We are trying a new format for our weekly deal summary by including growth metrics for the companies. Here are some of the following reasons to change the format.

- Already dedicated pages and coverage for unicorns and large deals are aplenty in press and online.

- We find these largely overlap with many feeds that our readers may already follow.

- Growth Metrics coverage in the press is patchy

Growth Metrics:

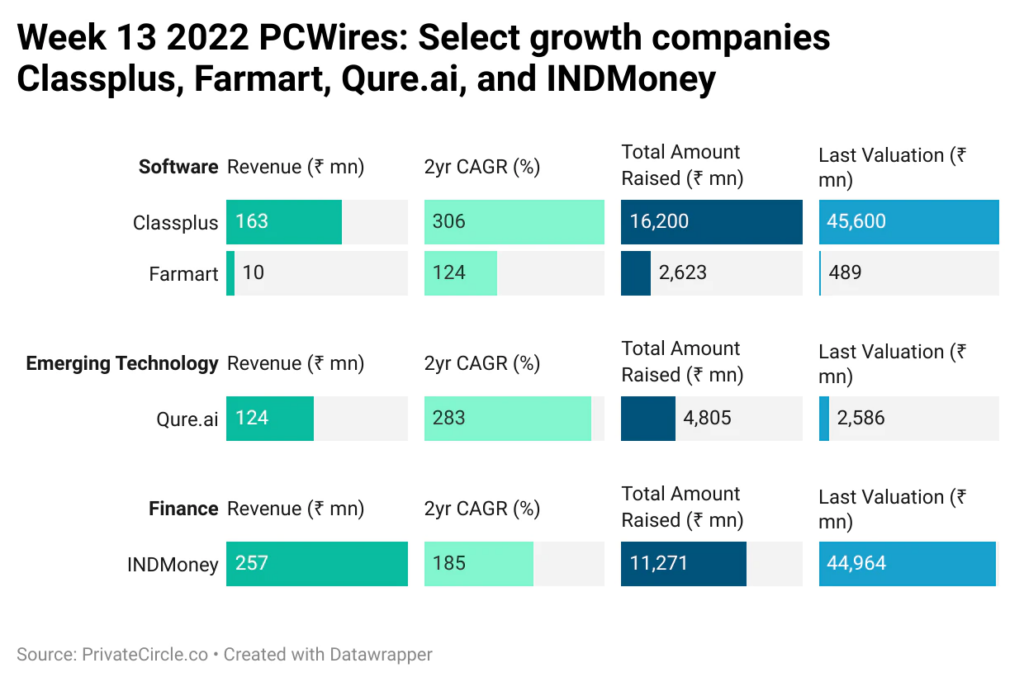

If sustainable growth is key to startups, we need to focus on growth metrics rather than covering only funding and valuations. As of now, we are yet to see dedicated coverage of companies based on these metrics. So instead of summarizing all deals or deals above a threshold value, we have decided to double down on the company-level data, covering this reporting gap in the ecosystem. With this change, our focus now is on companies that are on a fast growth path with more than 100% 2-year CAGR. This plays to our strengths and also gives a different flavor than regular deal coverages. We would love to hear feedback on the new format, and help refine our content.

The week in total saw about 53 deals and of which 28 were in tech/internet businesses. From these sectors, we selected 4 companies (across sub-sectors) that had clocked 2-year CAGR above 100 %, for coverage either in this blog.

Classplus

@ClassplusApps – an educational content mobile platform that works for the tutors and distributing their potential. Classplus had earlier announced it’s international expansion in the SE Asian markets. The company boasts Saurav Ganguly as brand ambassador and also has him the captable. The company had acquired merak.ai for its backend automations and more recently had invested into video infra startup 100ms. The ongoing series D round already has Alpha Wave Global, Tiger Global, RTP Global, Chimera Investments and GSV ventures as investors. So far in this round $ 150 mn has been pumped into Classplus for take its platform up a notch and also power its acquisitions and partnerships. They compete directly with numerous other providers in the area including Impartus, Eupheus, Knolskape among others.

farMart

General Catalyst, Matrix Partners India, Omidyar Network participate in a $ 32 mn series B of @farMart_ , a micro-SaaS B2B platform for agriculture, providing access to information, market linkages, and inputs. Farmart was basting 67,000+ retailers, 1.8+ Million farmers, dealing 75,000+ tonnes across, 7000+ pincodes in India. The full stack farmer startups we track includes several others like Aibono, and Gramco.

Qure.ai

@qure_ai has raised a $ 40 mn funding from Novo Holdings, HealthQuad, and MassMutual Ventures for scaling its medical ai applications across X-ray, TB and other areas. This round comes after the $ 20 mn raised across the two previous series. The company competes with other ai-based solutions startups as well as diagnostic specific ones like Actify, Fedo, Cogito among others.

INDMoney

Pursuing its vision to become the SuperBank for the Family, @INDmoneyApp raised $ 11 mn from Sixteenth Street Capital, Peyush Bansal, Ankur Warikoo, Ashish Kashyap, Sunny Bajaj as part of its series D. This funding closed the massive $ 86 mn raise planned as part of the round. The round also included key employees investing in. Both handholding as well as providing access to underserviced markets, bodes well for INDMoney. From our own experience the HNI business is only getting started.

Here is a brief summary of the companies we covered. For more company-specific details get onboard privatecircle.co.