Our rationale for covering growth metrics

It is the end of the first quarter since we decided to change the format of our weekly deal coverage. Instead of giving a deal summary, we have been reporting company headline financials of hyper-growth companies that had a deal in the previous week. It served two purposes,

- It addresses a huge gap in current reporting across various publications, where the focus is primarily on valuation and deal size. Whereas at PrivateCircle, we give importance to growth metrics as well as revenue, CAGR, and EBITDA for these companies and

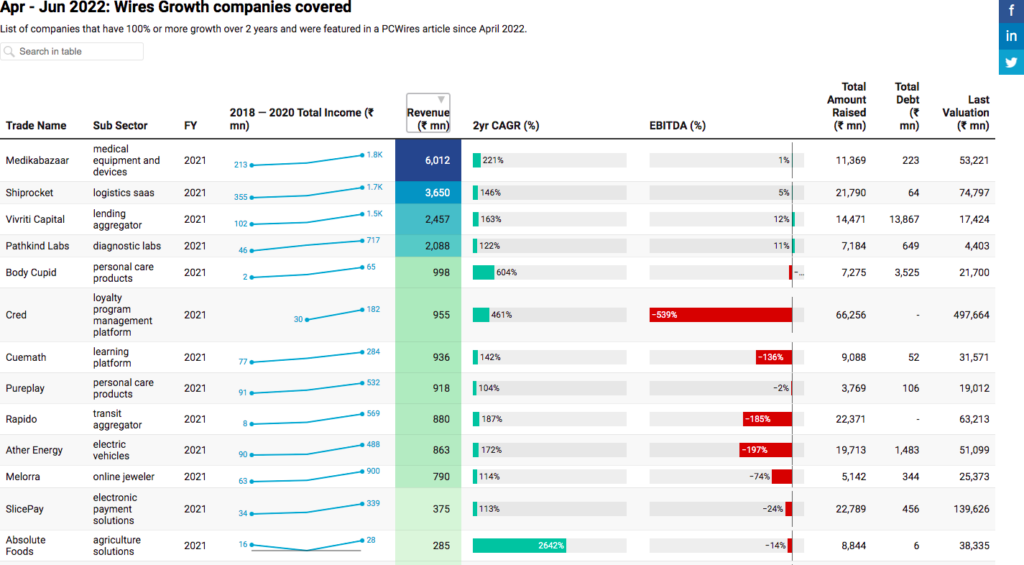

- It paves a way to build a curated deal flow of strong business companies and evaluate their fundamentals. We think it is a great time to summarize the quarter and show all the companies covered by PrivateCircle.

We have added more filters to see companies with at least one cr in revenue. It helps in dodging the low base issue and also surfaces companies that could require growth capital.

Note on the quality of companies closing deals:

Generally, the quality of companies that are getting deals done is improving. It is coming when VC/PE volumes have fallen in the past two months. Further vindicates that in India, there is significant cushioning from other investor types (non-VC/PEs including other domestic investors like HNIs, Family offices, and others) even if one class of institutional investors pulls back. It has been correct for both public and private markets.

Although in the last three months, the deal volumes are coming down. Still, among companies that are closing deals, they are exhibiting much better prospects for growth and profitability on average. Here is the list of growth companies featured on our blog/substack in the past three months.

More companies to choose from PrivateCircle:

These companies are a small subset of companies (clocking at more than 125K + as of June 2022) that get profiled on PrivateCircle Research, and we are sure you are likely to find more and possibly better growth companies from our dashboards. Whatever your stringent selection criteria, you will likely find a company that fits the bill on PrivateCircle.

Click here to read this blog Navigating the Challenges of Fundraising.

Author : Sumanjan