Welcome to the ‘It’s-a-big-deal’ blog, powered by PrivateCircle Research. It’s-a-big-deal is a video series where we dive into the world of Indian private markets and analyze deals to provide context with insights.

This is the blog version of our video series that is available on Linkedin and YouTube.

In this episode, we will be filtering PE/VC deals that went through between 27 February – 05 March, 2023, for unlisted companies in India. Among the 21 deals found and sorted by deal size in descending order, SpotDraft a contract management SaaS raising ₹200+ crore caught our attention.

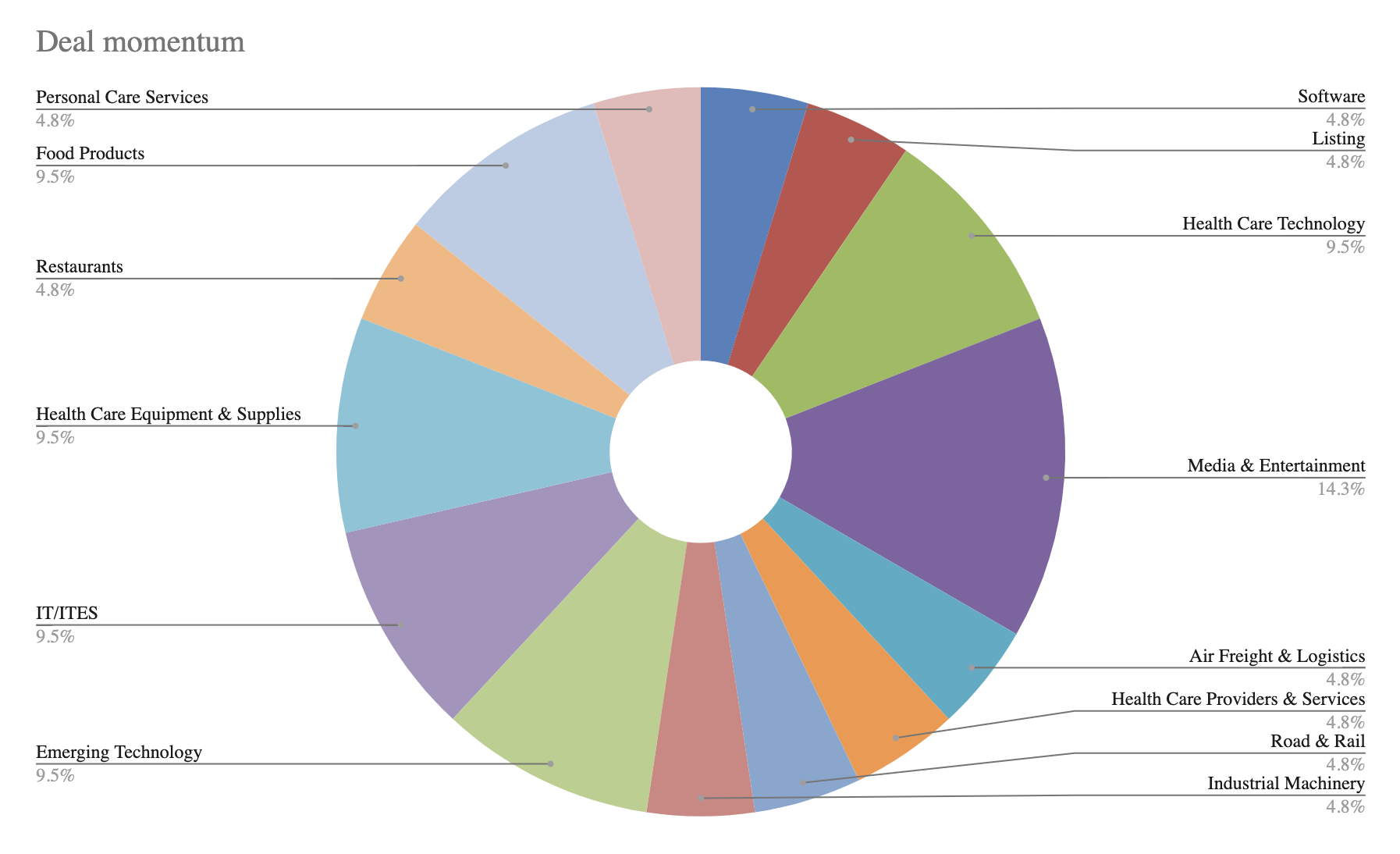

Deals Spread Across the Industries

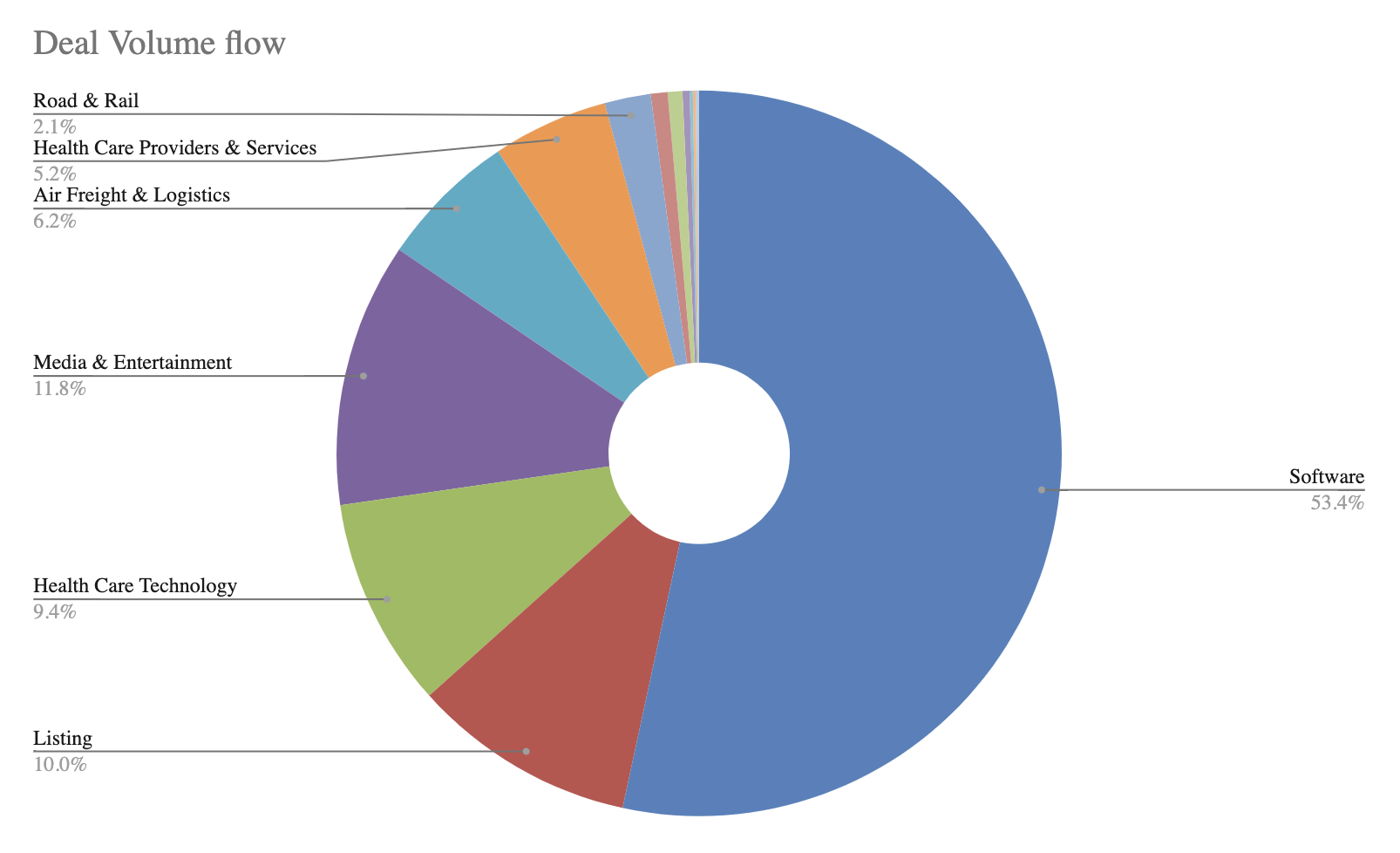

The 21 deals that we have analyzed were spread across sectors with healthcare tech/equipment (9.5%), media and entertainment (14.3%), IT/ITES (9.5%), emerging tech (9.5%), and food products (9.5%), being the top sectors with the highest number of deals.

However, when we looked at sector-wise deal value, we found that software (53.4%) alone accounted for over half of all the deals. This is largely owing to SpotDraft’s recent fundraise of over ₹200+ crore.

The SpotDraft Deal

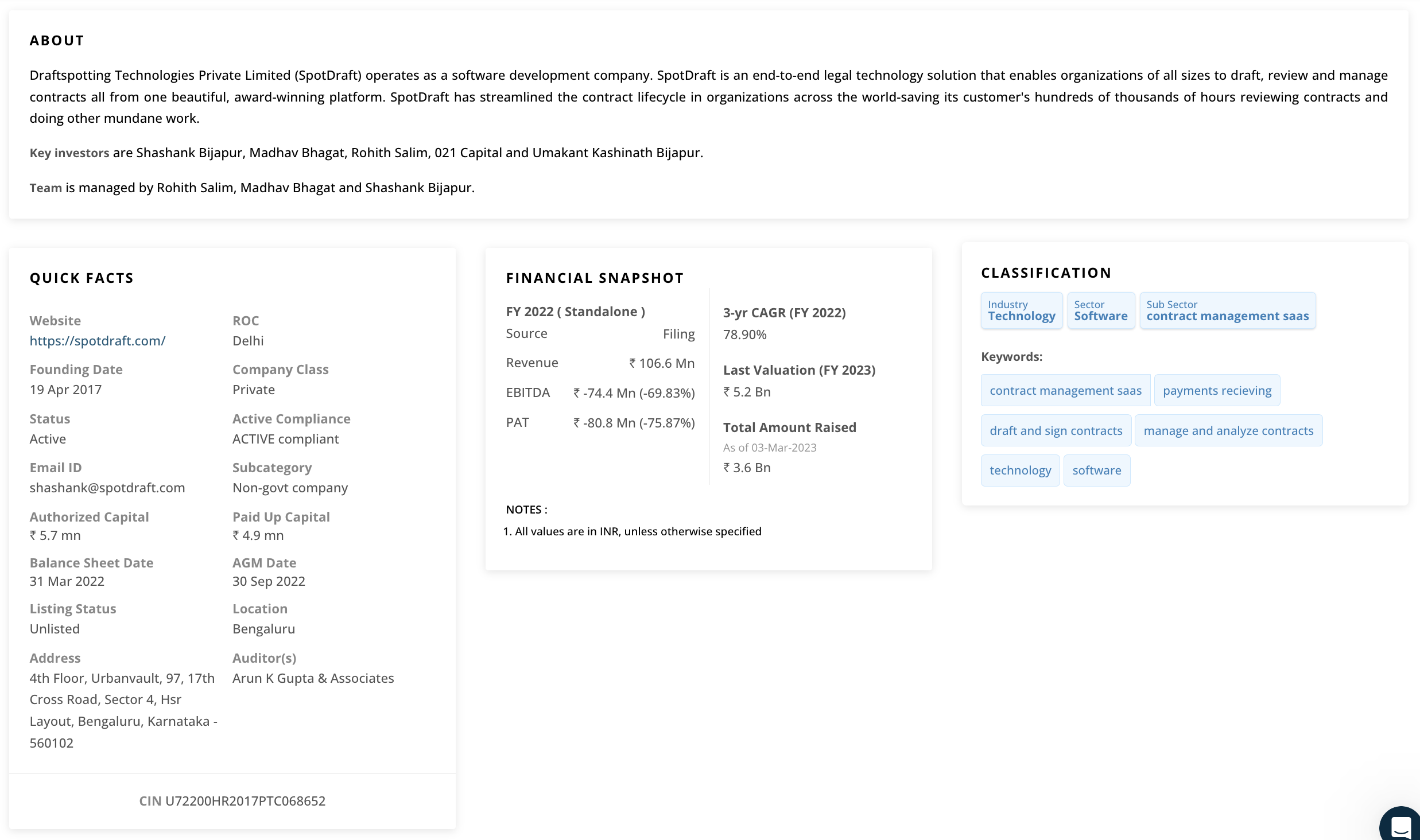

SpotDraft’s latest fundraise is a Series A that attracted investors like Premjiinvest and 021 Capital. Although we know that the company has raised ₹2.1bn, the equity diluted has not been disclosed yet.

SpotDraft’s last filed yearly revenue was ₹10 crore with a PAT of -75%, but growth has been good with a 3-year CAGR of almost 80%. The company has a direct approach to branding, which works well for a horizontal SaaS player like SpotDraft.

Funding Rounds and Shareholding Pattern

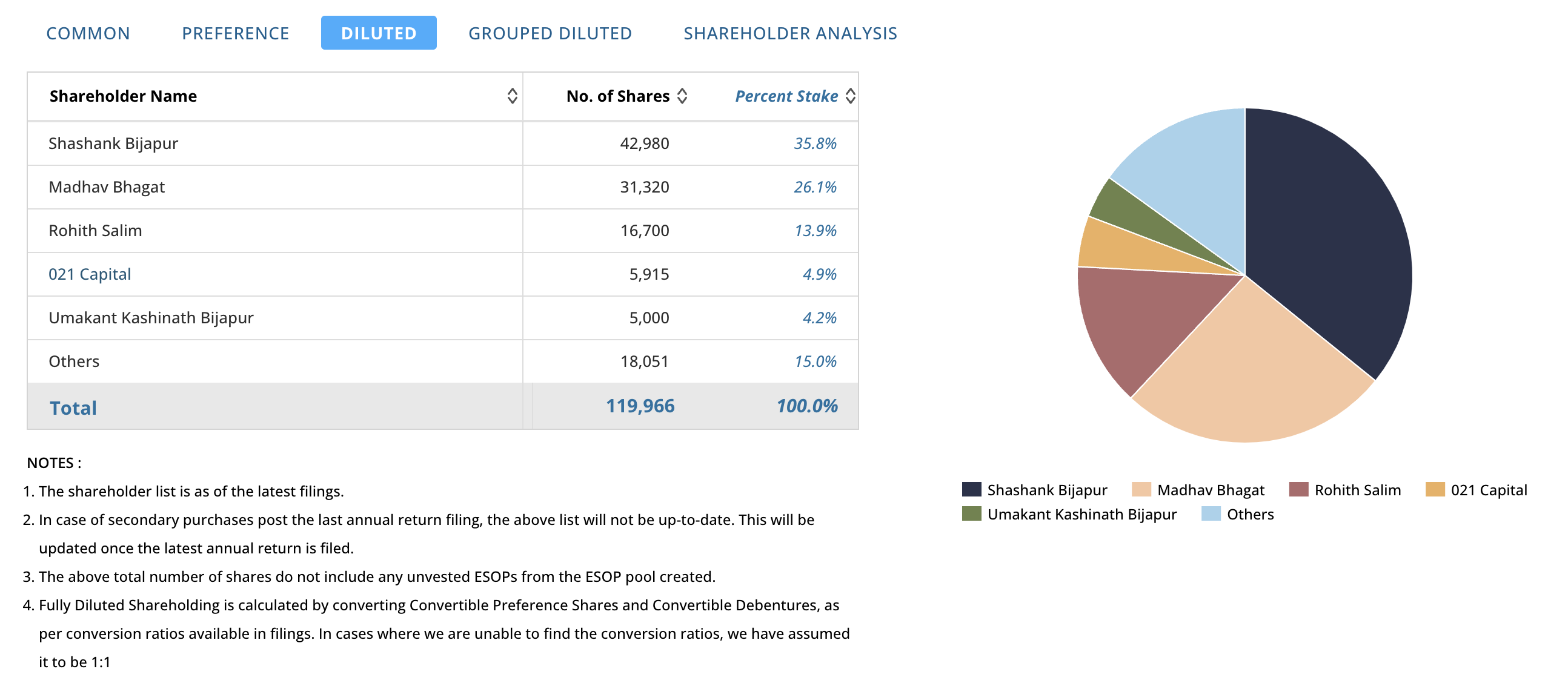

Since their inception in 2017, SpotDraft has raised several rounds of funding. In August 2022, we can see that the same set of investors who invested this time had invested ₹60 crore for about 12% stake, valuing the company at ₹520 crore. After a relatively small fundraise in 2017 and 2019, the company had to wait out the Covid-19 pandemic period before getting back into fund-raising mode.

We still do not know the latest valuation. The majority of the startup is still owned by the founders, and amongst the VC/PE funds, 021 Capital holds a maximum of ~5% of equity.

Comparison to Competitors

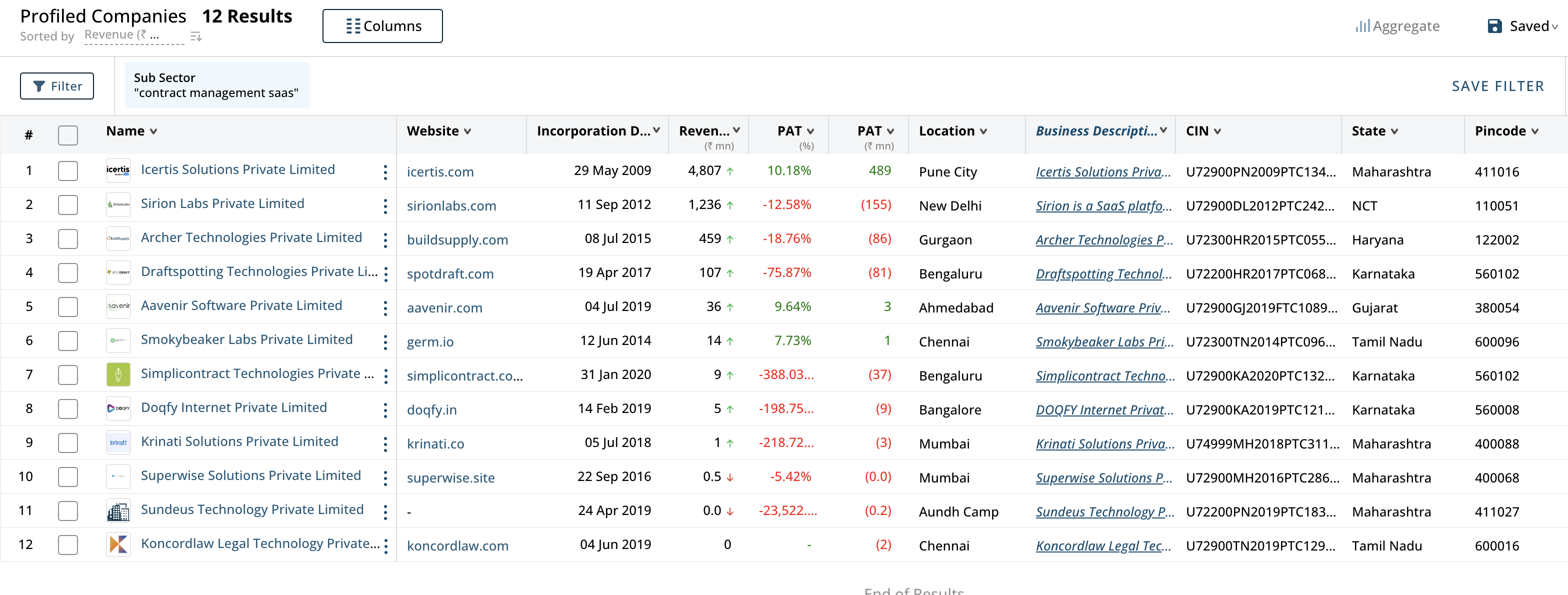

SpotDraft’s competitors in the contract management SaaS sub-sector include Icertis and others.

Icertis is almost 10 times the size of SpotDraft, but more interestingly, it is PAT positive. In contrast, SpotDraft is at -75% PAT. It’s impressive to see that Icertis has had a 3-year CAGR of over 44%, despite of its scale.

The company operates at a global scale and has received debt funding along with strategic investment from SAP. Their last PE/VC round was Series F in 2021 to the tune of ₹580 crore. Interestingly Premjiinvest has also invested in Icertis, while being one of the primary investors in SpotDraft.

Conclusion

The private market has been buzzing with deals over the past week, with SpotDraft’s ₹200+ crore fundraise standing out among the rest. The startup has been growing rapidly, with its revenue increasing at a 3-year CAGR of almost 80%.

However, with competition growing in the contract management SaaS sub-sector, it will be interesting to see how SpotDraft navigates the market and maintains its position. Additionally, it will be worth keeping an eye on the other companies in this sector and their growth trajectory as the market continues to evolve.

Disclaimer: The content provided in this article is for educational and informational purposes only and does not constitute professional financial advice. The opinions expressed herein are those of the author and do not necessarily reflect the views of the company / organization. Please consult a qualified financial professional prior to making any financial decisions.