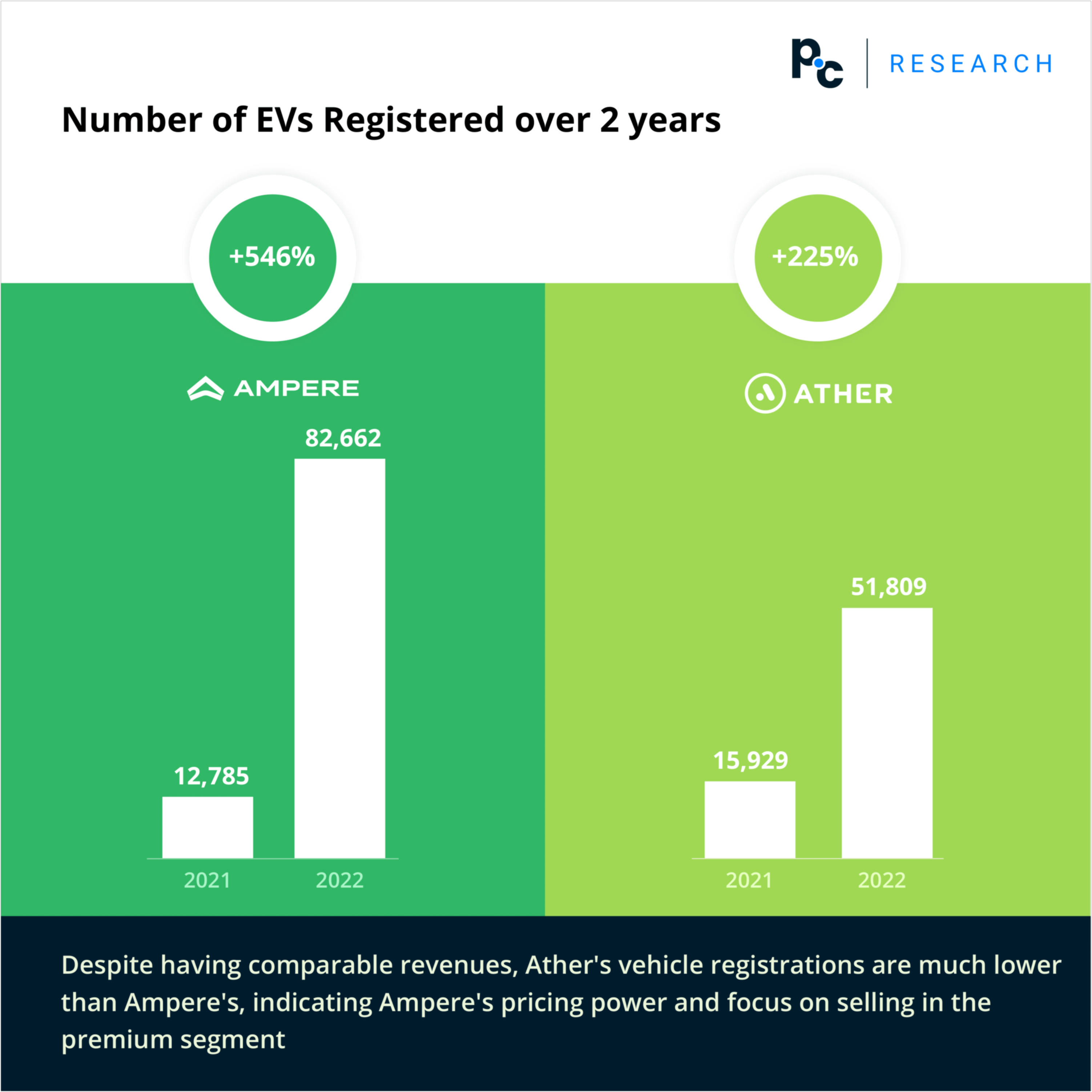

- Number of EVs Registered over 2 years

Latest news:

Latest deals:

Ampere Vehicles – Series G*, Primary, Investor/Buyer – Abdul Latif Jameel International Dmcc, Deal Size – ₹11.7 Bn, Total Stake – 36.8 %, Post Money Valuation – ₹31.8 Bn | 23 June, 2022.

Ather Energy – Series E, Primary, Investor/Buyer – GIC Singapore, Navam Capital, Deal Size – ₹4.0 Bn, Total Stake – 6.5 %, Post Money Valuation – ₹61.6 Bn | 18 October, 2022.

According to the e-AMRIT (Accelerated e-Mobility Revolution for India’s Transportation) portal, India has 7.96 lakh EVs registered till date, 380 EV manufacturers operating in the country, 1800 EV charging stations installed, 133% growth in EV sales from FY15 to FY20, and 191.5 M kgs of CO2 reduced under FAME I and FAME II schemes.

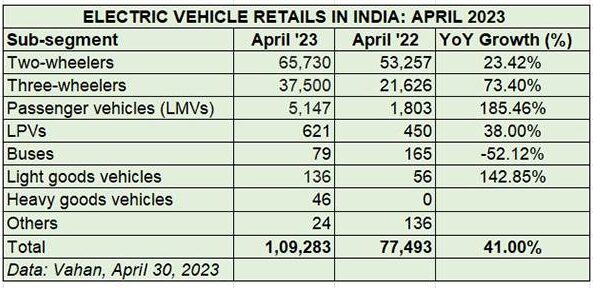

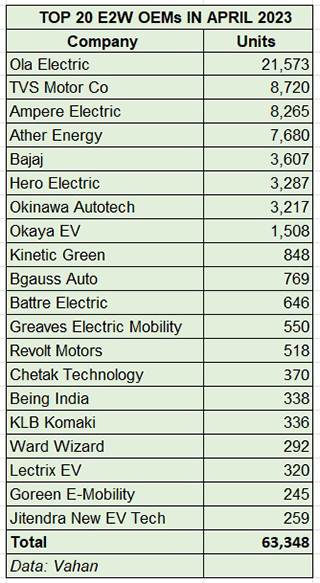

April, 2023 was the seventh consecutive month that overall EV sales surpassed the 100,000-unit mark in India. Ola, with 21,573 units clocks best-ever monthly sales. ePV leader Tata Motors’ share drops to 73% with Mahindra snapping up second place with 499 units. Olectra Greentech tops ebus retails.

India holds the title of the world’s largest two-wheeler market, boasting an estimated 375-400 million two-wheelers on road. Affordability emerges as the primary catalyst for two-wheeler sales, and the cost savings associated with owning electric two-wheelers (E2Ws) are anticipated to fuel further growth.

Moreover, the low ownership costs have led to a swift adoption of E2Ws by business-to-business (B2B) players, including food aggregators and last-mile delivery services.

Two-wheelers, primarily scooters and motorcycles, constitute over 70% of the total vehicles on Indian roads. Additionally, three-wheeled auto rickshaws contribute around 10%. Together, these two categories comprised 92% of the registered electric vehicles (EVs) in India in 2022.

Conclusion:

In 2023, the Indian electric two-wheeler market has emerged as a dynamic and promising sector, driven by factors such as government support, improved battery technology, and falling prices.

The advent of electric two-wheelers has not only offered a greener and more sustainable mode of transportation but has also transformed the way consumers perceive electric vehicles. As the market expands, addressing challenges related to charging infrastructure, battery disposal, and industry collaboration will be crucial.

With concerted efforts, the Indian EV two-wheeler landscape is poised for continued growth, contributing significantly to a cleaner and more sustainable future.

More CCARs from PrivateCircle Research:

Comparable Company Analysis Report: Indian HR SaaS Companies, 2022

Comparable Company Analysis Report: Indian Personal Care Products, 2022

Comparable Company Analysis Report: Indian Food Aggregators, 2022